Eaton Corporation plc (ETN) is a global leader in intelligent power-management solutions, serving a wide range of markets from electrical infrastructure and industrial systems to aerospace and vehicle components. The company is headquartered in Dublin, Ireland. Eaton’s market cap is around $143.5 billion.

Eaton’s shares have lagged behind the broader market. Over the past 52 weeks, ETN stock has surged marginally, while the broader S&P 500 Index ($SPX) has soared 14.5%. Moreover, the stock is up 11.3% on a YTD basis, compared to SPX’s 16.5% rise during the same time frame.

Zooming in further, Eaton’s shares have also underperformed the Industrial Select Sector SPDR Fund’s (XLI) 8.8% return over the past 52 weeks and 17.2% gain on a YTD basis.

Eaton is benefiting from strong structural tailwinds, particularly electrification, data center expansion, and infrastructure modernization, which are driving increased demand for its power management and electrical components. Analysts highlight that its positioning in high-growth markets, such as data centers and aerospace, gives it an advantage in capturing long-term growth opportunities and improving investor sentiment this year.

For the current fiscal year, ending in December 2025, analysts expect Eaton’s EPS to grow 11.9% year over year to $12.09. The company’s earnings surprise history is promising. It surpassed the Wall Street estimates in each of the last four quarters.

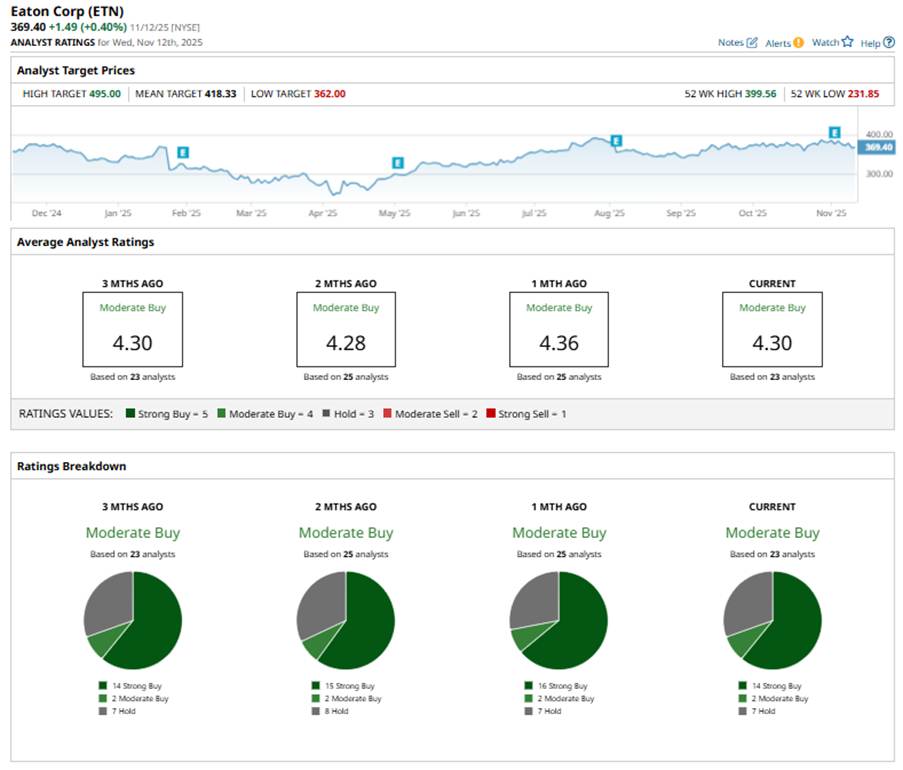

Among the 23 analysts covering the stock, the consensus rating is a “Moderate Buy.” This is based on 14 analysts recommending a “Strong Buy,” two advising a “Moderate Buy,” and the remaining seven analysts staying cautious with a “Hold” rating.

This configuration is slightly less bullish than it was one month ago, when there were 16 “Strong Buy” ratings.

Earlier this month, RBC Capital raised its price target on ETN stock to $432 from $425, maintaining an “Outperform” rating, citing strong demand for data centers.

The mean price target of $418.33 represents a 13.2% premium to ETN’s current price levels, and the Street-high price target of $495 suggests an upside potential of 34%.

On the date of publication, Sristi Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart