Chicago, Illinois-based Equity Residential (EQR) engages in the acquisition, development, and management of rental apartment properties. With a market cap of $23 billion, Equity Residential operates as one of the leading, fully integrated, publicly traded multi-family REITs in the United States.

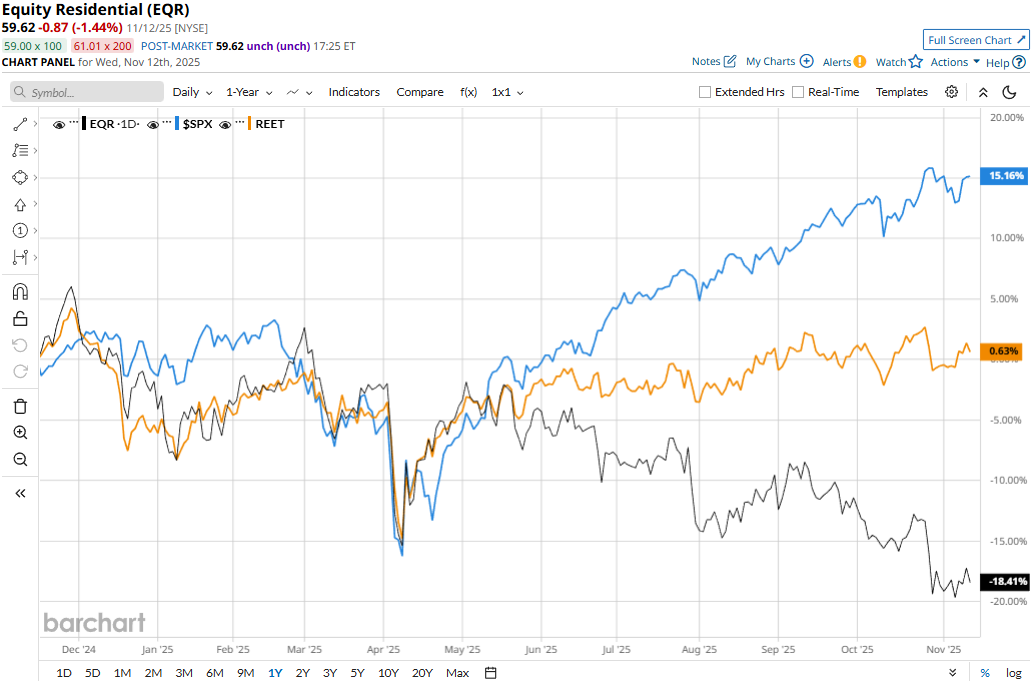

The real estate major has significantly underperformed the broader market over the past year. EQR stock prices have plunged 16.9% on a YTD basis and 18.4% over the past 52 weeks, compared to the S&P 500 Index’s ($SPX) 16.5% gains in 2025 and 14.5% returns over the past year.

Narrowing the focus, Equity Residential has also lagged behind the industry-focused iShares Global REIT ETF’s (REET) 6.4% gains in 2025 and a marginal 20 bps uptick over the past 52 weeks.

Equity Residential’s stock prices declined 2.9% in the trading session following the release of its mixed Q3 results on Oct. 28. The company’s same-store residential revenues increased 3% compared to the year-ago quarter. Meanwhile, its overall topline increased 4.6% year-over-year to $748.3 million, beating the consensus estimates by 13 bps. Meanwhile, its normalized funds from operations (NFFO) per share increased 4.1% year-over-year to $1.02, coming in line with Street’s expectations. However, the company lowered its full-year guidance for revenues, net operating income, EPS, and FFO, which unsettled investor confidence.

For the full fiscal 2025, ending in December, analysts expect EQR to deliver an NFFO of $4 per share, up 2.8% year-over-year. Meanwhile, the company has a solid NFFO surprise history. It has met or surpassed the Street NFFO projections in each of the past four quarters.

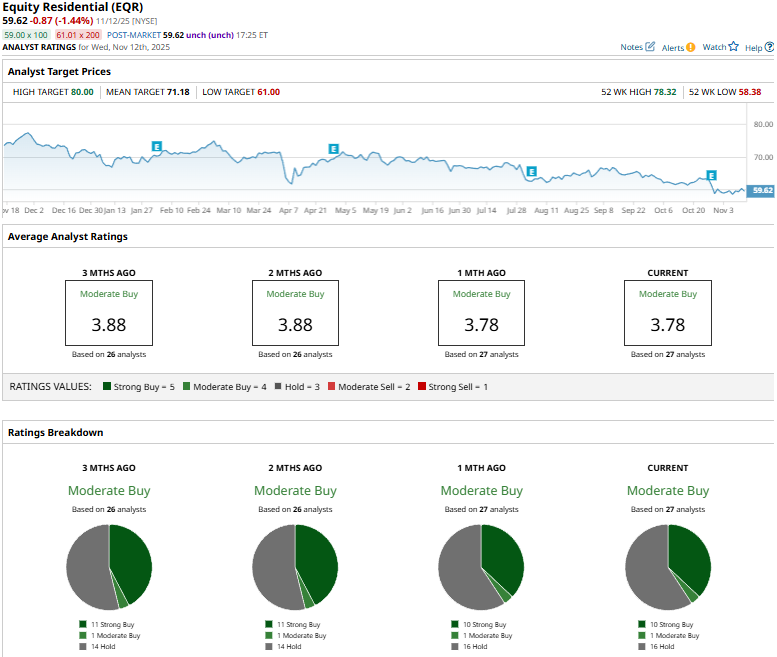

Among the 27 analysts covering the EQR stock, the consensus rating is a “Moderate Buy.” That’s based on 10 “Strong Buys,” one “Moderate Buy,” and 16 “Holds.”

This configuration is slightly less optimistic than two months ago, when 11 analysts gave “Strong Buy” recommendations.

On Nov. 11, Wells Fargo (WFC) analyst James Feldman maintained an "Equal-Weight" rating on EQR, but lowered the price target from $68 to $62.

EQR’s mean price target of $71.18 represents a 19.4% premium from current price levels. Meanwhile, the street-high target of $80 suggests a 34.2% potential upside.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Is This Dividend Stock a Buy for 2026 After More Than Doubling This Year?

- 4 Reasons to Roll Your Covered Call Option and Keep Your Income Strategy Alive

- AMD Says Data Center Revenue Could Jump 60% Annually from Here. Should You Buy AMD Stock Now?

- Circle Stock Enters Oversold Territory on Earnings Plunge. Should You Buy the Dip?