Earnings results often indicate what direction a company will take in the months ahead. With Q2 behind us, let’s have a look at Qualcomm (NASDAQ:QCOM) and its peers.

The biggest demand drivers for processors (CPUs) and graphics chips at the moment are secular trends related to 5G and Internet of Things, autonomous driving, and high performance computing in the data center space, specifically around AI and machine learning. Like all semiconductor companies, digital chip makers exhibit a degree of cyclicality, driven by supply and demand imbalances and exposure to PC and Smartphone product cycles.

The 9 processors and graphics chips stocks we track reported a mixed Q2. As a group, revenues beat analysts’ consensus estimates by 2.1% while next quarter’s revenue guidance was in line.

Thankfully, share prices of the companies have been resilient as they are up 8.2% on average since the latest earnings results.

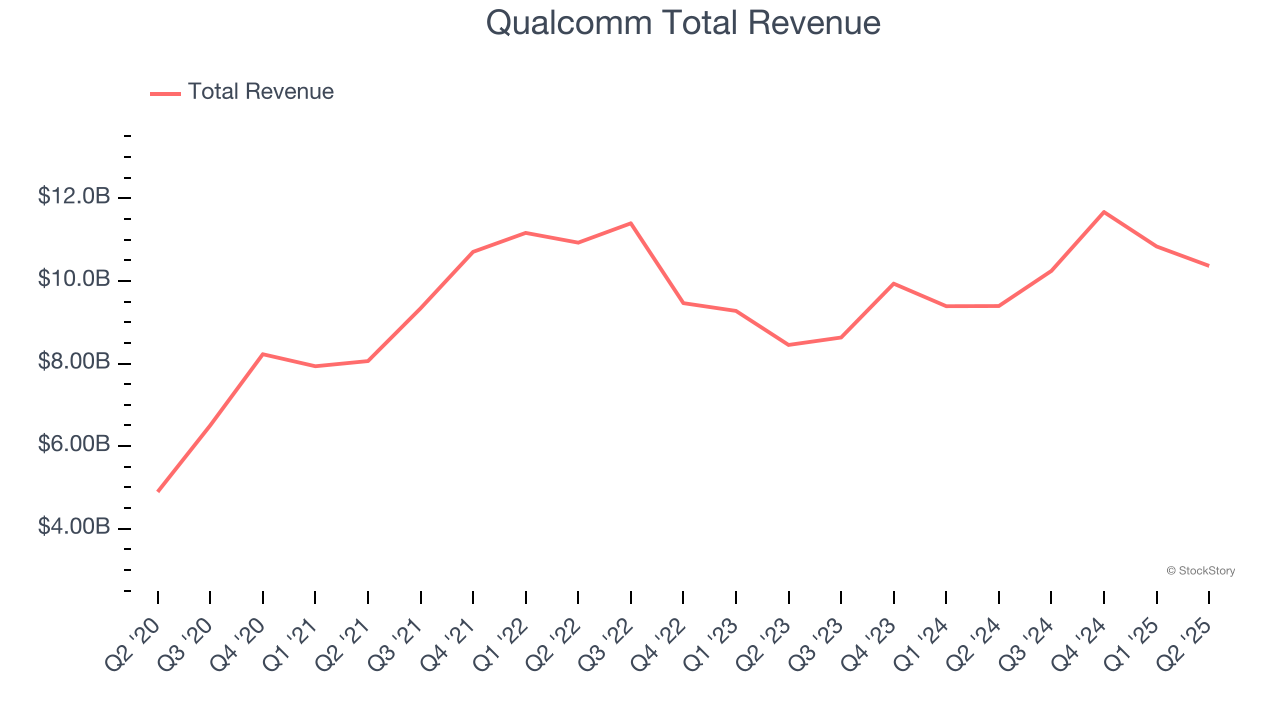

Qualcomm (NASDAQ:QCOM)

Having been at the forefront of developing the standards for cellular connectivity for over four decades, Qualcomm (NASDAQ:QCOM) is a leading innovator and a fabless manufacturer of wireless technology chips used in smartphones, autos and internet of things appliances.

Qualcomm reported revenues of $10.37 billion, up 10.3% year on year. This print was in line with analysts’ expectations, but overall, it was a mixed quarter for the company with an impressive beat of analysts’ adjusted operating income estimates but an increase in its inventory levels.

Interestingly, the stock is up 3.3% since reporting and currently trades at $164.17.

Is now the time to buy Qualcomm? Access our full analysis of the earnings results here, it’s free.

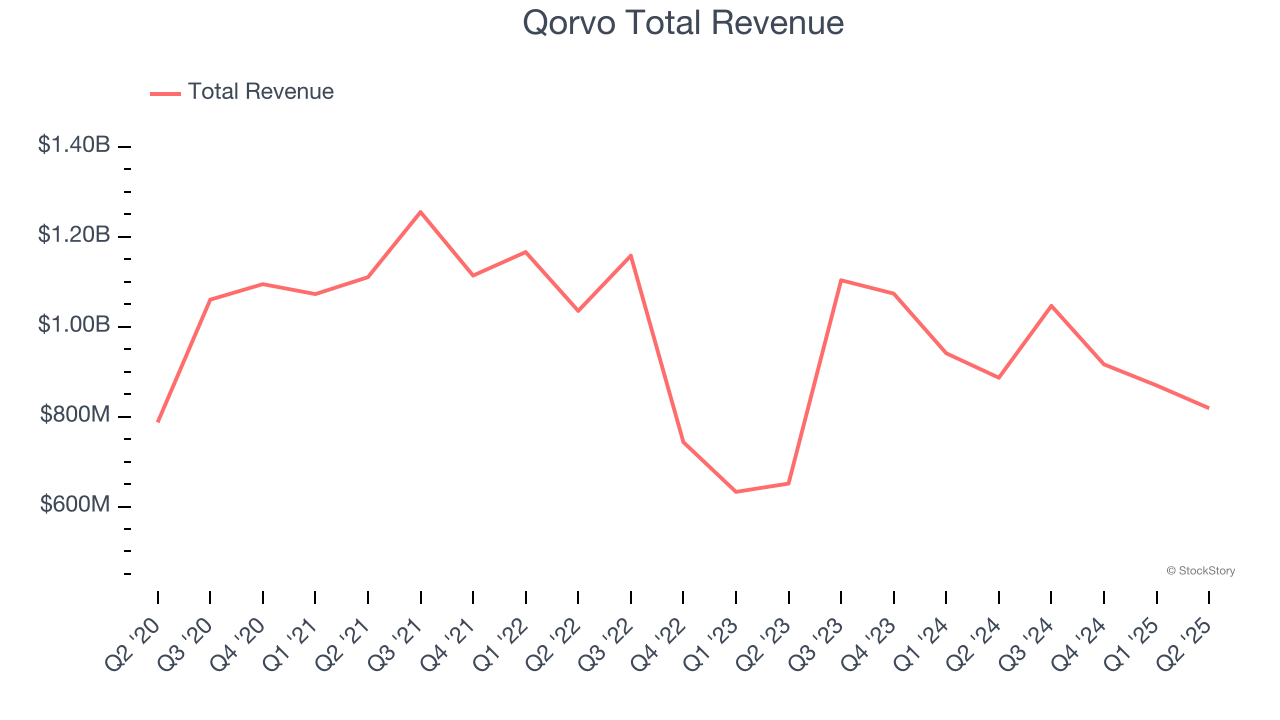

Best Q2: Qorvo (NASDAQ:QRVO)

Formed by the merger of TriQuint and RF Micro Devices, Qorvo (NASDAQ: QRVO) is a designer and manufacturer of RF chips used in almost all smartphones globally, along with a variety of chips used in networking equipment and infrastructure.

Qorvo reported revenues of $818.8 million, down 7.7% year on year, outperforming analysts’ expectations by 5.3%. The business had a very strong quarter with a beat of analysts’ EPS and adjusted operating income estimates.

The market seems content with the results as the stock is up 2.9% since reporting. It currently trades at $86.95.

Is now the time to buy Qorvo? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Intel (NASDAQ:INTC)

Inventor of the x86 processor that powered decades of technological innovation in PCs, data centers, and numerous other markets, Intel (NASDAQ:INTC) is a leading manufacturer of computer processors and graphics chips.

Intel reported revenues of $12.86 billion, flat year on year, exceeding analysts’ expectations by 7.8%. Still, it was a slower quarter as it posted a significant miss of analysts’ adjusted operating income and EPS estimates.

Interestingly, the stock is up 11.7% since the results and currently trades at $25.26.

Read our full analysis of Intel’s results here.

AMD (NASDAQ:AMD)

Founded in 1969 by a group of former Fairchild semiconductor executives led by Jerry Sanders, Advanced Micro Devices (NASDAQ:AMD) is one of the leading designers of computer processors and graphics chips used in PCs and data centers.

AMD reported revenues of $7.69 billion, up 31.7% year on year. This number surpassed analysts’ expectations by 3.4%. Aside from that, it was a mixed quarter as it also recorded a significant improvement in its inventory levels but revenue guidance for next quarter meeting analysts’ expectations.

The stock is down 8.1% since reporting and currently trades at $160.29.

Read our full, actionable report on AMD here, it’s free.

Broadcom (NASDAQ:AVGO)

Originally the semiconductor division of Hewlett Packard, Broadcom (NASDAQ:AVGO) is a semiconductor conglomerate spanning wireless communications, networking, and data storage as well as infrastructure software focused on mainframes and cybersecurity.

Broadcom reported revenues of $15.95 billion, up 22% year on year. This result was in line with analysts’ expectations. Taking a step back, it was a mixed quarter as it also produced a meaningful improvement in its inventory levels.

The stock is up 17.9% since reporting and currently trades at $360.80.

Read our full, actionable report on Broadcom here, it’s free.

Market Update

In response to the Fed’s rate hikes in 2022 and 2023, inflation has been gradually trending down from its post-pandemic peak, trending closer to the Fed’s 2% target. Despite higher borrowing costs, the economy has avoided flashing recessionary signals. This is the much-desired soft landing that many investors hoped for. The recent rate cuts (0.5% in September and 0.25% in November 2024) have bolstered the stock market, making 2024 a strong year for equities. Donald Trump’s presidential win in November sparked additional market gains, sending indices to record highs in the days following his victory. However, debates continue over possible tariffs and corporate tax adjustments, raising questions about economic stability in 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.