Texas Pacific Land Corporation (TPL) is one of the largest landowners in Texas, primarily engaged in managing and monetizing vast land holdings in the oil-rich Permian Basin. Valued at a market cap of $23.3 billion, it generates revenue through land sales, easements, royalties from oil and gas production, and water services for energy operations. It is expected to announce its Q4 earnings shortly.

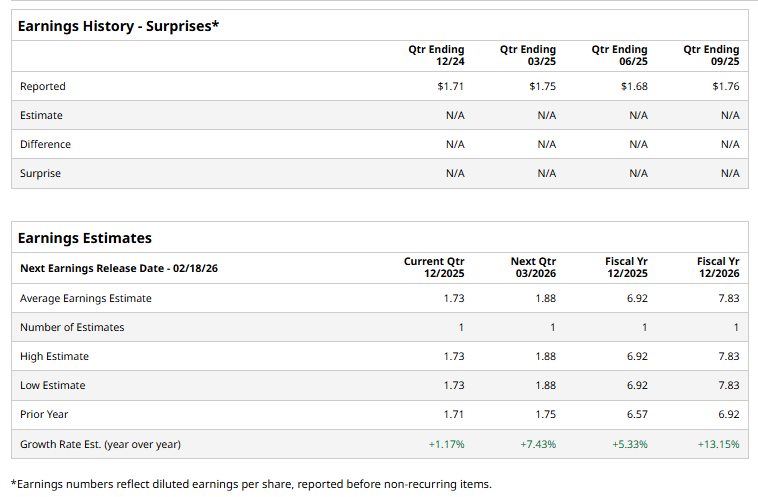

Ahead of the event, analysts expect Texas Pacific to announce a profit of $1.73 per share, up 1.2% from $1.71 per share reported in the year-ago quarter.

In fiscal 2025, analysts expect TPL to report an EPS of $6.92, up 5.3% from $6.57 in fiscal 2024. However, in fiscal 2026, its EPS is projected to grow 13.2% year over year to $7.83.

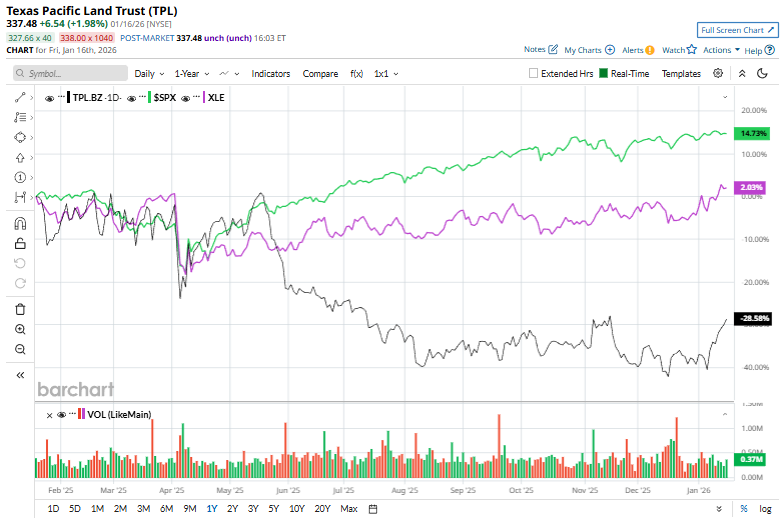

TPL stock decreased 27.3% over the past year, underperforming the S&P 500 Index’s ($SPX) 16.9% gains and the S&P 500 Energy Sector SPDR’s (XLE) 2.3% returns over the same time frame.

On Dec. 17, Texas Pacific Land’s shares surged over 7% and topped S&P 500 gainers after the company unveiled a deal with Bolt Data & Energy to build major data center facilities on its West Texas acreage, a move seen as expanding TPL’s growth opportunities beyond energy.

The consensus opinion on Texas Pacific stock is fairly bullish, with a “Moderate Buy” rating overall. Out of three analysts covering the stock, two recommend “Strong Buy,” and one suggests a “Hold” rating. While TPL currently trades above the mean price target of $316.11, its Street-high target price represents an upswing potential of 14.6% from the current market prices.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart