Apple (AAPL) is both one of the market's most influential stocks and one of the world's most valuable firms, making it difficult for investors to overlook. The company currently appears to be working on its next significant hardware development, with anticipation centered on a foldable iPhone set to emerge in the fall of 2026.

Ming-Chi Kuo, an analyst at TF International Securities, projects that shipments would only reach 3 million to 5 million units in 2026 before rapidly increasing to 20 million in 2027.

The device's anticipated ultra-thin glass does increase execution risk because it is extremely prone to cracks and costs two to four times as much as regular glass, which puts pressure on margins despite premium pricing. Retail prices could exceed $2,000.

However, if quality meets expectations, Apple's loyal customer base could continue to spur replacement demand. The book-style design might have a 7.8-inch internal display, a 5.5-inch exterior panel, Touch ID, dual lenses, and a stainless steel-titanium hinge.

Amid this development, analysts are increasingly focused on Apple's foldable ambitions, making investors wonder if buying Apple's shares ahead of its next major product cycle makes strategic sense.

About Apple Stock

Headquartered in Cupertino, California, Apple designs and sells smartphones, computers, tablets, wearables, and accessories alongside a broad services portfolio. Its ecosystem spans iPhone, Mac, iPad, proprietary operating systems, digital content, cloud, payments, and subscription platforms.

With a market cap of $4 trillion, Apple continues to enjoy considerable confidence among investors. Its stock has gained 9.56% over the past 52 weeks, driven by a strong 39.2% rally in the last six months.

Moreover, over the most recent three-month period, the company’s shares rose 11.47%, decisively outperforming the tech-heavy Nasdaq 100 Index’s ($IUXX) 2.3% gain.

Moreover, valuation metrics indicate that AAPL stock trades at 33.55 times forward adjusted earnings and 8.92 times forward sales, reflecting a clear premium to industry averages and signaling market expectations for sustained growth, strong margins, and durable competitive advantages.

Also, Apple returns capital through dividends, maintaining a 12-year payout streak. The company pays $1.04 annually, yielding 0.38%, with the most recent $0.26 dividend distributed on Nov. 13 to shareholders of record as of Nov. 10.

Apple Surpasses Q4 Earnings

On Oct. 30, Apple reported its Q4 2025 financial results, delivering another solid performance that exceeded expectations. Revenue rose 7.9% year-over-year (YOY) to $102.5 billion, topping Street forecasts of $101.2 billion, while EPS increased 90.7% from the previous year’s quarter to $1.85, ahead of the $1.73 consensus estimate.

Markets responded positively to the quarter, with management citing solid demand for both hardware and services. The successful rollout of the iPhone 17 lineup, resilient MacBook Air sales, and sustained momentum in services collectively contributed to performance.

The iPhone once again anchored growth. During the September quarter, iPhone revenue reached a record $49 billion, reflecting a 6% YOY increase. Strong uptake of the iPhone 16 and 17 models pushed Apple’s active installed base to an all-time high, reinforcing long-term monetization potential through upgrades, services, and ecosystem stickiness.

Additionally, Apple's Mac division generated significant gains. Revenue climbed 13% YOY to $8.7 billion, supported primarily by robust demand for the MacBook Air. At the same time, Services continued to emerge as a critical growth catalyst, generating a record $28.8 billion in quarterly revenue, up 15% YOY, with double-digit growth across both developed and emerging markets.

Looking ahead, management has guided for a record December quarter, projecting 10% to 12% YOY revenue growth. Expectations rest on double-digit iPhone growth, continued services strength, expanded AI capabilities, and sustained R&D investment.

Analysts echo the confidence, forecasting fiscal 2026 Q1 EPS rising 10.4% YOY to $2.65. They forecast a full-year fiscal 2026 bottom line growing 8.7% to $8.11, followed by a further 12.5% rise to $9.12 in fiscal year 2027, supporting a durable long-term growth narrative.

What Do Analysts Expect for Apple Stock?

Morgan Stanley analyst Erik Woodring recently lifted his price target on AAPL stock to $315 from $305 and reiterated a “Buy” rating, identifying the company as one of his preferred IT hardware stocks heading into 2026.

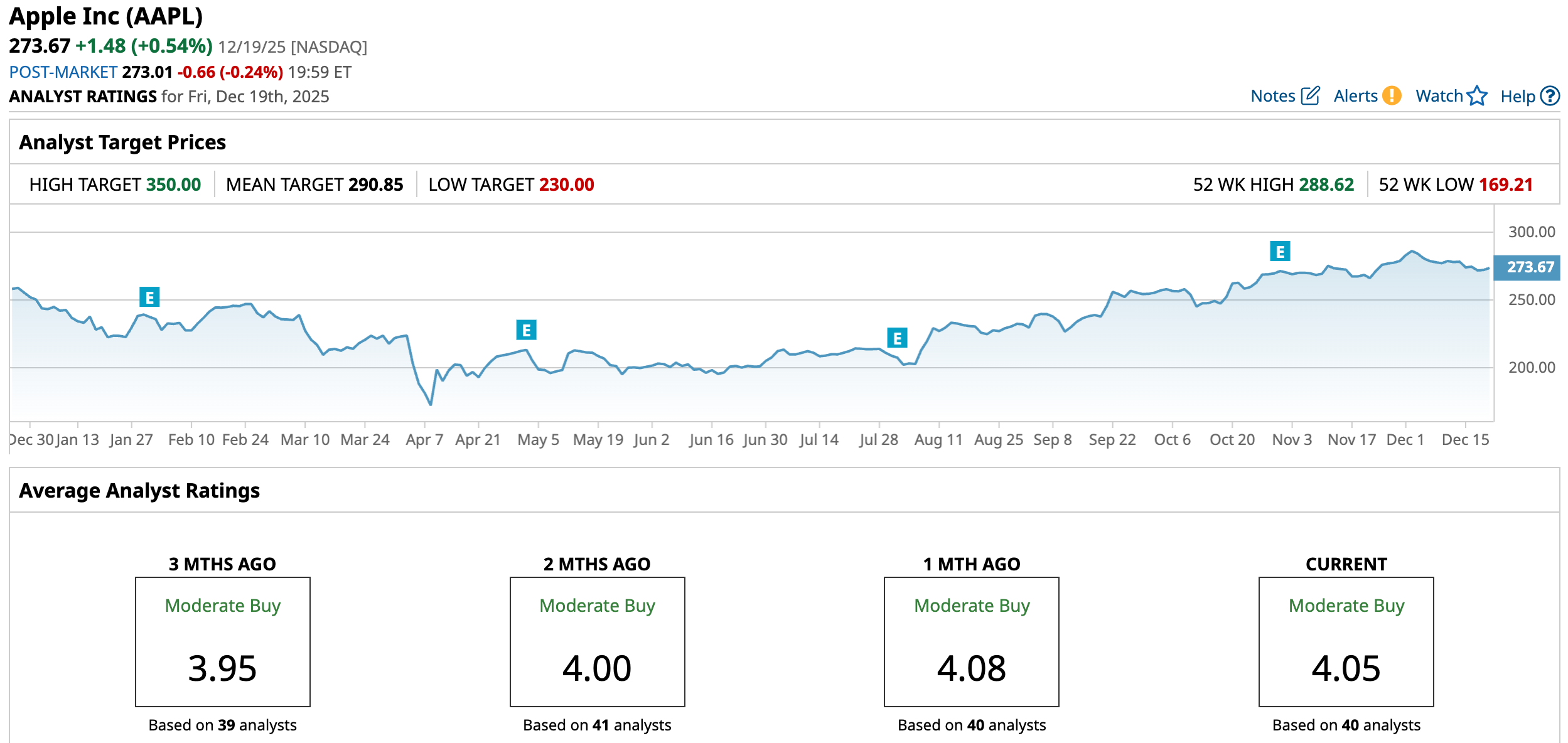

The optimism aligns closely with broader Wall Street sentiment. AAPL currently carries a “Moderate Buy” consensus rating. Among the 40 analysts covering the stock, 21 rate it “Strong Buy,” three assign “Moderate Buy,” 14 recommend “Hold,” while only one suggests “Moderate Sell” and one recommends “Strong Sell.”

The stock’s average price target of $290.85 represents potential upside of 6.3%. Meanwhile, the Street-high target of $350 implies potential gain of 27.9% from current levels, reflecting more bullish assumptions around Apple’s next growth cycle.

On the date of publication, Aanchal Sugandh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart