Atlanta, Georgia-based Assurant, Inc. (AIZ), founded in 1892, has built a global business around protection in everyday life. With a market capitalization of about $11.8 billion, the company operates across North America, Latin America, Europe, and Asia-Pacific, focusing on homes, vehicles, and connected devices.

Its Global Lifestyle segment supports mobile devices, consumer electronics, appliances, and auto-related services, while also offering select financial and insurance products. Meanwhile, Global Housing anchors the portfolio with homeowners, renters, flood, and manufactured housing insurance. Formerly known as Fortis, Assurant adopted its current name in 2004, reflecting a sharper focus on modern risk protection.

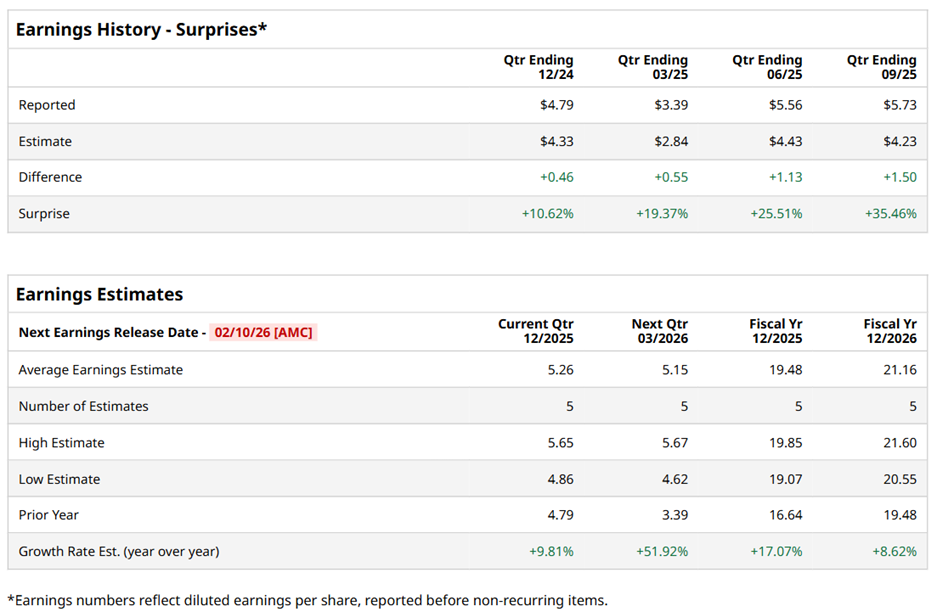

The lifestyle and housing solutions specialist is expected to announce its fourth-quarter 2025 earnings report on Tuesday, Feb. 10, after market closes, and Wall Street is highly upbeat. Analysts estimate earnings of $5.26 per share, a 9.8% surge from $4.79 per share reported in the year-ago quarter. Assurant’s consistency fuels this confidence. The company has surpassed EPS estimates in each of the past four quarters.

For fiscal 2025, analysts expect EPS to rise 17.1% from $16.64 reported in fiscal 2024 to $19.48, and then rise by another 8.6% year over year (YoY) to $21.16 in fiscal 2026.

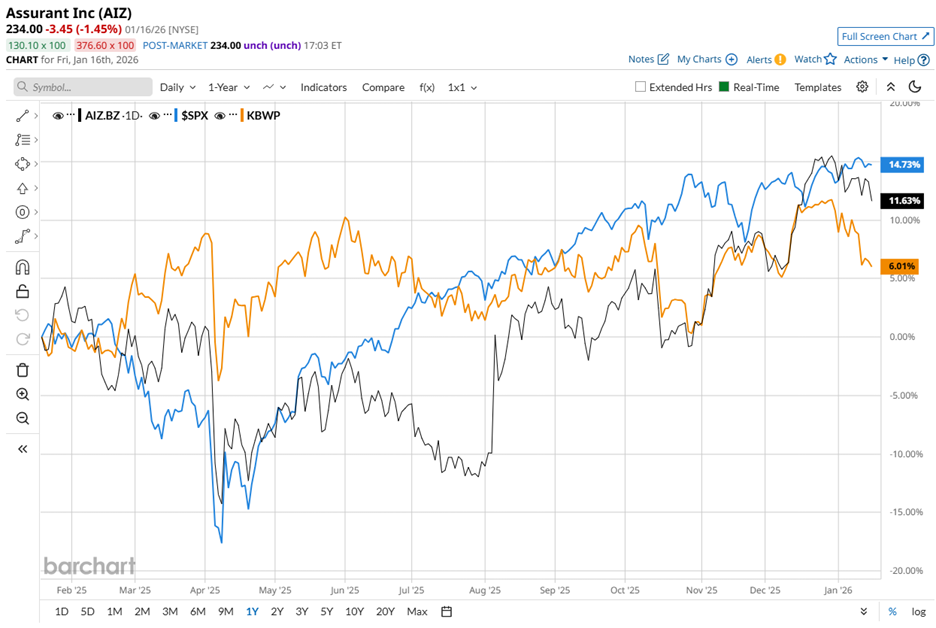

However, the stock’s performance has been mixed. AIZ has surged 10.5% over the past 52 weeks, underperforming the S&P 500 Index’s ($SPX) 16.9% rise, but outpacing the Invesco KBW Property & Casualty Insurance ETF’s (KBWP) 5% increase over the same time frame.

Recent results offer a glimpse of why investors remain engaged. Following the release of solid third-quarter earnings in early November, the stock climbed 1.7% in the next session. The quarter reflected balanced growth across the business, supported by higher premiums, stronger investment income, and rising fee-based revenues. Total revenue climbed nearly 9% YoY to $3.2 billion, topping expectations, while adjusted earnings surged sharply. It was another reminder that Assurant’s story is less about short-term noise and more about consistent progress.

Analysts, overall, remain cautiously positive on the stock, assigning it an overall “Moderate Buy” rating. Among the nine analysts covering the stock, five are recommending a “Strong Buy,” one advises a “Moderate Buy,” and the remaining three suggest a “Hold.”

AIZ’s average analyst price target of $257.83 suggests upside potential of 10.2%. The Street-high target of $270 implies the stock could rally as much as 15.4% from the current price levels.

On the date of publication, Sristi Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Want to Invest in Nvidia’s Futuristic Rubin Chips? Consider This 1 ‘Picks-and-Shovels’ Stock Instead.

- Microsoft Wants to Lower Data Center Energy Use. Does That Help the Bull Case for MSFT Stock?

- Trump Is Taking Aim at Credit Card Swipe Fees. Should You Ditch Visa Stock ASAP?

- Dear Apple Stock Fans, Mark Your Calendars for January 27