Earnings results often indicate what direction a company will take in the months ahead. With Q1 behind us, let’s have a look at Pitney Bowes (NYSE:PBI) and its peers.

Growing regulatory pressure on environmental compliance and increasing corporate ESG commitments should buoy the sector for years to come. On the other hand, environmental regulations continue to evolve, and this may require costly upgrades, volatility in commodity waste and recycling markets, and labor shortages in industrial services. As for digitization, a theme that is impacting nearly every industry, the increasing use of data, analytics, and automation will give rise to improved efficiency of operations. Conversely, though, the benefits of digitization also come with challenges of integrating new technologies into legacy systems.

The 8 industrial & environmental services stocks we track reported a strong Q1. As a group, revenues beat analysts’ consensus estimates by 3% while next quarter’s revenue guidance was 1% above.

Thankfully, share prices of the companies have been resilient as they are up 6.2% on average since the latest earnings results.

Pitney Bowes (NYSE:PBI)

With a century-long history dating back to 1920 and processing over 15 billion pieces of mail annually, Pitney Bowes (NYSE:PBI) provides shipping, mailing technology, logistics, and financial services to businesses of all sizes.

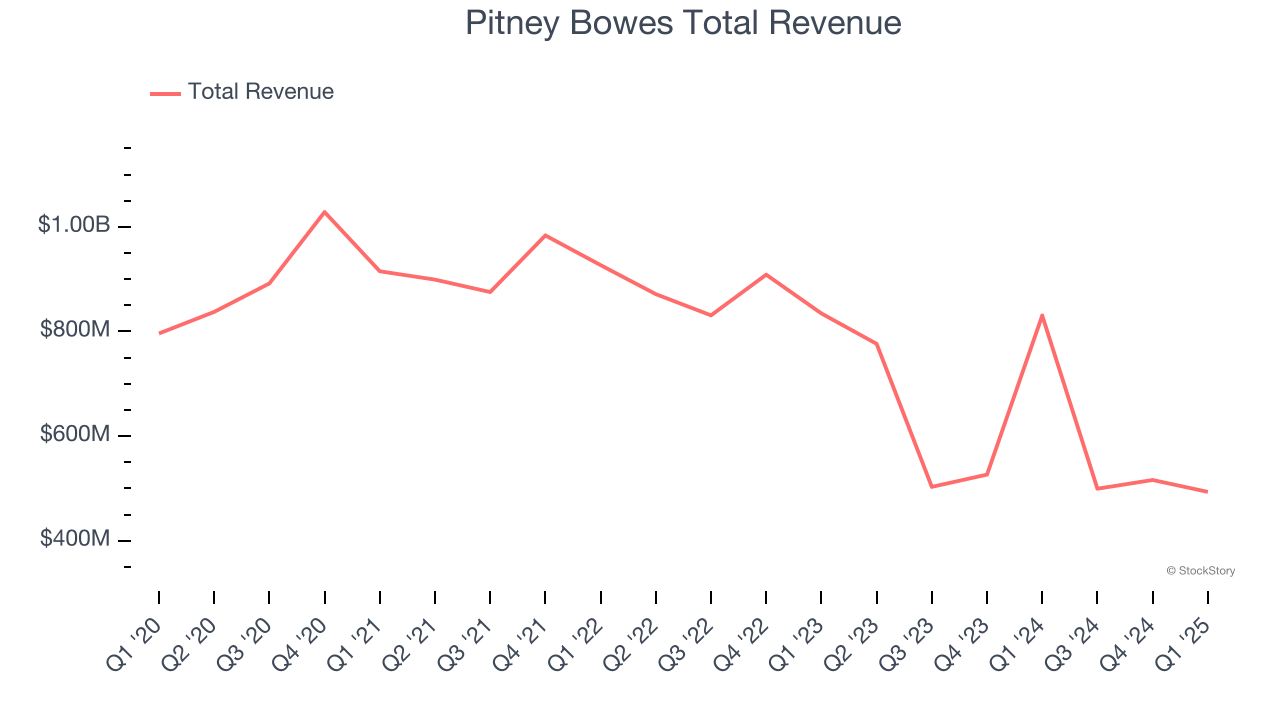

Pitney Bowes reported revenues of $493.4 million, down 40.6% year on year. This print fell short of analysts’ expectations by 0.9%, but it was still a satisfactory quarter for the company with an impressive beat of analysts’ EPS estimates.

Pitney Bowes delivered the slowest revenue growth and weakest full-year guidance update of the whole group. Interestingly, the stock is up 14.8% since reporting and currently trades at $10.28.

Is now the time to buy Pitney Bowes? Access our full analysis of the earnings results here, it’s free.

Best Q1: CECO Environmental (NASDAQ:CECO)

With roots dating back to 1869 and a focus on creating cleaner industrial operations, CECO Environmental (NASDAQ:CECO) provides technology and expertise that helps industrial companies reduce emissions, treat water, and improve energy efficiency across various sectors.

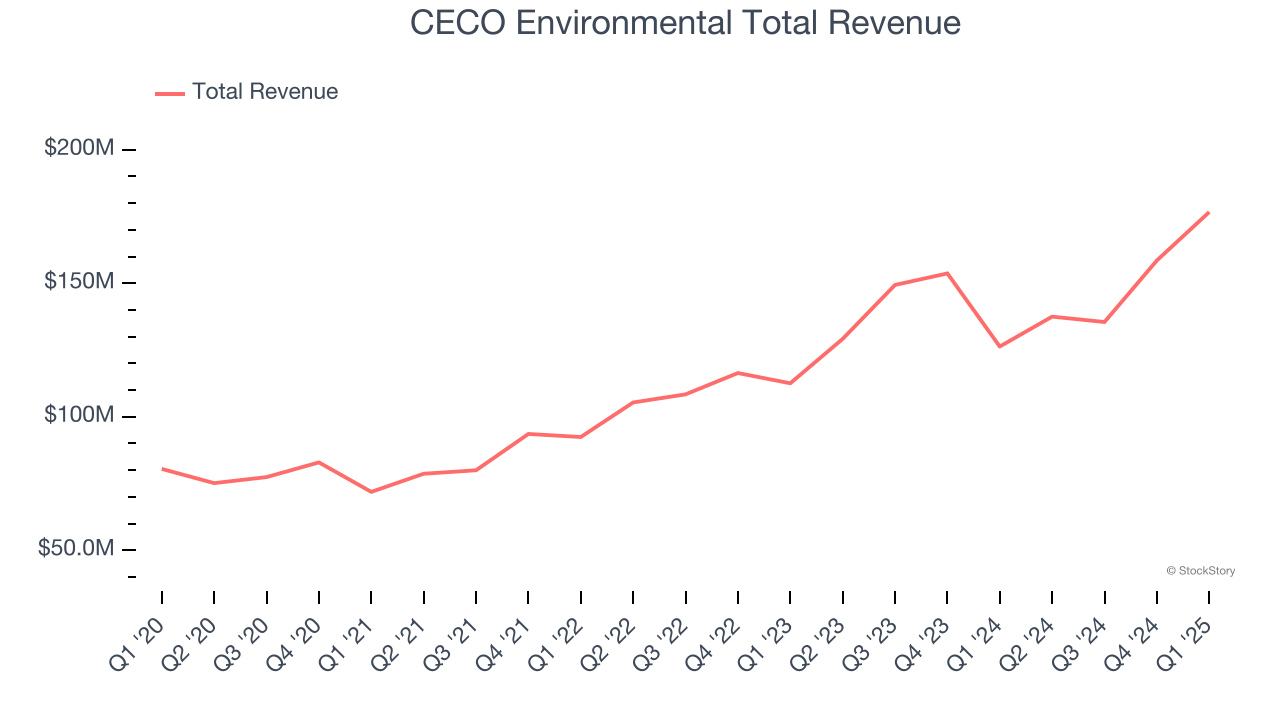

CECO Environmental reported revenues of $176.7 million, up 39.9% year on year, outperforming analysts’ expectations by 17%. The business had a stunning quarter with a solid beat of analysts’ EPS estimates and full-year revenue guidance beating analysts’ expectations.

CECO Environmental delivered the biggest analyst estimates beat and fastest revenue growth among its peers. The market seems happy with the results as the stock is up 44.3% since reporting. It currently trades at $27.70.

Is now the time to buy CECO Environmental? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: Vestis (NYSE:VSTS)

Operating a network of more than 350 facilities with 3,300 delivery routes serving customers weekly, Vestis (NYSE:VSTS) provides uniform rentals, workplace supplies, and facility services to over 300,000 business locations across the United States and Canada.

Vestis reported revenues of $665.2 million, down 5.7% year on year, falling short of analysts’ expectations by 4%. It was a softer quarter as it posted a significant miss of analysts’ EPS estimates.

Vestis delivered the weakest performance against analyst estimates in the group. As expected, the stock is down 32.8% since the results and currently trades at $5.85.

Read our full analysis of Vestis’s results here.

Driven Brands (NASDAQ:DRVN)

With approximately 5,000 locations across 49 U.S. states and 13 other countries, Driven Brands (NASDAQ:DRVN) operates a network of automotive service centers offering maintenance, car washes, paint, collision repair, and glass services across North America.

Driven Brands reported revenues of $516.2 million, up 7.1% year on year. This result beat analysts’ expectations by 2.8%. Overall, it was a strong quarter as it also put up an impressive beat of analysts’ EPS estimates and full-year revenue guidance meeting analysts’ expectations.

The stock is down 2.6% since reporting and currently trades at $16.88.

Read our full, actionable report on Driven Brands here, it’s free.

UniFirst (NYSE:UNF)

With a fleet of trucks making weekly deliveries to over 300,000 customer locations, UniFirst (NYSE:UNF) provides, rents, cleans, and maintains workplace uniforms and protective clothing for businesses across various industries.

UniFirst reported revenues of $602.2 million, up 1.9% year on year. This number was in line with analysts’ expectations. It was a strong quarter as it also logged a solid beat of analysts’ full-year EPS guidance estimates.

The stock is up 5.5% since reporting and currently trades at $184.45.

Read our full, actionable report on UniFirst here, it’s free.

Market Update

As a result of the Fed’s rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed’s 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump’s victory in the U.S. Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain, leaving much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.