DexCom, Inc. (DXCM), headquartered in San Diego, California, is a leading medical-device company that designs, develops and commercializes continuous glucose monitoring (CGM) systems for people with diabetes and healthcare providers. The company’s market cap is around $23.2 billion.

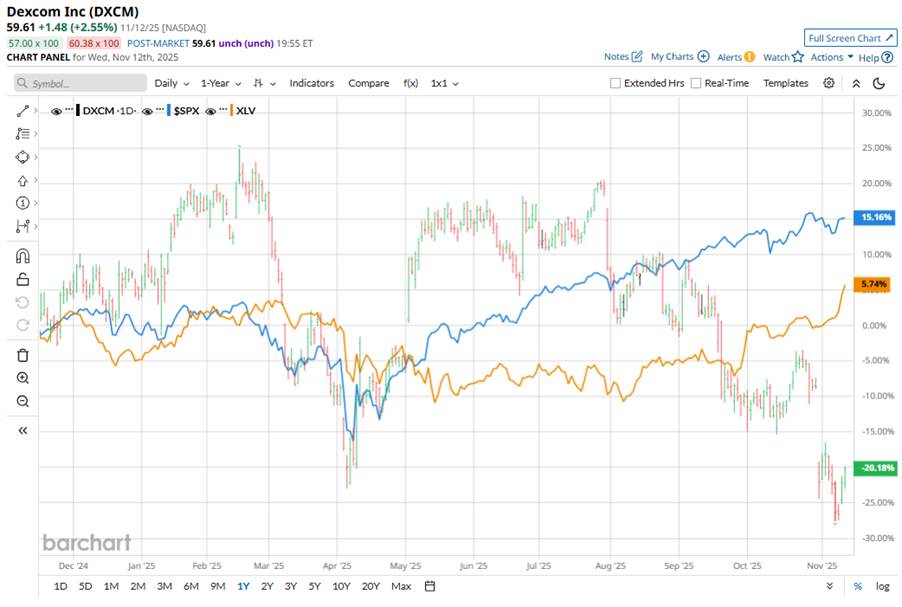

Shares of the medical device company have massively underperformed the broader market. Over the past 52 weeks, DXCM stock has declined 19.8%, while the broader S&P 500 Index ($SPX) has rallied 14.5%. Also, the stock is down 23.4% on a year-to-date (YTD) basis, compared to SPX’s 16.5% rise during the same time frame.

Zooming in further, DexCom's shares have lagged behind the Health Care Select Sector SPDR Fund’s (XLV) 3.8% return over the past 52 weeks and 11.1% gain on a YTD basis.

DexCom’s shares have been under pressure because, although the company delivered a solid quarter, management’s tone and future outlook sparked concern. Its third-quarter earnings beat estimates, yet the company signalled that growth in 2026 may come in slightly below current market expectations.

Also, earlier in the year, the company faced regulatory and operational headwinds, including a warning letter from the U.S. Food & Drug Administration (FDA) over manufacturing-process issues, making investors cautious.

For the current fiscal year, ending in December 2025, analysts expect DexCom’s EPS to grow 26.2% year over year to $2.07. The company’s earnings surprise history is mixed. It surpassed the Wall Street estimates in two of the last four quarters while missing on the other two occasions.

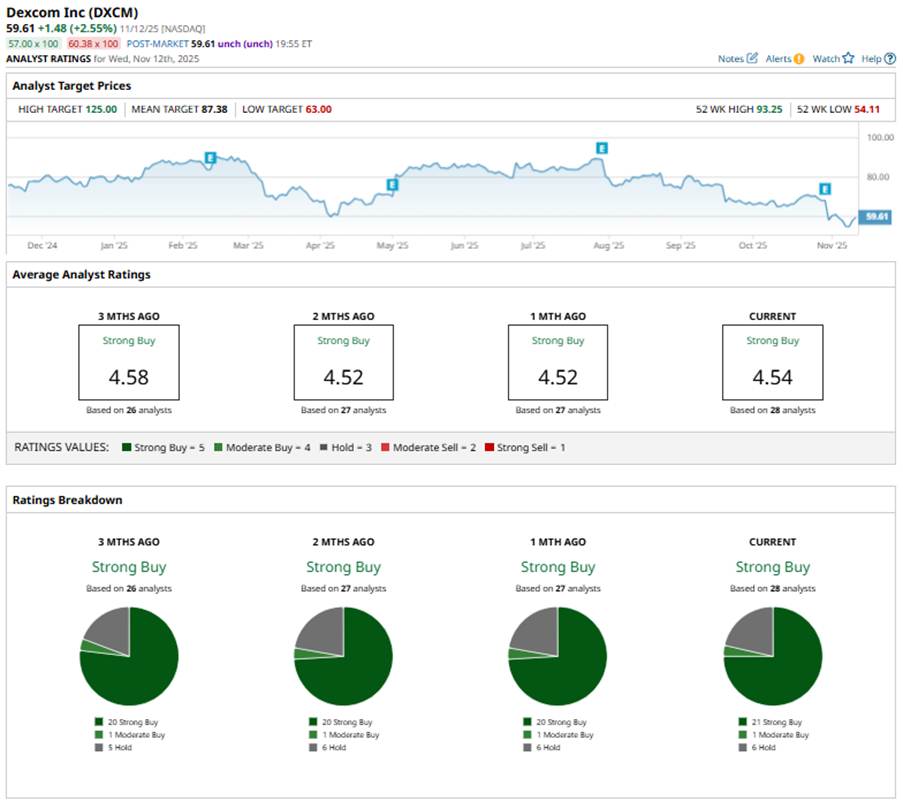

Among the 28 analysts covering the stock, the consensus rating is a “Strong Buy,” which is based on 21 “Strong Buys,” one “Moderate Buy,” and six “Hold” ratings.

This configuration is slightly more bullish compared to three months ago, when there were 20 “Strong Buy” ratings.

Recently, Bernstein SocGen Group lowered its price target on DexCom to $84 from $98 but kept an “Outperform” rating.

The mean price target of $87.38 represents a 46.7% potential upside from DXCM’s current price levels, while the Street-high price target of $125 suggests the stock rally as much as 109.7%.

On the date of publication, Sristi Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart