Earnings results often indicate what direction a company will take in the months ahead. With Q4 behind us, let’s have a look at Telephone and Data Systems (NYSE:TDS) and its peers.

Terrestrial telecommunication companies face an uphill battle, as they mostly sell into a deflationary market, where the price of moving a bit tends to decrease over time with better technology. Without dependable volume growth, revenue growth could be challenged. Unfortunately, broadband penetration in their core US market is quite high already. On the other hand, data consumption from streaming entertainment and 5G expansion could provide a floor on growth for the next number of years. As if that wasn't enough to worry about, competition is intense, with larger telecom providers and hyperscalers expanding their own networks.

The 4 terrestrial telecommunication services stocks we track reported a very strong Q4. As a group, revenues beat analysts’ consensus estimates by 0.8%.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 9.2% since the latest earnings results.

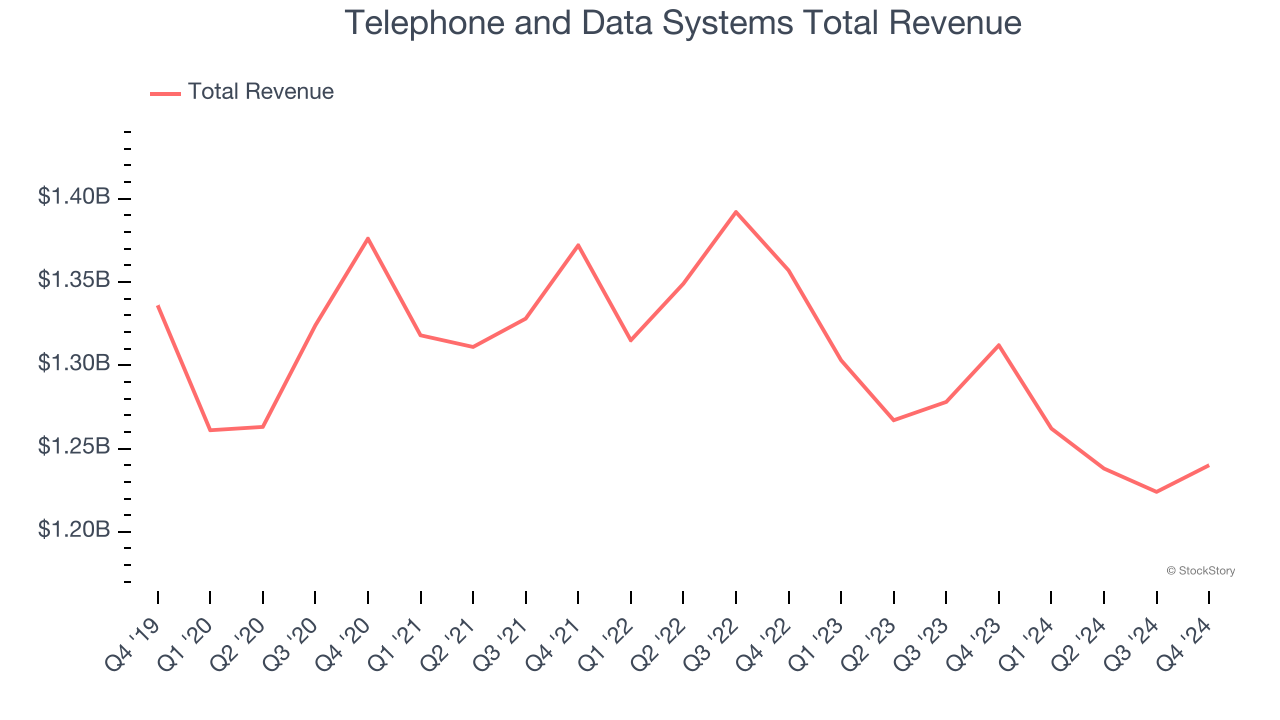

Telephone and Data Systems (NYSE:TDS)

Operating since 1968 with a strong regional focus in smaller communities across America, Telephone and Data Systems (NYSE:TDS) provides wireless, broadband, video, and voice communications services to 4.6 million wireless and 1.2 million broadband customers across the United States.

Telephone and Data Systems reported revenues of $1.24 billion, down 5.5% year on year. This print exceeded analysts’ expectations by 1%. Overall, it was an exceptional quarter for the company with an impressive beat of analysts’ EPS estimates.

"During 2024, we made significant progress on the strategic review of alternatives at UScellular," said Walter C. D. Carlson, TDS President and CEO.

The stock is down 12.8% since reporting and currently trades at $34.56.

Is now the time to buy Telephone and Data Systems? Access our full analysis of the earnings results here, it’s free.

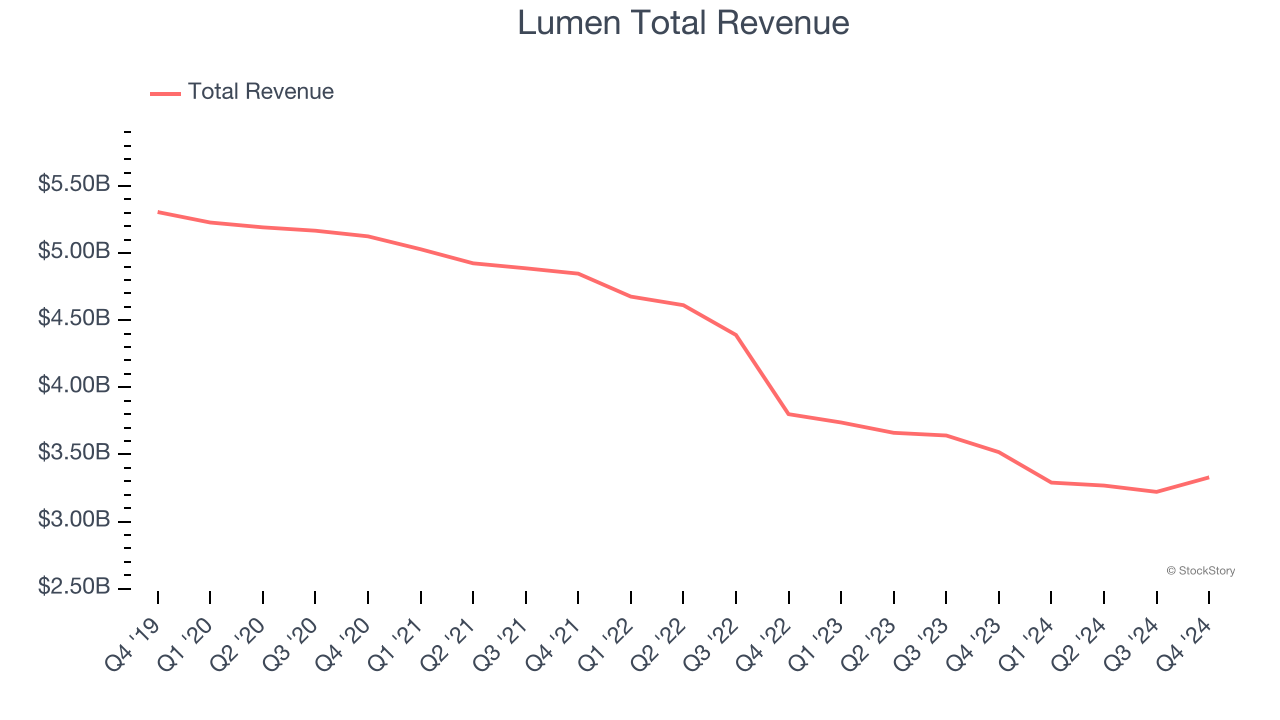

Best Q4: Lumen (NYSE:LUMN)

Formerly known as CenturyLink until its 2020 rebranding, Lumen Technologies (NYSE:LUMN) operates one of the world's largest fiber networks, providing connectivity, cloud, and security solutions to businesses and residential customers.

Lumen reported revenues of $3.33 billion, down 5.3% year on year, outperforming analysts’ expectations by 4.2%. The business had a stunning quarter with an impressive beat of analysts’ EPS estimates.

Lumen achieved the biggest analyst estimates beat among its peers. Although it had a fine quarter compared to its peers, the market seems unhappy with the results as the stock is down 6.1% since reporting. It currently trades at $4.72.

Is now the time to buy Lumen? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: Cogent (NASDAQ:CCOI)

With a massive network spanning 54 countries across six continents and connecting over 3,200 buildings, Cogent Communications (NASDAQ:CCOI) is a facilities-based provider of high-speed Internet access, private network services, and data center colocation space to businesses and bandwidth-intensive organizations.

Cogent reported revenues of $252.3 million, down 7.3% year on year, falling short of analysts’ expectations by 2.5%. Still, it was a satisfactory quarter as it posted an impressive beat of analysts’ EPS estimates.

Cogent delivered the weakest performance against analyst estimates and slowest revenue growth in the group. As expected, the stock is down 14.3% since the results and currently trades at $68.59.

Read our full analysis of Cogent’s results here.

U.S. Cellular (NYSE:USM)

Operating as a majority-owned subsidiary of Telephone and Data Systems, U.S. Cellular (NYSE:USM) is a regional wireless telecommunications company providing mobile phone service, home internet, and business solutions across 21 states.

U.S. Cellular reported revenues of $970 million, down 3% year on year. This result topped analysts’ expectations by 0.6%. Overall, it was an exceptional quarter as it also put up a solid beat of analysts’ EPS estimates.

U.S. Cellular delivered the fastest revenue growth among its peers. The stock is down 3.7% since reporting and currently trades at $64.76.

Read our full, actionable report on U.S. Cellular here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.