Looking back on regional banks stocks’ Q1 earnings, we examine this quarter’s best and worst performers, including TowneBank (NASDAQ:TOWN) and its peers.

Regional banks, financial institutions operating within specific geographic areas, serve as intermediaries between local depositors and borrowers. They benefit from rising interest rates that improve net interest margins (the difference between loan yields and deposit costs), digital transformation reducing operational expenses, and local economic growth driving loan demand. However, these banks face headwinds from fintech competition, deposit outflows to higher-yielding alternatives, credit deterioration (increasing loan defaults) during economic slowdowns, and regulatory compliance costs. Recent concerns about regional bank stability following high-profile failures and significant commercial real estate exposure present additional challenges.

The 103 regional banks stocks we track reported a satisfactory Q1. As a group, revenues were in line with analysts’ consensus estimates.

In light of this news, share prices of the companies have held steady as they are up 1% on average since the latest earnings results.

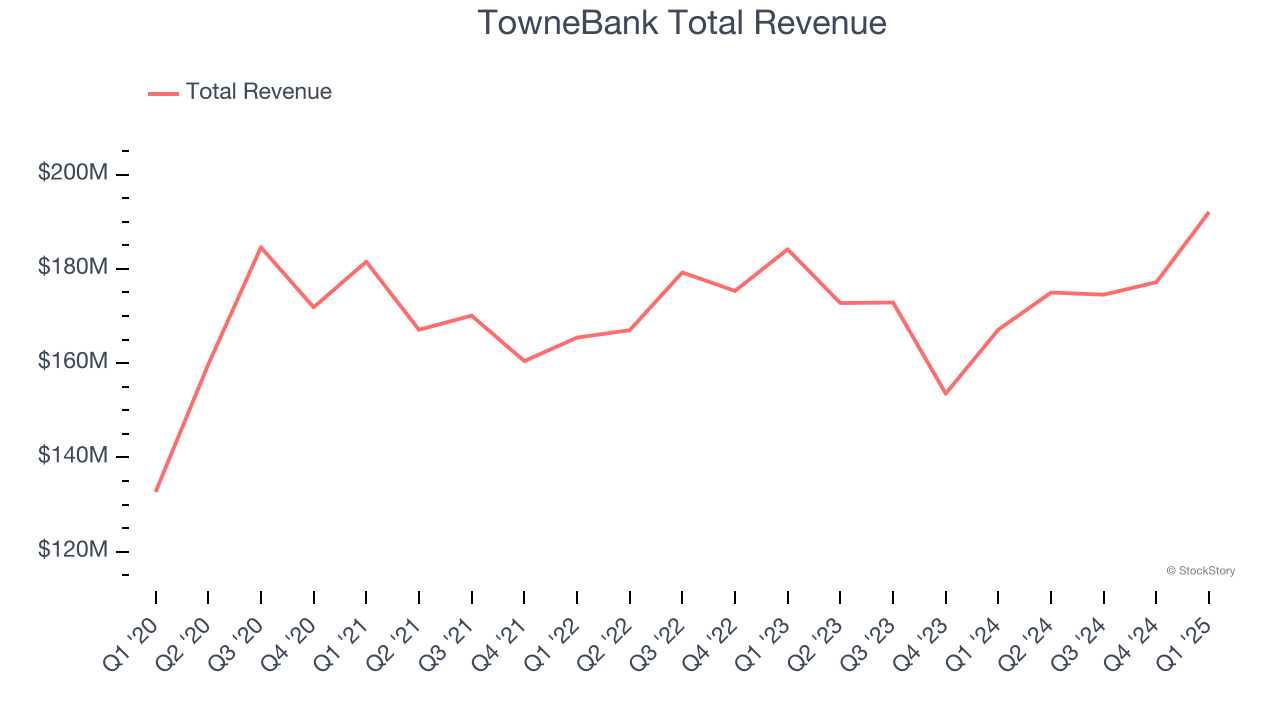

TowneBank (NASDAQ:TOWN)

Founded in 1998 with a commitment to community-centered banking in the Hampton Roads region, TowneBank (NASDAQ:TOWN) is a community-focused financial institution providing banking, lending, and wealth management services to individuals and businesses in Virginia and North Carolina.

TowneBank reported revenues of $192 million, up 14.9% year on year. This print exceeded analysts’ expectations by 1.3%. Overall, it was a strong quarter for the company with an impressive beat of analysts’ tangible book value per share estimates and EPS in line with analysts’ estimates.

"We were pleased to close our partnership with Village Bank and Trust Financial Corp. on April 1, 2025 followed by our latest announcement of the signing of a definitive agreement with Old Point Financial Corporation. Both transactions are strategically important for our Company and follow our disciplined model of targeting partnerships that enhance shareholder returns with low execution risk," stated William I. Foster III, President and Chief Executive Officer.

Interestingly, the stock is up 15.6% since reporting and currently trades at $37.64.

Is now the time to buy TowneBank? Access our full analysis of the earnings results here, it’s free.

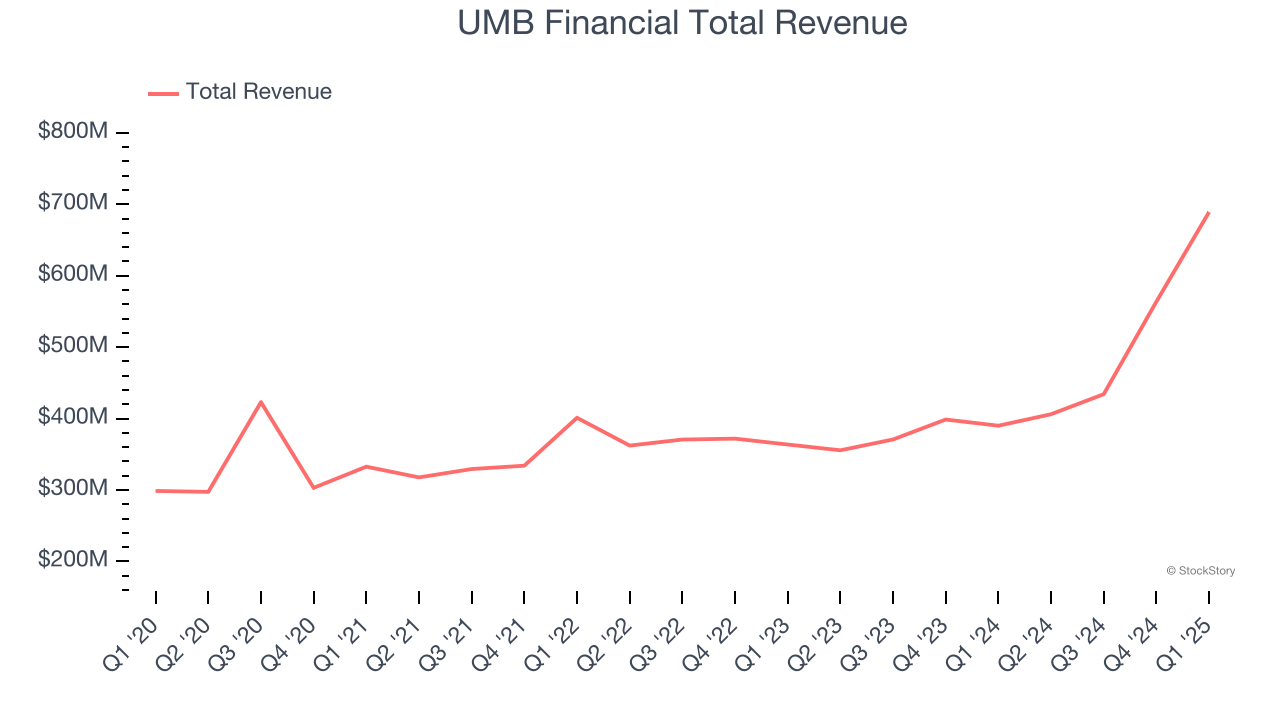

Best Q1: UMB Financial (NASDAQ:UMBF)

With roots dating back to 1913 and a name derived from "United Missouri Bank," UMB Financial (NASDAQ:UMBF) is a financial holding company that provides banking, asset management, and fund services to commercial, institutional, and individual customers.

UMB Financial reported revenues of $689.2 million, up 76.7% year on year, outperforming analysts’ expectations by 8.6%. The business had a stunning quarter with EPS in line with analysts’ estimates and an impressive beat of analysts’ tangible book value per share estimates.

The market seems happy with the results as the stock is up 6.3% since reporting. It currently trades at $116.68.

Is now the time to buy UMB Financial? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: Coastal Financial (NASDAQ:CCB)

Pioneering the intersection of traditional banking and financial technology in the Pacific Northwest, Coastal Financial (NASDAQ:CCB) operates as a bank holding company that provides traditional banking services and Banking-as-a-Service (BaaS) solutions to consumers and businesses.

Coastal Financial reported revenues of $119.4 million, down 11.7% year on year, falling short of analysts’ expectations by 21.5%. It was a disappointing quarter as it posted a significant miss of analysts’ net interest income estimates and a significant miss of analysts’ EPS estimates.

Interestingly, the stock is up 6.9% since the results and currently trades at $108.45.

Read our full analysis of Coastal Financial’s results here.

BOK Financial (NASDAQ:BOKF)

Tracing its roots back to 1910 when Oklahoma was still a young state, BOK Financial (NASDAQ:BOKF) is a regional bank holding company that provides commercial banking, consumer banking, and wealth management services across eight states in the central and southwestern US.

BOK Financial reported revenues of $535.3 million, down 3.7% year on year. This result surpassed analysts’ expectations by 3.3%. Overall, it was a strong quarter as it also put up EPS in line with analysts’ estimates and a narrow beat of analysts’ tangible book value per share estimates.

The stock is down 1.4% since reporting and currently trades at $105.41.

Read our full, actionable report on BOK Financial here, it’s free.

First Financial Bankshares (NASDAQ:FFIN)

With roots dating back to 1890 and a network spanning over 70 locations across the Lone Star State, First Financial Bankshares (NASDAQ:FFIN) is a Texas-focused regional bank providing commercial banking, trust services, and wealth management across numerous communities throughout the state.

First Financial Bankshares reported revenues of $156.6 million, up 14.2% year on year. This print topped analysts’ expectations by 1.9%. More broadly, it was a mixed quarter as it also logged a narrow beat of analysts’ tangible book value per share estimates but a slight miss of analysts’ net interest income estimates.

The stock is down 2.2% since reporting and currently trades at $36.01.

Read our full, actionable report on First Financial Bankshares here, it’s free.

Market Update

Thanks to the Fed’s series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.