Austin, Minnesota-based Hormel Foods Corporation (HRL) is a leading manufacturer as well as marketer of various meat and food products. It develops and distributes various meat, nuts, and other food products to retail, foodservice, and commercial customers. With a market cap of $12.4 billion, Hormel Foods operates in various countries across the globe through its Retail, Foodservice, and International segments.

The packaged foods major has substantially underperformed the broader market over the past year. Hormel Foods' stock prices have plummeted 29% on a YTD basis and 26.7% over the past 52 weeks, compared to the S&P 500 Index’s ($SPX) 16.5% gains in 2025 and 14.5% returns over the past year.

Narrowing the focus, Hormel Foods has also underperformed the First Trust Nasdaq Food & Beverage ETF’s (FTXG) 7.9% decline on a YTD basis and 12.3% drop over the past year.

Hormel Foods’ stock prices tanked 13.1% in a single trading session following the release of its mixed Q3 results on Aug. 28. The company observed strong organic growth across its segments, leading to a solid 4.6% year-over-year growth in overall net sales to $3 billion, beating the Street’s expectations by 1.9%. However, the company’s earnings performance has remained grim. Due to a steep rise in commodity input costs, the company’s adjusted EPS declined by 5% year-over-year to $0.35, missing the consensus estimates by 14.6%, making investors jittery.

For the full fiscal 2025, ended in October, analysts expect HRL to deliver an adjusted EPS of $1.37, down 13.3% year-over-year. The company has a lackluster earnings surprise history. While it met the Street’s bottom-line estimates once over the past four quarters, it has missed the projections on three other occasions.

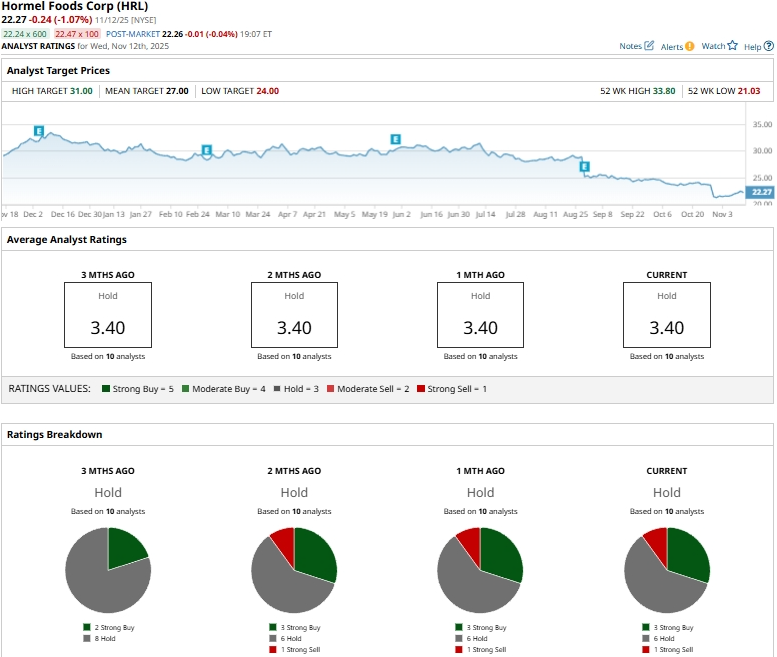

Among the 10 analysts covering the stock, the consensus rating is a “Hold.” That’s based on three “Strong Buys,” six “Holds,” and one “Strong Sell.”

This configuration is slightly different from three months ago, when two analysts gave “Strong Buy” recommendations and none of the analysts suggested “Strong Sell” ratings.

On Nov. 6, Piper Sandler analyst Michael Lavery maintained a “Neutral” rating on HRL, but notched down the price target from $26 to $25.

HRL’s mean price target of $27 represents a premium of 21.2% to current price levels. Meanwhile, the street-high target of $31 suggests a potential upside of 39.2%.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Is This Dividend Stock a Buy for 2026 After More Than Doubling This Year?

- 4 Reasons to Roll Your Covered Call Option and Keep Your Income Strategy Alive

- AMD Says Data Center Revenue Could Jump 60% Annually from Here. Should You Buy AMD Stock Now?

- Circle Stock Enters Oversold Territory on Earnings Plunge. Should You Buy the Dip?