Wabtec has been treading water for the past six months, recording a small return of 1.5% while holding steady at $203.60.

Does this present a buying opportunity for WAB? Or is its underperformance reflective of its story and business quality? Find out in our full research report, it’s free.

Why Does WAB Stock Spark Debate?

Also known as Wabtec, Westinghouse Air Brake Technologies (NYSE:WAB) provides equipment, systems, and related software for the railway industry.

Two Positive Attributes:

1. Organic Growth Indicates Solid Core Business

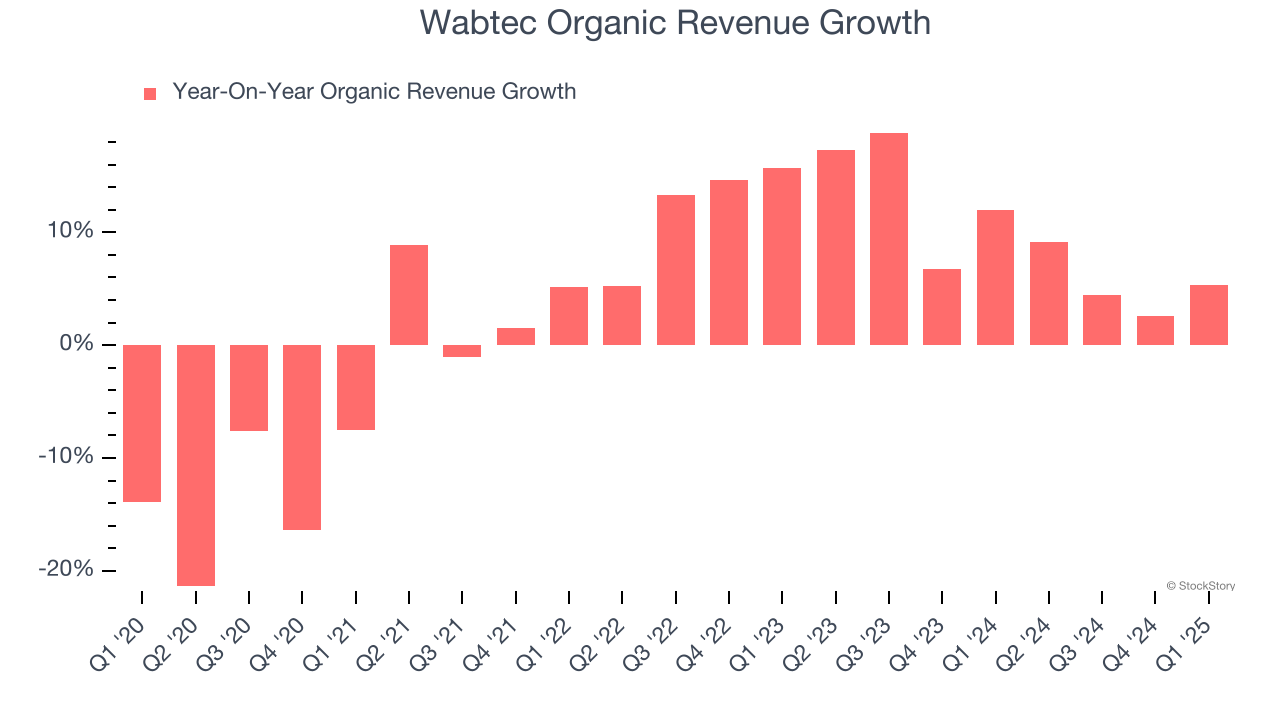

Investors interested in Heavy Transportation Equipment companies should track organic revenue in addition to reported revenue. This metric gives visibility into Wabtec’s core business because it excludes one-time events such as mergers, acquisitions, and divestitures along with foreign currency fluctuations - non-fundamental factors that can manipulate the income statement.

Over the last two years, Wabtec’s organic revenue averaged 9.5% year-on-year growth. This performance was solid and shows it can expand steadily without relying on expensive (and risky) acquisitions.

2. Outstanding Long-Term EPS Growth

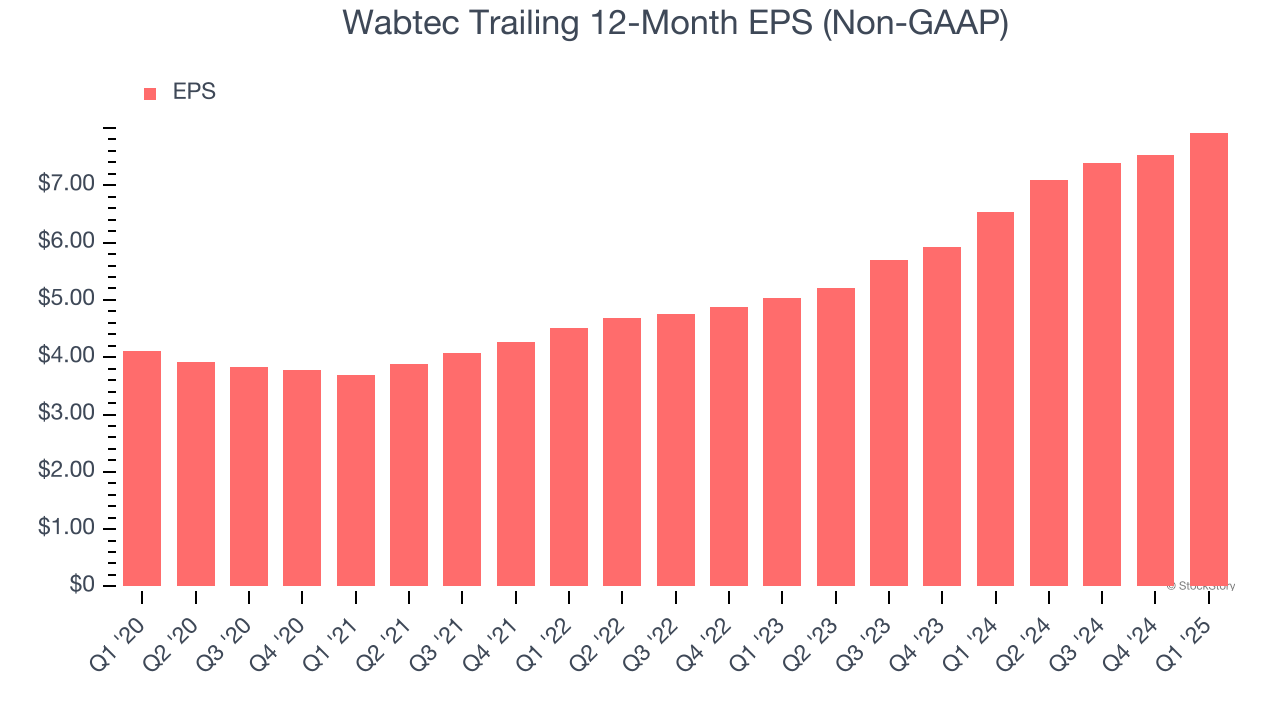

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Wabtec’s EPS grew at a remarkable 14.1% compounded annual growth rate over the last five years, higher than its 4.2% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

One Reason to be Careful:

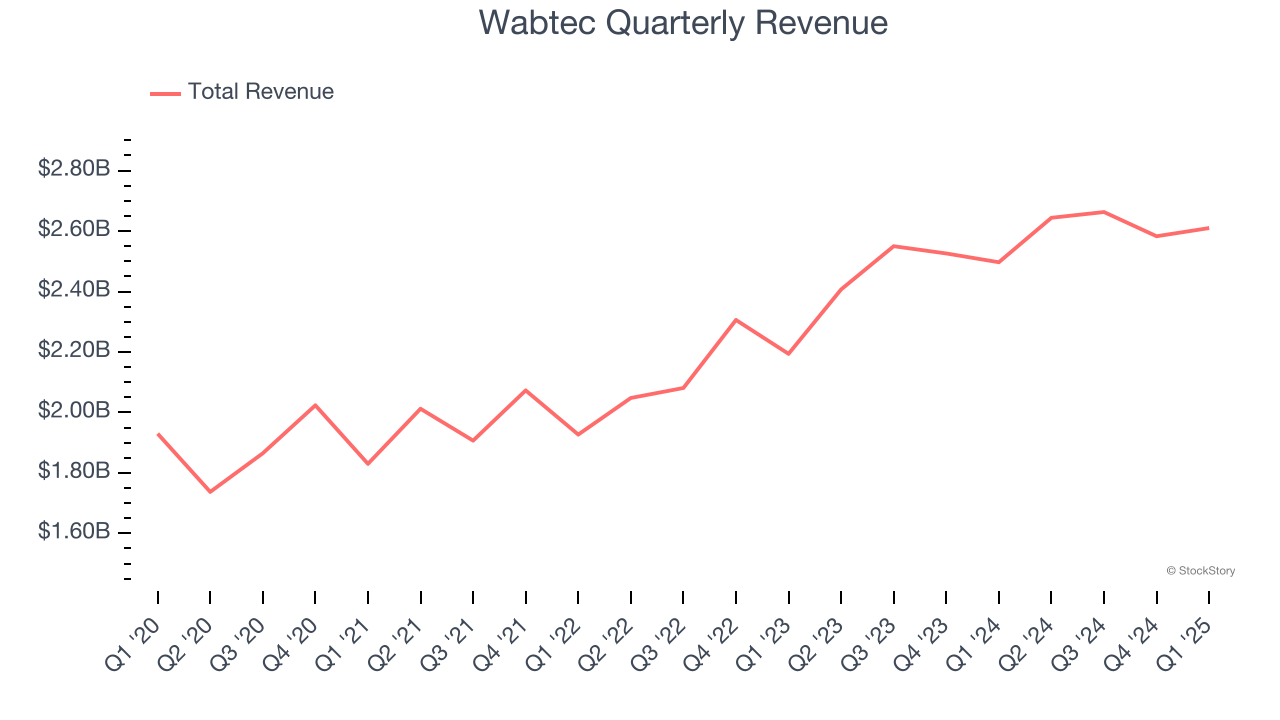

Long-Term Revenue Growth Disappoints

Examining a company’s long-term performance can provide clues about its quality. Any business can have short-term success, but a top-tier one grows for years. Regrettably, Wabtec’s sales grew at a sluggish 4.2% compounded annual growth rate over the last five years. This wasn’t a great result compared to the rest of the industrials sector, but there are still things to like about Wabtec.

Final Judgment

Wabtec’s merits more than compensate for its flaws, but at $203.60 per share (or 23.1× forward P/E), is now the time to initiate a position? See for yourself in our full research report, it’s free.

Stocks We Like Even More Than Wabtec

Market indices reached historic highs following Donald Trump’s presidential victory in November 2024, but the outlook for 2025 is clouded by new trade policies that could impact business confidence and growth.

While this has caused many investors to adopt a "fearful" wait-and-see approach, we’re leaning into our best ideas that can grow regardless of the political or macroeconomic climate. Take advantage of Mr. Market by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.