Latest News

Caterpillar is positioned to benefit from large, long-term investment trends.

Via The Motley Fool · March 7, 2026

The company combines a hyper-efficient automated platform with massive account growth to justify the stock's premium valuation.

Via The Motley Fool · March 7, 2026

President Trump blamed Iran for a deadly bombing at an Iranian girls' school, contradicting U.S. reports and fueling international concern.

Via Benzinga · March 7, 2026

Crude oil prices surged 35% amid attacks on Gulf energy infrastructure and the near shutdown of tanker traffic through the Strait of Hormuz.

Via Benzinga · March 7, 2026

Tilray Brands is losing money as it attempts to build a consumer staples business, while this industry giant throws off tons of cash.

Via The Motley Fool · March 7, 2026

Keep these points in mind before you sign a loan.

Via The Motley Fool · March 7, 2026

Iran warns US against escalation, blames Trump for ending chance at de-escalation. Warns of military response.

Via Benzinga · March 7, 2026

Via Talk Markets · March 7, 2026

Business travel management company Global Business Travel Group (NYSE:GBTG) will be reporting earnings this Monday morning. Here’s what to expect. American E...

Via StockStory · March 7, 2026

Carbonate fuel cell technology developer FuelCell Energy (NASDAQ:FCEL) will be reporting earnings this Monday before market hours. Here’s what investors shou...

Via StockStory · March 7, 2026

Enterprise technology company Hewlett Packard Enterprise (NYSE:HPE) will be reporting results this Monday afternoon. Here’s what to look for. Hewlett Packard...

Via StockStory · March 7, 2026

Organizational consulting firm Korn Ferry (NYSE:KFY) will be announcing earnings results this Monday before market hours. Here’s what to expect. Korn Ferry b...

Via StockStory · March 7, 2026

Via Talk Markets · March 7, 2026

Luxury ski resort company Vail Resorts (NYSE:MTN) will be announcing earnings results this Monday after the bell. Here’s what to look for. Vail Resorts misse...

Via StockStory · March 7, 2026

Via Benzinga · March 7, 2026

Sometimes, the wisdom of the crowds is more distracting than it is useful.

Via The Motley Fool · March 7, 2026

If you are a dividend lover, these high-yield power providers are preparing for the future today.

Via The Motley Fool · March 7, 2026

Via Talk Markets · March 7, 2026

The U.S. attack on Iran is moving markets and driving oil prices higher.

Via The Motley Fool · March 7, 2026

A decline in Fluor's stock price could signal a good time to buy the engineering and construction company.

Via The Motley Fool · March 7, 2026

Via Benzinga · March 7, 2026

The failure of the Warner Bros. Discovery deal has boosted the stock, but will it keep going higher?

Via The Motley Fool · March 7, 2026

Great news for Ford investors: The automaker is trying to make it even more valuable to customers and (indirectly) for investors.

Via The Motley Fool · March 7, 2026

These AI leaders are positioned to win over the long run.

Via The Motley Fool · March 7, 2026

The market is gifting investors several potentially incredible buying opportunities.

Via The Motley Fool · March 7, 2026

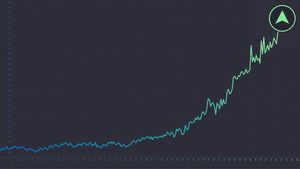

AST SpaceMobile stock has surged over the last couple of years.

Via The Motley Fool · March 7, 2026

Via Talk Markets · March 7, 2026

The PC manufacturer has a dirt-cheap valuation and one of the best dividends around.

Via The Motley Fool · March 7, 2026

Micron stock continues to set new record highs in 2026, as demand soars for its high-bandwidth memory.

Via The Motley Fool · March 7, 2026

As competition intensifies and expectations reset, investors must decide whether the sell-off reflects temporary uncertainty or deeper structural pressure.

Via The Motley Fool · March 7, 2026

Even Warren Buffett and his superb team of investors don't always get it right.

Via The Motley Fool · March 7, 2026

Both of these established industry leaders have been beaten down over the last year, but their healthy dividends can pay investors to wait out the current headwinds.

Via The Motley Fool · March 7, 2026

The company just confirmed its enormous opportunity in custom artificial intelligence (AI) chips.

Via The Motley Fool · March 7, 2026

Novo Nordisk reportedly will sell its weight-loss drugs via the online pharmacy.

Via Investor's Business Daily · March 7, 2026

Shares are trading at 50% off their highs, but that may not be enough.

Via The Motley Fool · March 7, 2026

These five stocks are all growing revenue by at least 40% annually.

Via The Motley Fool · March 7, 2026

Caterpillar is generally viewed as a construction equipment company, but it may be more than just that.

Via The Motley Fool · March 7, 2026

Don't fall victim to these blunders.

Via The Motley Fool · March 7, 2026

Via Benzinga · March 7, 2026

On Saturday, Caitlin Kalinowski said she resigned from OpenAI, arguing that potential uses of AI for warrantless monitoring of Americans and weapon systems operating without a human decision demanded more careful debate than they received.

Via Benzinga · March 7, 2026

Microsoft stock is down more than 25% from its October highs.

Via The Motley Fool · March 7, 2026