Digital insurance provider Lemonade (NYSE:LMND) announced better-than-expected revenue in Q2 CY2025, with sales up 34.5% year on year to $164.1 million. Its GAAP loss of $0.60 per share was 24.9% above analysts’ consensus estimates.

Is now the time to buy Lemonade? Find out by accessing our full research report, it’s free.

Lemonade (LMND) Q2 CY2025 Highlights:

- Net Premiums Earned: $112.5 million vs analyst estimates of $115.6 million (26% year-on-year growth, 2.6% miss)

- Revenue: $164.1 million vs analyst estimates of $160.3 million (34.5% year-on-year growth, 2.4% beat)

- Full-year guidance: revenue raised, EBITDA maintained

- Pre-Tax Profit Margin: -26% (19.2 percentage point year-on-year increase)

- EPS (GAAP): -$0.60 vs analyst estimates of -$0.80 (24.9% beat)

- Market Capitalization: $2.71 billion

Company Overview

Built on the principle of giving back unused premiums to charitable causes selected by policyholders, Lemonade (NYSE:LMND) is a technology-driven insurance company that offers homeowners, renters, pet, car, and life insurance through an AI-powered digital platform.

Revenue Growth

Big picture, insurers generate revenue from three key sources. The first is the core business of underwriting policies. The second source is income from investing the “float” (premiums collected upfront not yet paid out as claims) in assets such as fixed-income assets and equities. The third is fees from various sources such as policy administration, annuities, or other value-added services.

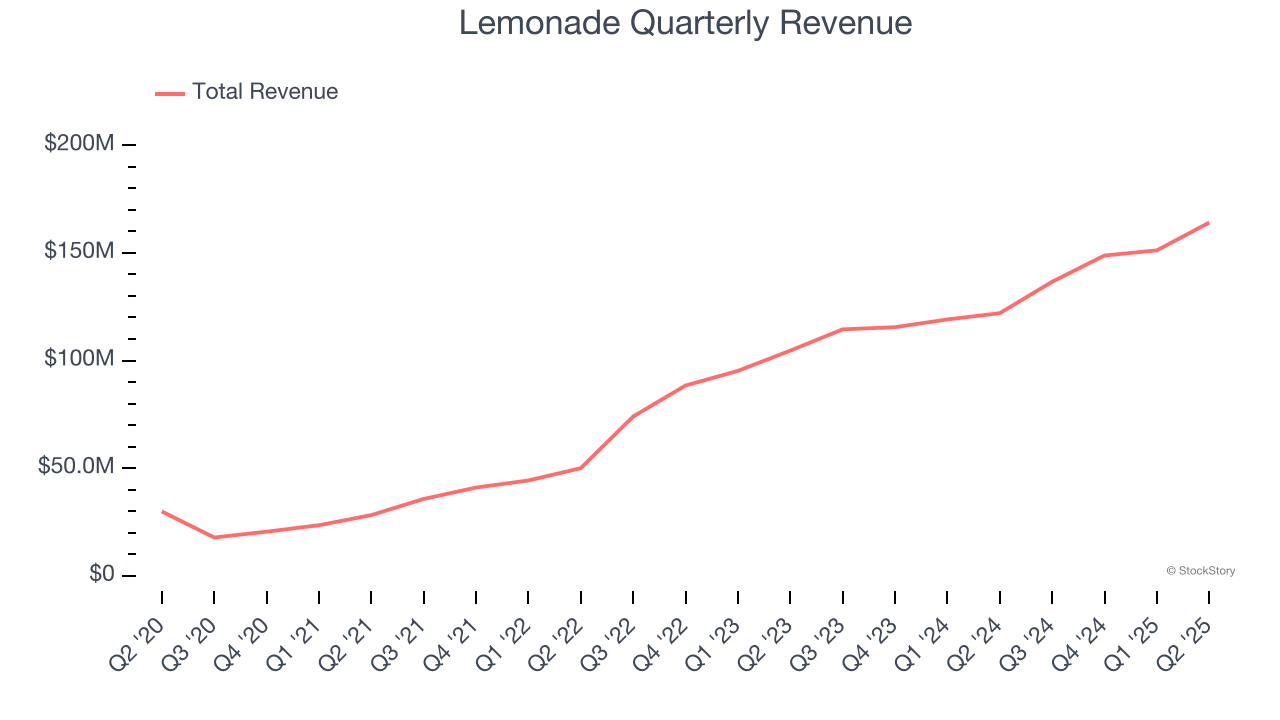

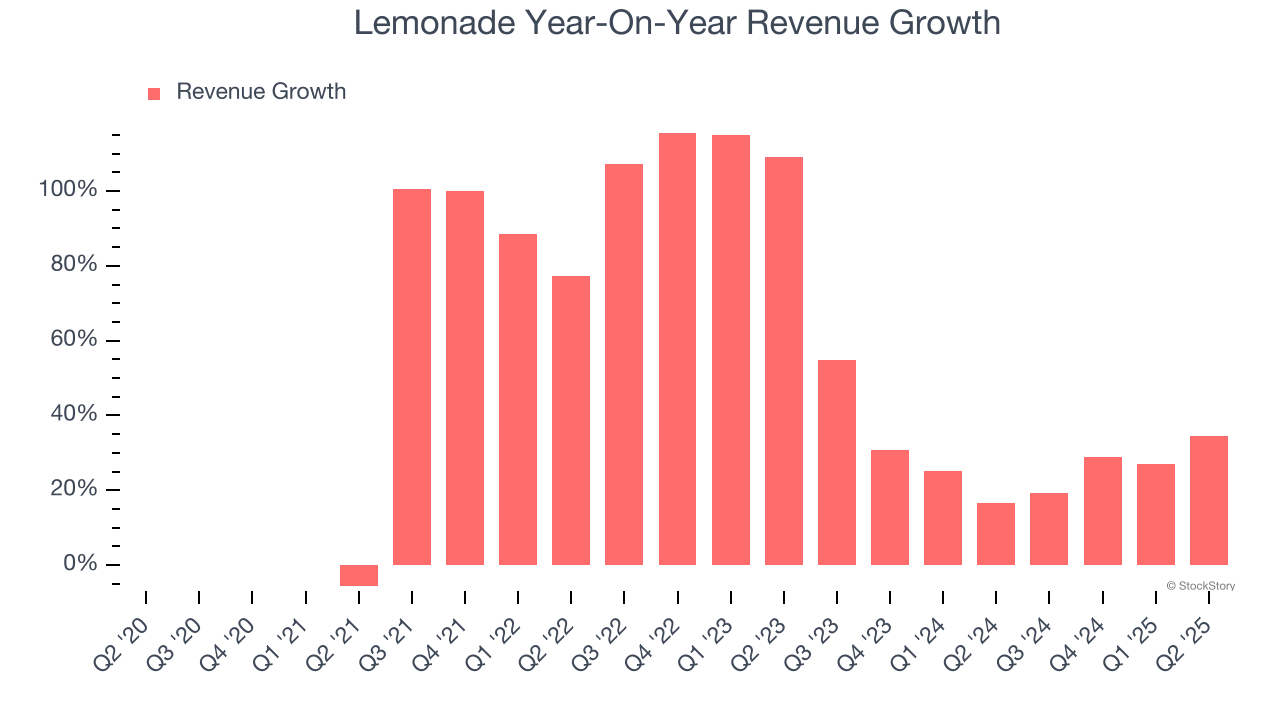

Luckily, Lemonade’s revenue grew at an incredible 43.5% compounded annual growth rate over the last five years. Its growth beat the average insurance company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within financials, a half-decade historical view may miss recent interest rate changes, market returns, and industry trends. Lemonade’s annualized revenue growth of 28.8% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Lemonade reported wonderful year-on-year revenue growth of 34.5%, and its $164.1 million of revenue exceeded Wall Street’s estimates by 2.4%.

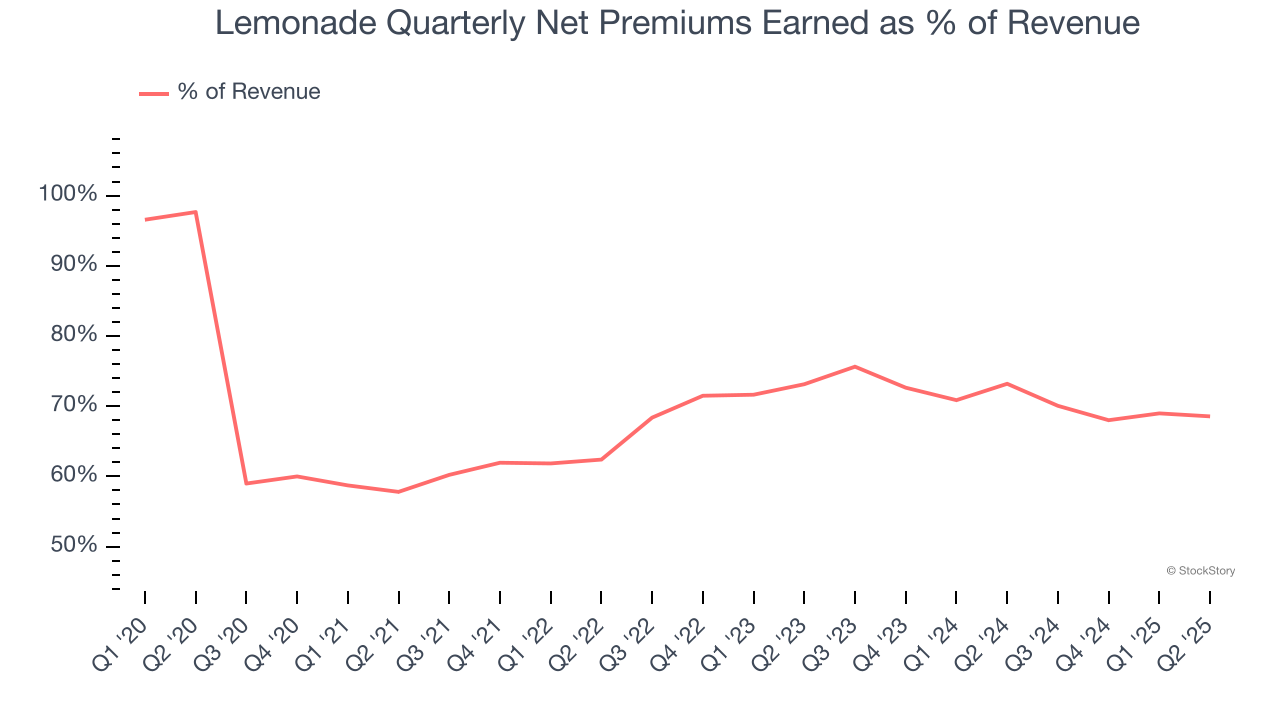

Net premiums earned made up 69.3% of the company’s total revenue during the last five years, meaning insurance operations are Lemonade’s largest source of revenue.

While insurers generate revenue from multiple sources, investors view net premiums earned as the cornerstone - its direct link to core operations stands in sharp contrast to the unpredictability of investment returns and fees.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Net Premiums Earned

Insurers sell policies then use reinsurance (insurance for insurance companies) to protect themselves from large losses. Net premiums earned are therefore what's collected from selling policies less what’s paid to reinsurers as a risk mitigation tool.

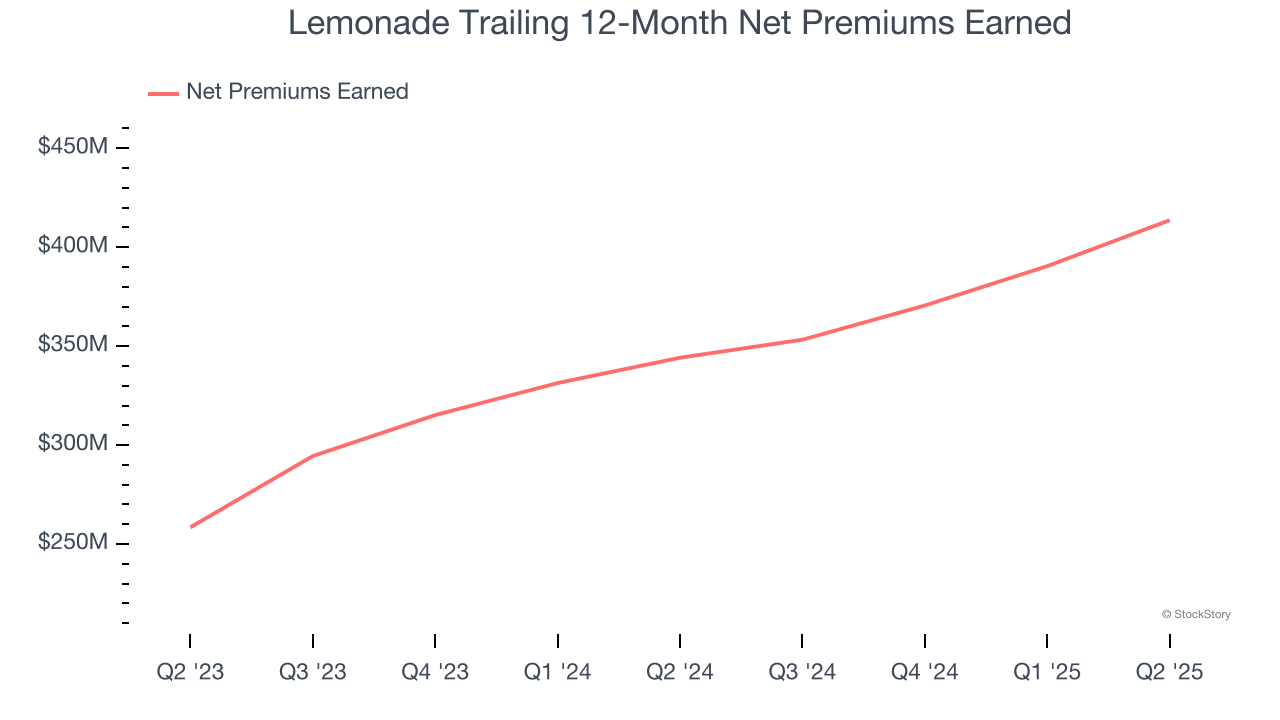

Lemonade’s net premiums earned has grown at a 31.8% annualized rate over the last five years, much better than the broader insurance industry but slower than its total revenue.

When analyzing Lemonade’s net premiums earned over the last two years, we can see that growth decelerated to 26.5% annually. Since two-year net premiums earned grew slower than total revenue over this period, it’s implied that other line items such as investment income grew at a faster rate. These extra revenue streams are important to the bottom line, yet their performance can be inconsistent. Some firms have been more successful and consistent in managing their float, but sharp fluctuations in the fixed income and equity markets can dramatically affect short-term results.

Lemonade produced $112.5 million of net premiums earned in Q2, up a hearty 26% year on year. But this wasn’t enough juice to meet Wall Street Consensus estimates.

Key Takeaways from Lemonade’s Q2 Results

We were impressed by how significantly Lemonade blew past analysts’ EPS expectations this quarter. We were also glad its revenue outperformed Wall Street’s estimates. Looking ahead, full-year revenue guidance was raised and full-year EBITDA guidance was maintained. On the other hand, its net premiums earned missed. Zooming out, we think this was a good print with some key areas of upside. The stock traded up 28.6% to $47.64 immediately after reporting.

Lemonade had an encouraging quarter, but one earnings result doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.