L'Oreal Unsp/Adr (LRLCY)

94.79

+1.64 (1.76%)

OP · Last Trade: Feb 21st, 1:31 AM EST

Detailed Quote

| Previous Close | 93.15 |

|---|---|

| Open | 93.01 |

| Bid | - |

| Ask | - |

| Day's Range | 92.85 - 94.79 |

| 52 Week Range | 69.48 - 95.10 |

| Volume | 109,614 |

| Market Cap | - |

| PE Ratio (TTM) | - |

| EPS (TTM) | - |

| Dividend & Yield | N/A (N/A) |

| 1 Month Average Volume | 235,205 |

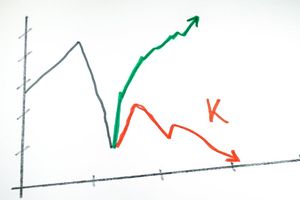

Chart

News & Press Releases

Date: February 6, 2026 Introduction The high-stakes world of prestige beauty was sent into a tailspin yesterday as The Estée Lauder Companies Inc. (NYSE: EL) witnessed a dramatic 19.2% collapse in its share price. The sell-off, which represents one of the steepest single-day declines in the company’s nearly 80-year history, came on the heels of [...]

Via Finterra · February 6, 2026

The company has had a whirlwind year, selling a stake in Kim K’s Skims, initiating a strategic review of its consumer beauty business, and now having a new interim CEO.

Via Stocktwits · December 23, 2025

The K-pop star’s new role signals Chanel’s big bet on fandom-driven beauty spending as luxury brands scramble to reignite demand.

Via Stocktwits · December 11, 2025

Luxury spending surges in the U.S. as wealthy consumers drive demand, even while mass-market sentiment and job prospects deteriorate sharply.

Via Benzinga · November 13, 2025

SMX (NASDAQ: SMX) has announced its groundbreaking entry into the global $824 billion plastics market, introducing its pioneering molecular marker technology. This innovation promises to embed verifiable "digital passports" directly into polymers, heralding a new era of transparency, traceability, and accountability across the entire plastics lifecycle. The move is set

Via MarketMinute · October 2, 2025

It's not good enough for your company to just endure. It needs to grow. You can attract and retain customers continually.

Via Investor's Business Daily · September 26, 2025

Armani’s death was confirmed by the brand on its official Instagram page, with the firm stating that the iconic designer continued to work until his final days.

Via Stocktwits · September 4, 2025

Sanofi has purchased 2.3% of its shares from L'Oréal SA as part of its share repurchase program. The €3 billion deal involves acquiring 29.6 million shares at €101.50 each, with cancellation expected by April 29, 2025.

Via Benzinga · February 3, 2025

The 2025 TIME 100 Most Influential Companies list includes over 40 companies that investors can buy stock in.

Via Benzinga · June 27, 2025

With the U.S. stock market reaching all-time highs, it might be a good idea to check out some quality European stocks.

Via The Motley Fool · December 16, 2024

Via The Motley Fool · December 8, 2024

This growth stock is up over 500% in the last five years.

Via The Motley Fool · October 23, 2024

Berkshire may have sold Apple stock last quarter, but it was buying Ulta shares and holding on to Occidental Petroleum and Mastercard.

Via The Motley Fool · September 9, 2024

Cosmetics upstart e.l.f. Beauty still has plenty of room to grow.

Via The Motley Fool · September 1, 2024

These three overvalued stocks highlight the pitfalls of ignoring fundamental investing principles in a bullish market.

Via InvestorPlace · June 25, 2024

The renowned French beauty conglomerate L'Oreal SA (OTC: LRLCY) (OTC: LRLCF) is reportedly mulling over an investment opportunity in Omani luxury fragrance brand Amouage.

Via Benzinga · April 4, 2024

Investors looking for consumer staples stocks with moats should consider these three super strong investments.

Via InvestorPlace · March 26, 2024

Goldman Sachs urges investors to diversify geographically due to high concentration in US tech stocks, with Japan, healthcare, and European GRANOLAS highlighted as promising markets.

Via Benzinga · March 11, 2024

A group of stocks, which Goldman Sachs dubbed the "Granolas," accounted for 50% of gains of the Stoxx Europe 600 Index for the past year.

Via Benzinga · February 28, 2024

Dive into the compelling world of GRANOLAS stocks: Europe's elite players shaping the future of pharmaceuticals, tech, and consumer goods.

Via InvestorPlace · February 22, 2024

The advent of artificial intelligence has forced the world to rethink what's possible and how things get done.

Via The Motley Fool · January 25, 2024

ETFs typically include many company stocks, eliminating single-stock risk and providing major diversification benefits. Here are three of our favorites.

Via MarketBeat · January 17, 2024

Cosmetics giant L'Oreal gave CES 2024 a glow-up on Tuesday as it debuted several beauty tech devices for hair and skin care.

Via Investor's Business Daily · January 9, 2024

Artificial intelligence will take center stage at the massive CES 2024 technology trade show, which opens Tuesday in Las Vegas.

Via Investor's Business Daily · January 3, 2024

CES 2024 will showcase artificial intelligence and keynotes from Intel, Qualcomm and more.

Via Investor's Business Daily · January 2, 2024