Latest News

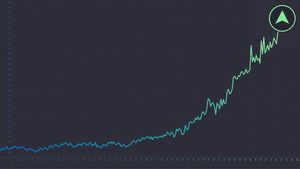

It's actually pretty common for cryptocurrencies to pull absurd price moves.

Via The Motley Fool · March 8, 2026

It's smarter to buy the entire haystack than to seek out the needles.

Via The Motley Fool · March 8, 2026

It’s been an eventful week in the world of business and finance. Here’s a quick look at the top stories that made headlines.

Via Benzinga · March 8, 2026

Your retirement income and healthcare could look a little different depending on where you live.

Via The Motley Fool · March 8, 2026

The stock's current valuation is below its three-year average.

Via The Motley Fool · March 8, 2026

After Iran's Islamic Revolutionary Guard Corps attacked another commercial ship, Strait of Hormuz tensions rose significantly.

Via Stocktwits · March 8, 2026

TransMedics continues to reinvent the organ transplant industry, but the market insists the stock is "overvalued" now.

Via The Motley Fool · March 8, 2026

Axiom, Orbital Reef, Starlab, and Vast: Which of these four teams will replace the International Space Station?

Via The Motley Fool · March 8, 2026

Microsoft stock hasn't been this cheap in over three years.

Via The Motley Fool · March 8, 2026

Explosion at U.S. embassy in Oslo causes minor damage and smoke, but no injuries. Police investigate for perpetrators. Trump links blast to Nobel Prize frustration.

Via Benzinga · March 8, 2026

Weekend roundup: Warren worries after Iran briefing, Trump blames Iran for school bombing, rejects U.K. carrier offer, Blinken flags drone costs, and White House reshuffles continue.

Via Benzinga · March 8, 2026

A big change is coming, and there are still many details to work out.

Via The Motley Fool · March 8, 2026

Warren Buffett's still got his magic touch, but even the Oracle of Omaha can't fully foresee every change to every industry that might undermine one of his picks.

Via The Motley Fool · March 8, 2026

The question of "too late" may be the wrong one to ask.

Via The Motley Fool · March 8, 2026

These Wall Street analysts are forecasting major losses for Palantir and Micron shareholders.

Via The Motley Fool · March 8, 2026

Ray Dalio stresses the importance of embracing uncertainty and seeking diverse perspectives for smarter decisions in business and life.

Via Benzinga · March 8, 2026

Wall Street's bull market rally under Trump is running on borrowed time.

Via The Motley Fool · March 8, 2026

Crude oil has been in focus since the U.S. and Israel began their strikes on Iran, which also killed the Islamic Republic's Supreme Leader, Ayatollah Ali Khamenei.

Via Benzinga · March 8, 2026

Almost everything in crypto is in the bargain bin right now, so you need to be selective about what to buy.

Via The Motley Fool · March 8, 2026

U.S. intelligence warn that Iran can still access its uranium stockpile at Isfahan despite earlier strikes.

Via Benzinga · March 8, 2026

Four dominant, cash-generating compounders just went on sale. The fundamentals say the long-term story is only getting stronger.

Via The Motley Fool · March 8, 2026

The retailer's turnaround plan won't work if shoppers just aren't ready, willing, or able to spend like they have in the past.

Via The Motley Fool · March 8, 2026

AI costs surge for startup 8090 as Chamath Palihapitiya warns of inefficient usage and expensive tools like Cursor.

Via Benzinga · March 8, 2026

Claude beat ChatGPT to become the top free US app on Apple last week.

Via Stocktwits · March 8, 2026

President Trump rejected the U.K.'s offer to deploy aircraft carriers to the Middle East amid the ongoing U.S.-Iran conflict.

Via Benzinga · March 8, 2026

The S&P 500 declined 2% last week as conflict in the Middle East pushed oil prices to a multiyear high.

Via The Motley Fool · March 8, 2026

Greg Abel kicked off his tenure as the new CEO of Berkshire Hathaway with his annual letter to shareholders, something that former CEO Warren Buffett did for decades.

Via The Motley Fool · March 8, 2026

Mortgage rates may be falling, but retirees should pause before pouncing.

Via The Motley Fool · March 8, 2026

The heated battle to acquire Warner Bros. crowned a winner. It might not be who you think.

Via The Motley Fool · March 8, 2026

With shares trading 46% off their record, the Tex-Mex chain needs to win over investors.

Via The Motley Fool · March 8, 2026

If you're investing in crypto, there's a right way and a wrong way to use prediction markets.

Via The Motley Fool · March 8, 2026

Trump denies Russia-Iran intelligence sharing despite claims. Officials warn of escalating tensions and impact on global energy markets.

Via Benzinga · March 8, 2026

Over 600 million X users might make X Money the next great thing as social media turns into an everything app.

Via Stocktwits · March 8, 2026

Saudi Arabia warned Iran that continued attacks on Gulf energy infrastructure could prompt U.S. military access to its bases.

Via Benzinga · March 8, 2026

Archer Aviation tanked after earnings, but progress continues for this flying car start-up.

Via The Motley Fool · March 8, 2026

Trump admin denies Iran's claims of capturing US soldiers. US dismisses accusations as false and maintains optimism about progress in the war.

Via Benzinga · March 8, 2026

Lawmakers criticize Iran war funding, calling for funds to be used for healthcare, housing, and family costs.

Via Benzinga · March 8, 2026

These tech conglomerates are uniquely positioned for long-term business growth.

Via The Motley Fool · March 8, 2026

Caterpillar is positioned to benefit from large, long-term investment trends.

Via The Motley Fool · March 7, 2026

Amazon objects to SpaceX's plan to launch a million satellites, citing feasibility concerns and potential for orbital congestion.

Via Benzinga · March 7, 2026

The company combines a hyper-efficient automated platform with massive account growth to justify the stock's premium valuation.

Via The Motley Fool · March 7, 2026

President Trump blamed Iran for a deadly bombing at an Iranian girls' school, contradicting U.S. reports and fueling international concern.

Via Benzinga · March 7, 2026

Crude oil prices surged 35% amid attacks on Gulf energy infrastructure and the near shutdown of tanker traffic through the Strait of Hormuz.

Via Benzinga · March 7, 2026

Tilray Brands is losing money as it attempts to build a consumer staples business, while this industry giant throws off tons of cash.

Via The Motley Fool · March 7, 2026