Smith & Wesson has gotten torched over the last six months - since February 2025, its stock price has dropped 24.5% to $8.15 per share. This was partly driven by its softer quarterly results and may have investors wondering how to approach the situation.

Is now the time to buy Smith & Wesson, or should you be careful about including it in your portfolio? See what our analysts have to say in our full research report, it’s free.

Why Do We Think Smith & Wesson Will Underperform?

Despite the more favorable entry price, we don't have much confidence in Smith & Wesson. Here are three reasons why SWBI doesn't excite us and a stock we'd rather own.

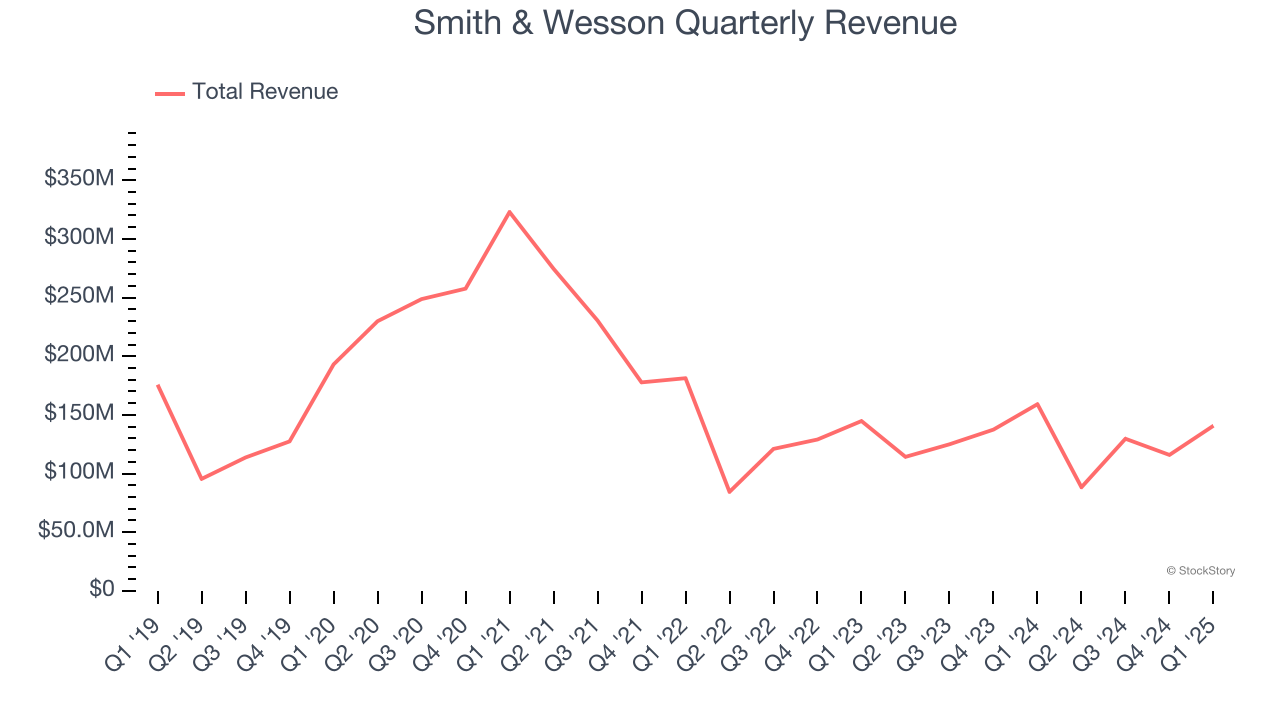

1. Revenue Spiraling Downwards

A company’s long-term sales performance can indicate its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Smith & Wesson’s demand was weak over the last five years as its sales fell at a 2.2% annual rate. This was below our standards and signals it’s a low quality business.

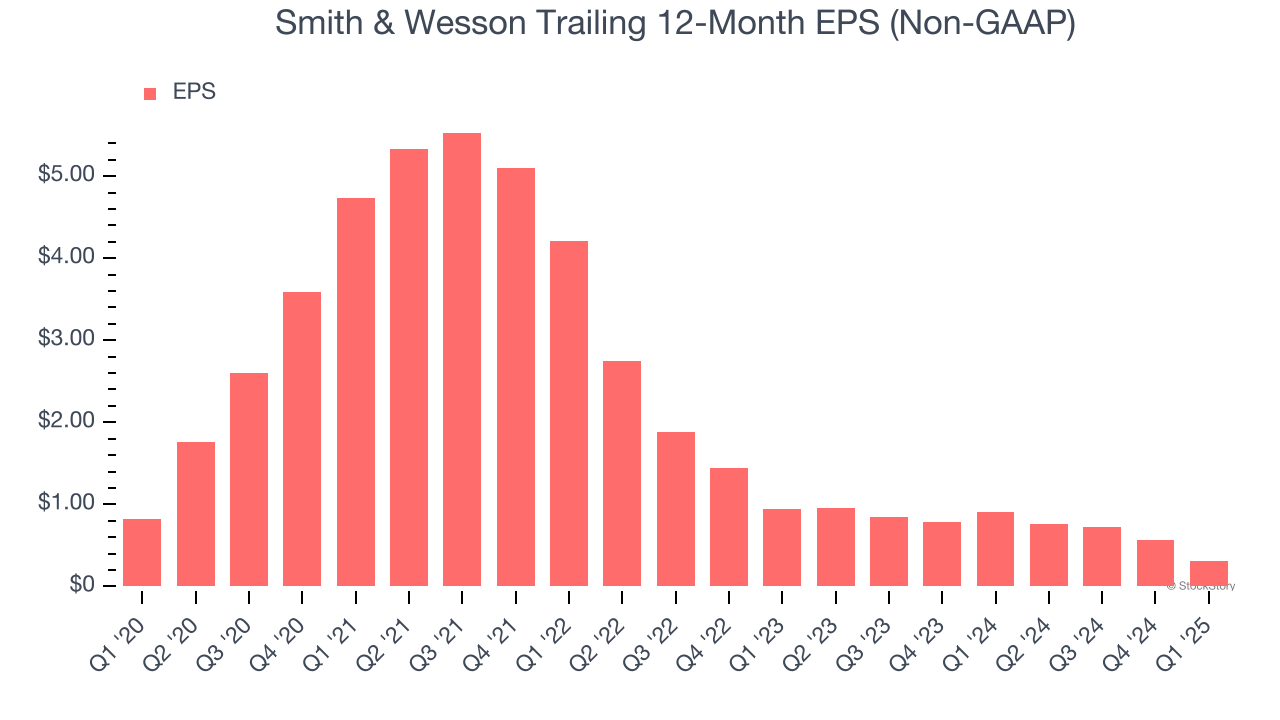

2. EPS Trending Down

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Sadly for Smith & Wesson, its EPS declined by 17.7% annually over the last five years, more than its revenue. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

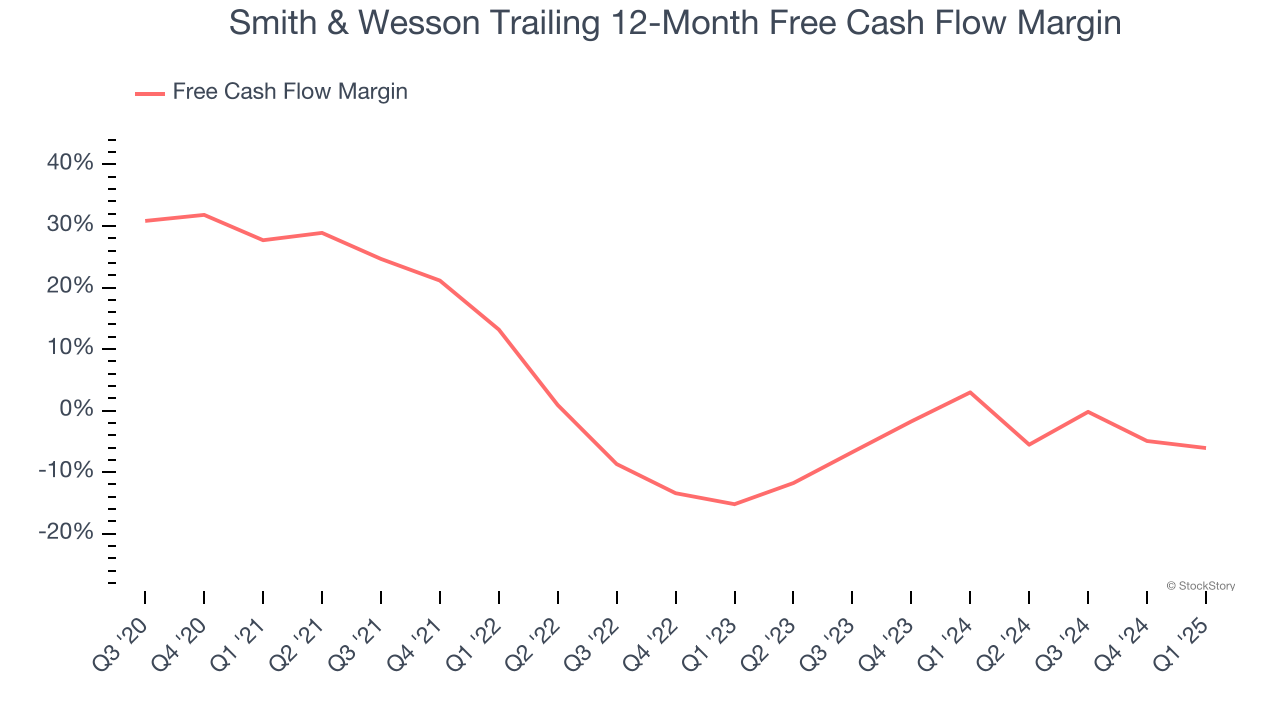

3. Cash Burn Ignites Concerns

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

While Smith & Wesson posted positive free cash flow this quarter, the broader story hasn’t been so clean. Over the last two years, Smith & Wesson’s demanding reinvestments to stay relevant have drained its resources, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 1.3%, meaning it lit $1.28 of cash on fire for every $100 in revenue.

Final Judgment

Smith & Wesson doesn’t pass our quality test. After the recent drawdown, the stock trades at 18.1× forward P/E (or $8.15 per share). This valuation multiple is fair, but we don’t have much confidence in the company. There are better investments elsewhere. We’d recommend looking at the Amazon and PayPal of Latin America.

Stocks We Like More Than Smith & Wesson

Trump’s April 2025 tariff bombshell triggered a massive market selloff, but stocks have since staged an impressive recovery, leaving those who panic sold on the sidelines.

Take advantage of the rebound by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.