Netflix (NFLX)

83.54

-1.82 (-2.13%)

NASDAQ · Last Trade: Jan 22nd, 9:23 PM EST

Detailed Quote

| Previous Close | 85.36 |

|---|---|

| Open | 85.02 |

| Bid | 83.63 |

| Ask | 83.64 |

| Day's Range | 82.98 - 85.10 |

| 52 Week Range | 81.93 - 134.12 |

| Volume | 69,113,657 |

| Market Cap | 36.97B |

| PE Ratio (TTM) | 3.490 |

| EPS (TTM) | 23.9 |

| Dividend & Yield | N/A (N/A) |

| 1 Month Average Volume | 45,408,161 |

Chart

About Netflix (NFLX)

Netflix is a leading global entertainment service that provides streaming video content to millions of subscribers worldwide. The company offers a wide variety of films, television shows, documentaries, and original programming across various genres and languages, enabling users to watch content on-demand via multiple devices, including smartphones, tablets, smart TVs, and computers. Netflix continually invests in producing exclusive content and acquiring licensing rights to deliver a diverse catalog, aiming to enhance user experience and maintain its position as a dominant player in the digital streaming industry. Read More

News & Press Releases

Today, Jan. 22, 2026, investors are weighing blockbuster subscriber and revenue growth against cautious guidance and a massive Warner bid.

Via The Motley Fool · January 22, 2026

Netflix now counts nearly 325 million paid subscribers, highlighting its vast scale despite ongoing strategic uncertainty.

Via Barchart.com · January 22, 2026

The opening weeks of 2026 have signaled a seismic shift in the American corporate landscape, as a tidal wave of "mega-deals" valued at over $30 billion each sweeps through the financial markets. After years of high interest rates and aggressive antitrust scrutiny, the floodgates have officially opened. Driven by a

Via MarketMinute · January 22, 2026

Stay informed about the most active stocks in the S&P500 index on Thursday's session.chartmill.com

Via Chartmill · January 22, 2026

Residents in Denmark and other countries are looking to boycott American-made products. Apps that help show country origins are rocketing up the app chart.

Via Benzinga · January 22, 2026

There were 1,425 unusually active options on Wednesday, a day that included several ups and downs resulting from Davos. Ultimately, the S&P 500 closed up over 1%. Three stocks and their options stood out. Here’s why.

Via Barchart.com · January 22, 2026

Netflix, Inc. (NASDAQ:NFLX) reported its fourth-quarter 2025 earnings on January 20, 2026, delivering a set of results that comfortably met Wall Street's headline expectations but failed to ignite investor enthusiasm. While the streaming giant continues to dominate the global landscape with a record subscriber count and surging advertising revenue,

Via MarketMinute · January 22, 2026

Netflix and Apple land Best Picture Academy Award nominations, but this media company led the way and has two of the favorites to win.

Via Benzinga · January 22, 2026

Netflix stock is down 35% since last summer.

Via The Motley Fool · January 22, 2026

The landscape of American media has reached a fever pitch this week as Warner Bros. Discovery (Nasdaq: WBD) finds itself at the center of a monumental corporate tug-of-war. On January 22, 2026, the industry is reeling from a massive $108.4 billion hostile tender offer from Paramount Skydance (NYSE: PSKY)

Via MarketMinute · January 22, 2026

Via Benzinga · January 22, 2026

Ark Invest is beating the market again in 2026, and the iconic growth investor wants to keep it that way.

Via The Motley Fool · January 22, 2026

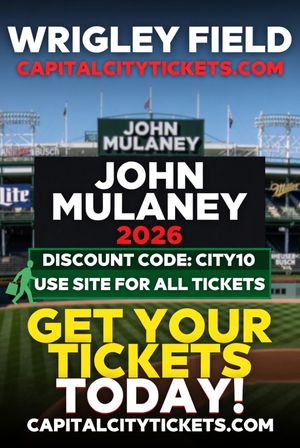

Comedy fans, get ready for laughs on a historic scale! Emmy-winning comedian John Mulaney is bringing his razor-sharp wit and storytelling mastery to stages across North America in 2026 as part of his wildly popular Mister Whatever Tour . The crown jewel? A groundbreaking performance at Wrigley Field in Chicago on July 11, 2026—marking the first time a comedian has ever headlined the iconic ballpark. As a Chicago native, this hometown milestone promises to be unforgettable, blending Mulaney's signature humor with the electric atmosphere of the Friendly Confines.

Via AB Newswire · January 22, 2026

Via Benzinga · January 22, 2026

Netflix's ad revenue is soaring, but it's leaving money on the table.

Via The Motley Fool · January 22, 2026

The move aims to convince WBD shareholders to vote against the Netflix transaction at a special meeting, while Paramount also extended its $30-per-share cash tender offer until Feb. 20, 2026.

Via Stocktwits · January 22, 2026

The Vanguard Growth ETF has a stellar track record against the S&P 500 thanks to its unique portfolio.

Via The Motley Fool · January 22, 2026

The streaming giant is enduring a period of uncertainty while its bid to buy Warner Bros. plays out.

Via The Motley Fool · January 22, 2026

Retail sentiment on Stocktwits for SPY and QQQ remains ‘bearish,’ signaling caution.

Via Stocktwits · January 22, 2026

The Davos Pivot: Trump’s Tariff U-Turn Sends Markets Into a Greenland Glowchartmill.com

Via Chartmill · January 22, 2026

The noted tech investor bought over $7 million worth of NFLX shares, doubling down on her initial purchase in October.

Via Stocktwits · January 22, 2026

On Wednesday, Jan. 21, 2026, Cathie Wood-led Ark Invest bought $7.11 million in Netflix shares, but sold shares of Pinterest.

Via Benzinga · January 21, 2026

On Jan. 21, 2026, investors assess how Q4 earnings and a massive studio bid reshape this streaming giant’s growth, cash flow, and risk profile.

Via The Motley Fool · January 21, 2026

Netflix Inc. stock is trading below its one-year low prices, along with heavy out-of-the-money call and put option activity. This is a major bullish signal, especially given Netflix's strong free cash flow results released yesterday.

Via Talk Markets · January 21, 2026

Netflix Q4 earnings call highlighted the company's transition to becoming a multi-dimensional entertainment hub.

Via Benzinga · January 21, 2026