Valued at a market capitalization of $10.66 billion, Globe Life Inc. (GL) is recognized for providing a broad range of life and supplemental health insurance solutions to millions of Americans. The company achieves a nationwide reach through various distribution channels, including exclusive agencies, independent brokers, and direct-response approaches. Globe Life’s key focus is on delivering straightforward application processes, affordable coverage, and dependable financial protection for families. Its main headquarters is situated in McKinney, Texas, establishing Globe Life as a well-known insurance provider across the U.S.

The company exhibits stable financial health, which has led to a 21.4% rise in its stock over the past 52 weeks. Over the past six months, the stock has been up 11%. On the other hand, the broader S&P 500 Index ($SPX) has gained 14.5% and 17.2% over the same periods, respectively, indicating that the stock has outperformed the broader market over the past year but underperformed it over the past six months.

Next, we compare the stock with its own sector. The Financial Select Sector SPDR Fund (XLF) gained 7.9% over the past 52 weeks and 5.5% over the past six months, exhibiting that the stock has outperformed its sector over these periods.

On Oct. 22, Globe Life reported its third-quarter results for fiscal 2025. The company’s revenue increased 4% year-over-year (YOY) to $1.51 billion, slightly missing the expectations of Wall Street analysts. This growth was predicated upon revenue from life premiums increasing 3.2% from the prior year’s period to $844.48 million. Its net operating income grew 37.8% YOY to $4.81 per share.

Globe Life projects net operating income in the range of $14.40 to $14.60 per share for fiscal 2025. For fiscal 2026, the figure is projected to be in the range of $14.60 to $15.30 per share.

For the fiscal year 2025, which ends in December 2025, Wall Street analysts expect Globe Life’s EPS to grow 17.9% year over year to $14.58 on a diluted basis. Moreover, EPS is expected to increase 3.2% annually to $15.04 in fiscal 2026. The company has a mixed history of surpassing consensus estimates, topping them in three of the four trailing quarters, while missing on another quarter.

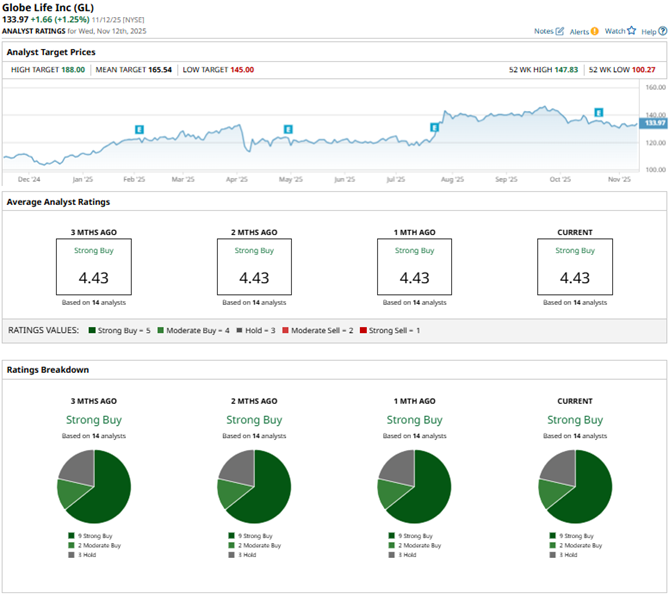

Among the 14 Wall Street analysts covering Globe Life’s stock, the consensus is a “Strong Buy.” That’s based on nine “Strong Buy” ratings, two “Moderate Buys,” and three “Holds.” The ratings configuration has remained the same over the past three months.

Last month, analysts at Keefe, Bruyette & Woods raised the price target on Globe Life’s stock from $160 to $162, while maintaining an “Outperform” rating on its shares. The company’s solid third-quarter results likely prompted this raise.

Globe Life’s mean price target of $165.54 indicates a 23.6% upside over current market prices. The Street-high price target of $188 implies a potential upside of 40.3%.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart