Boston Scientific has been treading water for the past six months, recording a small loss of 1.2% while holding steady at $104.10. The stock also fell short of the S&P 500’s 5.5% gain during that period.

Does this present a buying opportunity for BSX? Or is its underperformance reflective of its story and business quality? Find out in our full research report, it’s free.

Why Does Boston Scientific Spark Debate?

Founded in 1979 with a mission to advance less-invasive medicine, Boston Scientific (NYSE:BSX) develops and manufactures medical devices used in minimally invasive procedures across cardiovascular, urological, neurological, and gastrointestinal specialties.

Two Things to Like:

1. Core Business Firing on All Cylinders

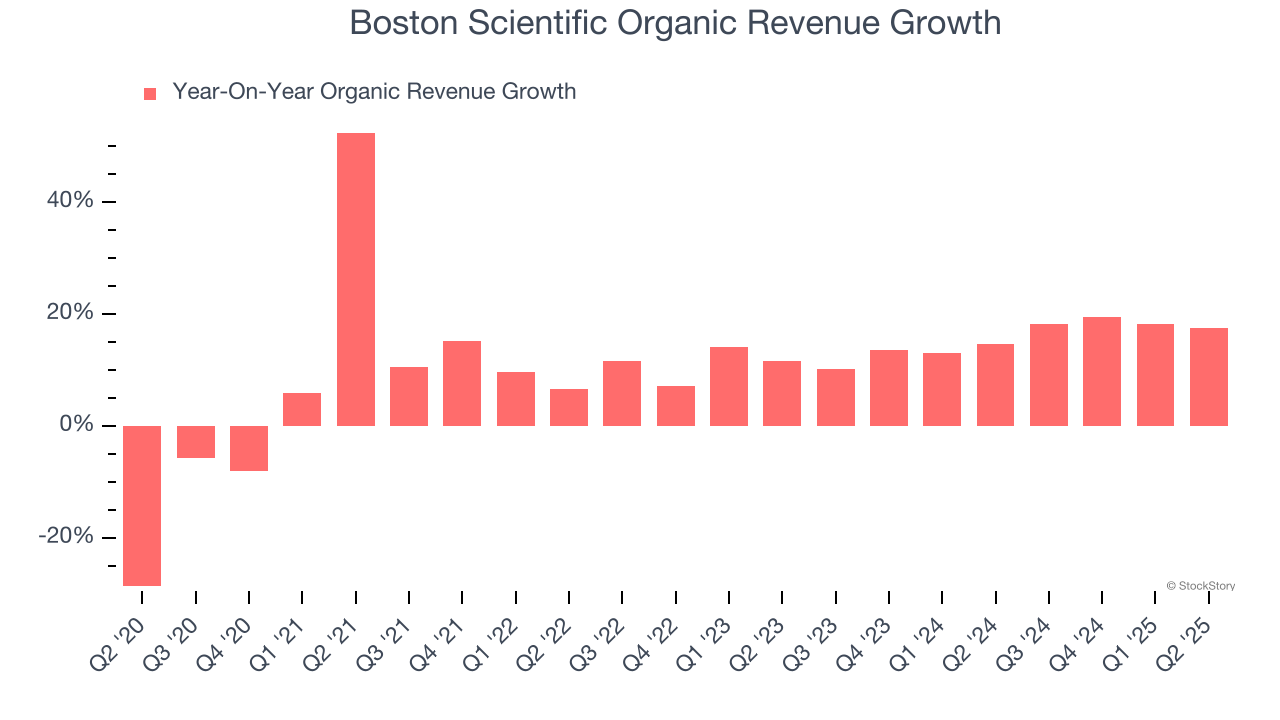

In addition to reported revenue, organic revenue is a useful data point for analyzing Medical Devices & Supplies - Diversified companies. This metric gives visibility into Boston Scientific’s core business because it excludes one-time events such as mergers, acquisitions, and divestitures along with foreign currency fluctuations - non-fundamental factors that can manipulate the income statement.

Over the last two years, Boston Scientific’s organic revenue averaged 15.6% year-on-year growth. This performance was impressive and shows it can expand quickly without relying on expensive (and risky) acquisitions.

2. Outstanding Long-Term EPS Growth

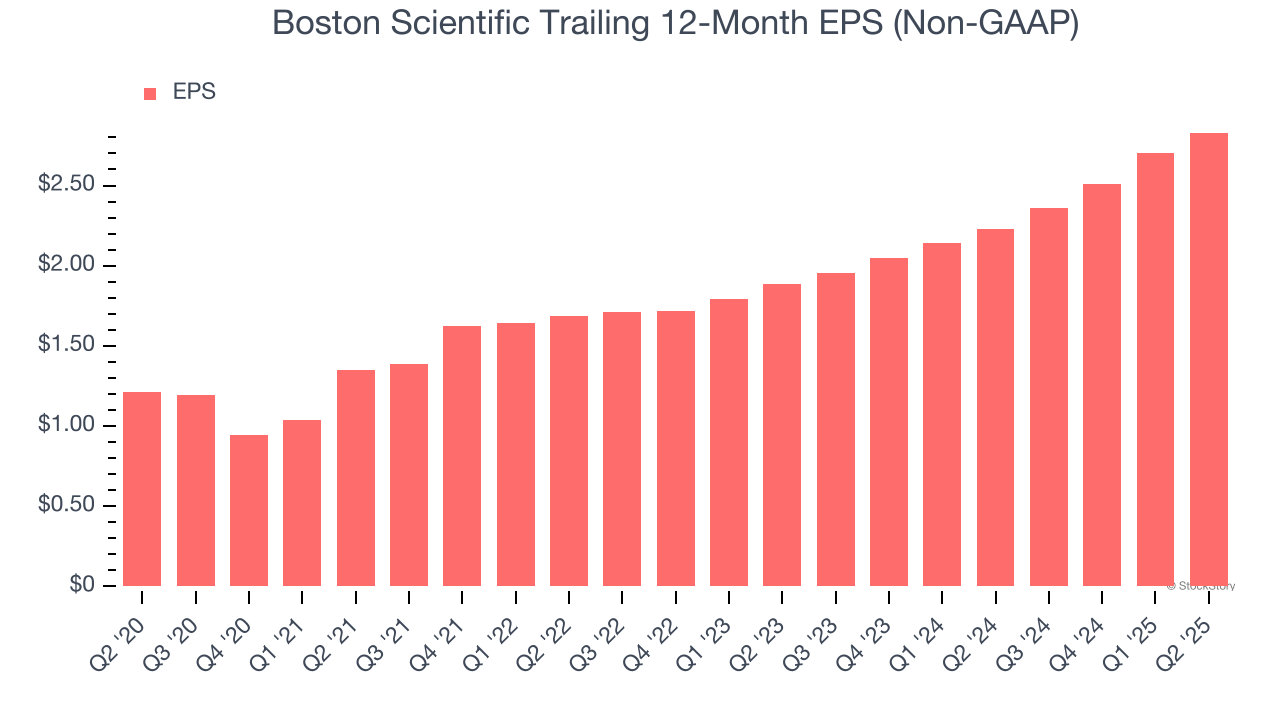

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Boston Scientific’s EPS grew at an astounding 18.4% compounded annual growth rate over the last five years, higher than its 12.7% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

One Reason to be Careful:

Previous Growth Initiatives Haven’t Impressed

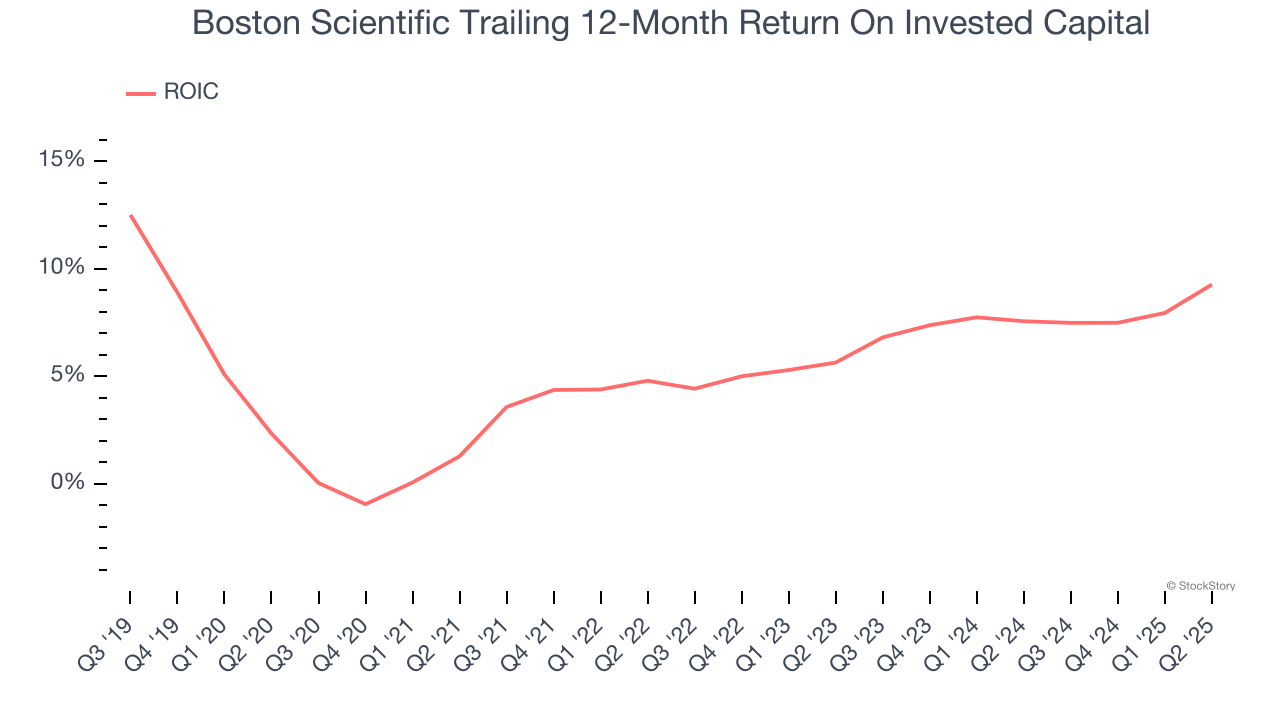

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Although Boston Scientific has shown solid business quality lately, it historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 5.7%, somewhat low compared to the best healthcare companies that consistently pump out 20%+.

Final Judgment

Boston Scientific has huge potential even though it has some open questions. With its shares underperforming the market lately, the stock trades at 34.3× forward P/E (or $104.10 per share). Is now a good time to initiate a position? See for yourself in our comprehensive research report, it’s free.

High-Quality Stocks for All Market Conditions

Trump’s April 2025 tariff bombshell triggered a massive market selloff, but stocks have since staged an impressive recovery, leaving those who panic sold on the sidelines.

Take advantage of the rebound by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.