Let’s dig into the relative performance of Wyndham (NYSE:WH) and its peers as we unravel the now-completed Q1 travel and vacation providers earnings season.

Airlines, hotels, resorts, and cruise line companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted from buying "things" (wasteful) to buying "experiences" (memorable). In addition, the internet has introduced new ways of approaching leisure and lodging such as booking homes and longer-term accommodations. Traditional airlines, hotel, resorts, and cruise line companies must innovate to stay relevant in a market rife with innovation.

The 19 travel and vacation providers stocks we track reported a mixed Q1. As a group, revenues beat analysts’ consensus estimates by 0.6% while next quarter’s revenue guidance was 4.5% above.

Luckily, travel and vacation providers stocks have performed well with share prices up 10.3% on average since the latest earnings results.

Wyndham (NYSE:WH)

Established in 1981, Wyndham (NYSE:WH) is a global hotel franchising company with over 9,000 hotels across nearly 95 countries on six continents.

Wyndham reported revenues of $316 million, up 3.6% year on year. This print was in line with analysts’ expectations, but overall, it was a mixed quarter for the company with a decent beat of analysts’ EPS estimates but a miss of analysts’ adjusted operating income estimates.

"We delivered a solid start to the year with strong system growth, record first-quarter openings and continued expansion across every region," said Geoff Ballotti, president and chief executive officer.

The stock is down 6.1% since reporting and currently trades at $79.87.

Read our full report on Wyndham here, it’s free.

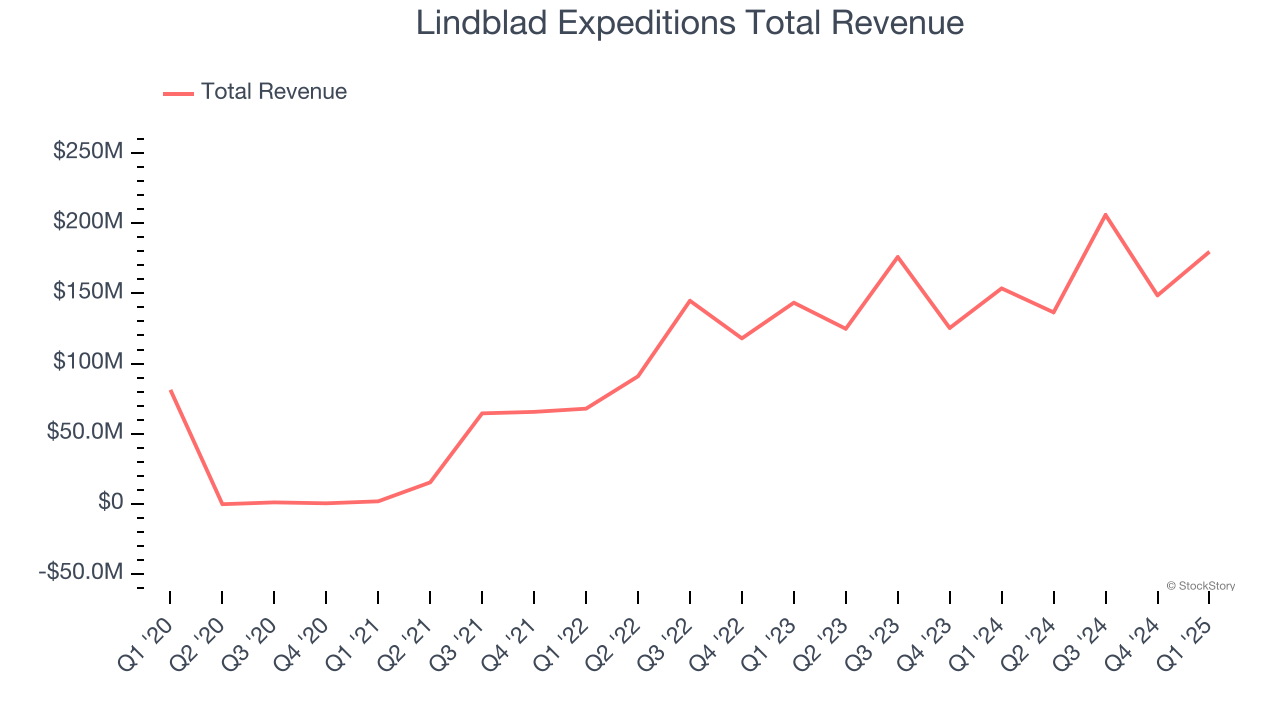

Best Q1: Lindblad Expeditions (NASDAQ:LIND)

Founded by explorer Sven-Olof Lindblad in 1979, Lindblad Expeditions (NASDAQ:LIND) offers cruising experiences to remote destinations in partnership with National Geographic.

Lindblad Expeditions reported revenues of $179.7 million, up 17% year on year, outperforming analysts’ expectations by 18.8%. The business had an exceptional quarter with an impressive beat of analysts’ EPS estimates and a solid beat of analysts’ EBITDA estimates.

Lindblad Expeditions scored the biggest analyst estimates beat, fastest revenue growth, and highest full-year guidance raise among its peers. The market seems happy with the results as the stock is up 19.2% since reporting. It currently trades at $10.86.

Is now the time to buy Lindblad Expeditions? Access our full analysis of the earnings results here, it’s free.

Slowest Q1: Hilton Grand Vacations (NYSE:HGV)

Spun off from Hilton Worldwide in 2017, Hilton Grand Vacations (NYSE:HGV) is a global timeshare company that provides travel experiences for its customers through its timeshare resorts and club membership programs.

Hilton Grand Vacations reported revenues of $1.15 billion, flat year on year, falling short of analysts’ expectations by 7.6%. It was a disappointing quarter as it posted a significant miss of analysts’ adjusted operating income and EPS estimates.

Hilton Grand Vacations delivered the weakest performance against analyst estimates in the group. Interestingly, the stock is up 13.7% since the results and currently trades at $38.24.

Read our full analysis of Hilton Grand Vacations’s results here.

Hyatt Hotels (NYSE:H)

Founded in 1957, Hyatt Hotels (NYSE:H) is a global hospitality company with a portfolio of 20 premier brands and over 950 properties across 65 countries.

Hyatt Hotels reported revenues of $1.72 billion, flat year on year. This number surpassed analysts’ expectations by 2%. It was a very strong quarter as it also logged an impressive beat of analysts’ adjusted operating income estimates and a solid beat of analysts’ EPS estimates.

The stock is up 19.5% since reporting and currently trades at $134.67.

Read our full, actionable report on Hyatt Hotels here, it’s free.

Marriott (NASDAQ:MAR)

Founded by J. Willard Marriott in 1927, Marriott International (NASDAQ:MAR) is a global hospitality company with a portfolio of over 7,000 properties and 30 brands, spanning 130+ countries and territories.

Marriott reported revenues of $6.26 billion, up 4.8% year on year. This result beat analysts’ expectations by 0.8%. Taking a step back, it was a mixed quarter as it also recorded a decent beat of analysts’ adjusted operating income estimates but EBITDA guidance for next quarter missing analysts’ expectations.

The stock is up 3.6% since reporting and currently trades at $256.27.

Read our full, actionable report on Marriott here, it’s free.

Market Update

Thanks to the Fed’s series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.