What a time it’s been for Wayfair. In the past six months alone, the company’s stock price has increased by a massive 60.9%, reaching $79.04 per share. This performance may have investors wondering how to approach the situation.

Is now the time to buy Wayfair, or should you be careful about including it in your portfolio? See what our analysts have to say in our full research report, it’s free.

Why Do We Think Wayfair Will Underperform?

We’re glad investors have benefited from the price increase, but we're sitting this one out for now. Here are three reasons why there are better opportunities than W and a stock we'd rather own.

1. Declining Active Customers Reflect Product Weakness

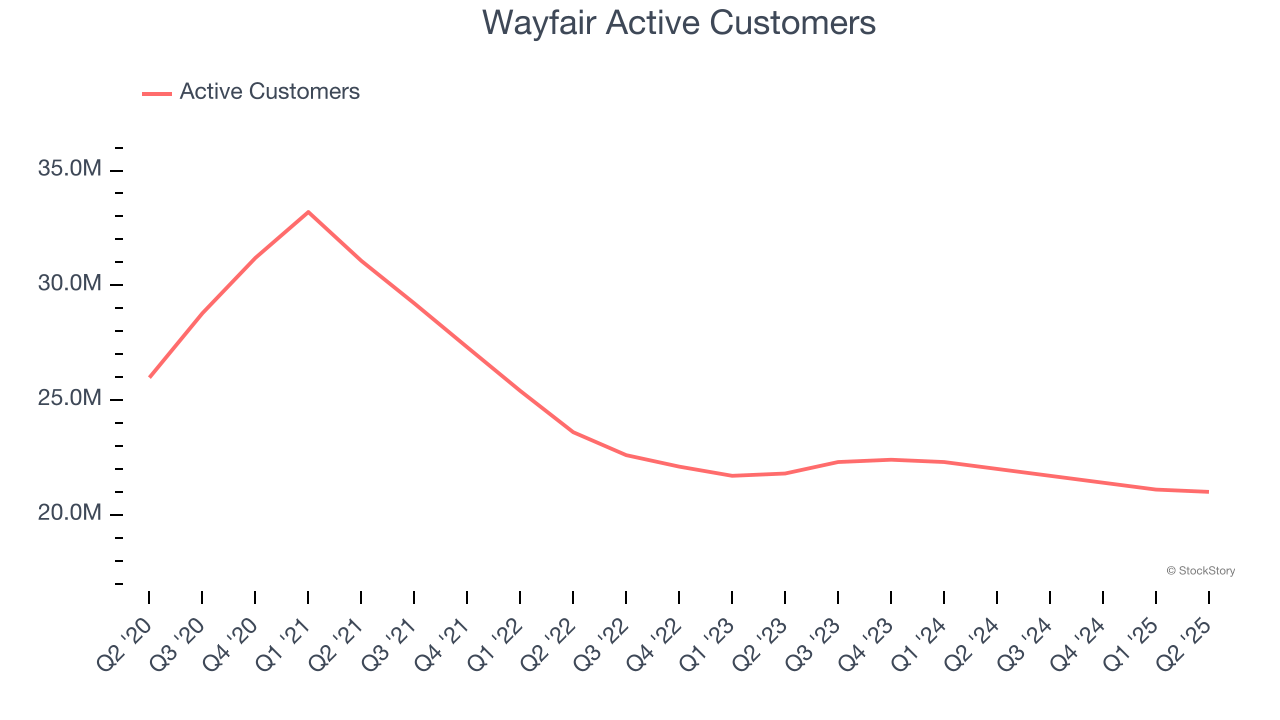

As an online retailer, Wayfair generates revenue growth by expanding its number of users and the average order size in dollars.

Wayfair struggled with new customer acquisition over the last two years as its active customers have declined by 1.7% annually to 21 million in the latest quarter. This performance isn't ideal because internet usage is secular, meaning there are typically unaddressed market opportunities. If Wayfair wants to accelerate growth, it likely needs to enhance the appeal of its current offerings or innovate with new products.

2. Customer Spending Stalls, Engagement Falling?

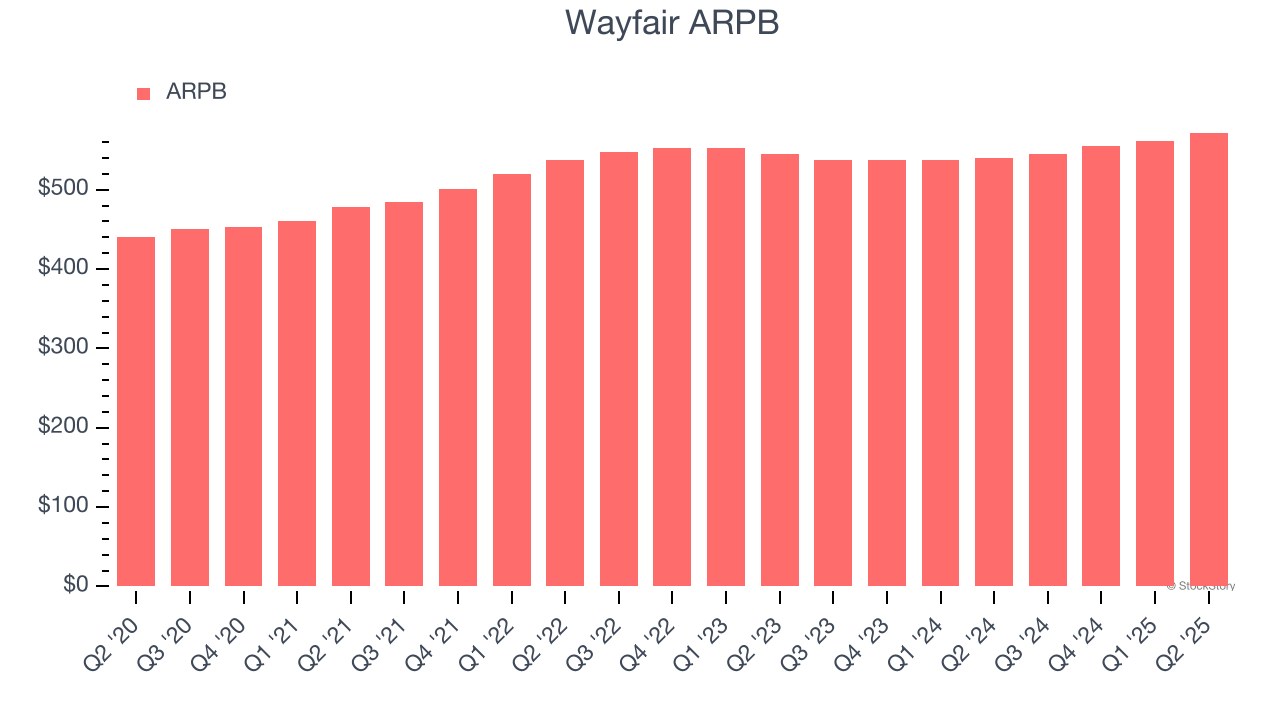

Average revenue per buyer (ARPB) is a critical metric to track because it measures how much customers spend per order.

Wayfair’s ARPB has been roughly flat over the last two years. This raises questions about its platform’s health when paired with its declining active customers. If Wayfair wants to increase its buyers, it must either develop new features or provide some existing ones for free.

3. Low Gross Margin Reveals Weak Structural Profitability

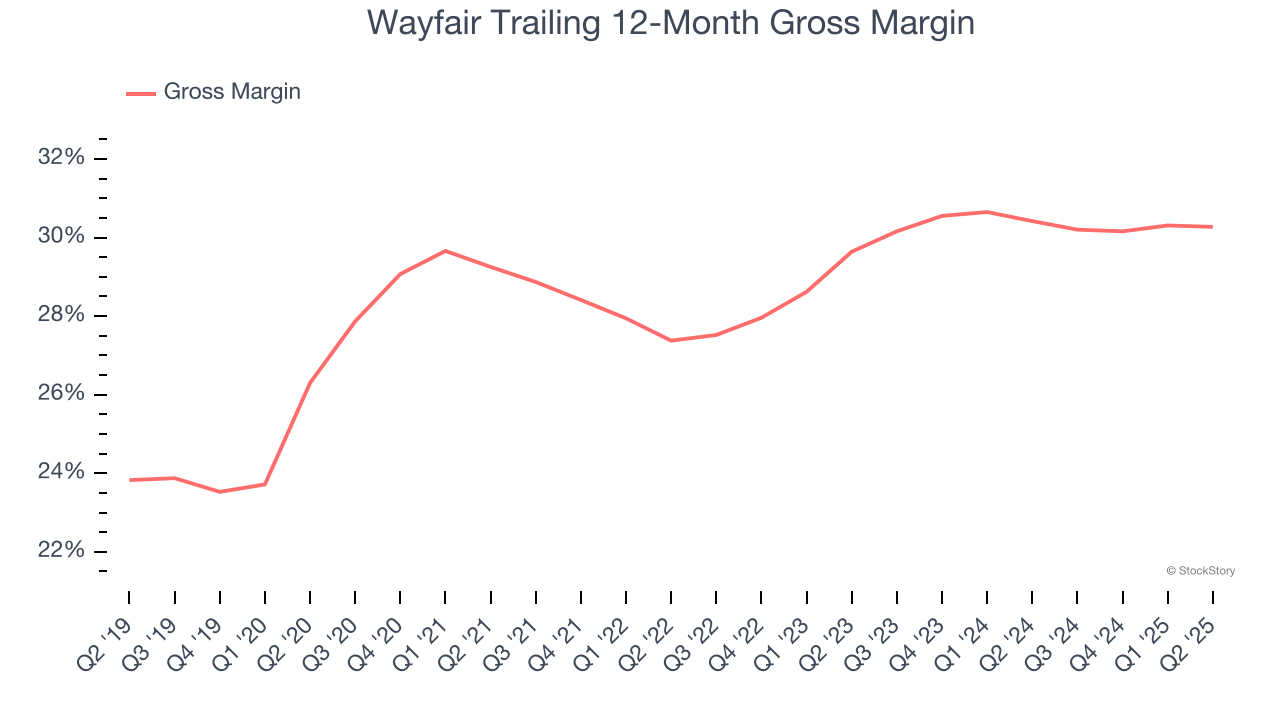

For online retail (separate from online marketplaces) businesses like Wayfair, gross profit tells us how much money the company gets to keep after covering the base cost of its products and services, which typically include the cost of acquiring the products sold, shipping and fulfillment, customer service, and digital infrastructure.

Wayfair’s unit economics are far below other consumer internet companies because it must carry inventories as an online retailer. This means it has relatively higher capital intensity than a pure software business like Meta or Airbnb and signals it operates in a competitive market. As you can see below, it averaged a 30.3% gross margin over the last two years. Said differently, Wayfair had to pay a chunky $69.66 to its service providers for every $100 in revenue.

Final Judgment

Wayfair falls short of our quality standards. Following the recent rally, the stock trades at 19.4× forward EV/EBITDA (or $79.04 per share). This multiple tells us a lot of good news is priced in - we think there are better opportunities elsewhere. We’d suggest looking at a dominant Aerospace business that has perfected its M&A strategy.

High-Quality Stocks for All Market Conditions

When Trump unveiled his aggressive tariff plan in April 2025, markets tanked as investors feared a full-blown trade war. But those who panicked and sold missed the subsequent rebound that’s already erased most losses.

Don’t let fear keep you from great opportunities and take a look at Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.