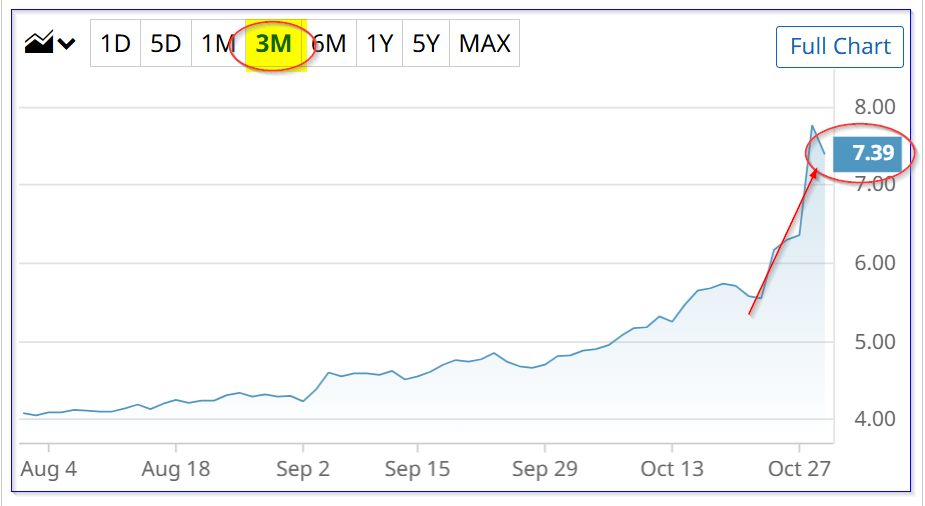

A large volume of long-dated put options has traded in Nokia Corp (NOK) ADRs (American Depository Receipts) following Nvidia, Inc.'s $1 billion stake in new NOK shares, announced on Oct. 28. Nokia, which makes 5G cellular equipment, will use the money for AI-related investments.

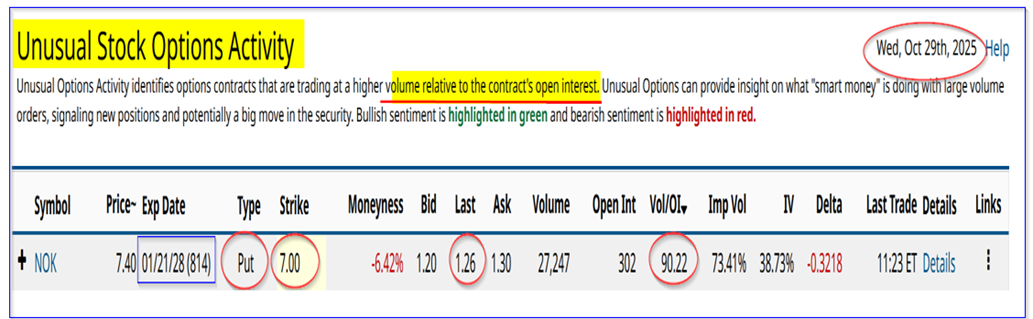

The put options are unusual in that they won't expire for over 2 years (814 days) on Jan. 21, 2028, and are out-of-the-money (OTM) at $7.00 per share. Moreover, this was over 90 times the prior number of put options outstanding.

NOK shares are at $7.45 today, after having risen 34% from $5.55 last week on Oct. 22.

The deal will help Nokia make 6G mobile equipment based on AI-related technology. Nvidia already has a profit on its deal, since its shares were bought at a price of $6.01 per share. It also gives Nvidia a 2.9% stake in Nokia, according to the Wall Street Journal.

But why are investors trading in put options that expire in over 2 years from now?

Unusual Put Volume is a Bullish Trade

This trade can be seen in today's Barchart Unusual Stock Options Activity Report. It shows that over 27,000 NOK put contracts have traded at the $7.00 strike price for expiry on Jan. 21, 2028. That's 814 days from now.

It most likely was initiated by a short-seller of these puts. The last trade was at $1.26, but now it is trading for $1.31 at the midpoint.

This means that the investor who sold these puts has a breakeven point of $7.00 - $1.26, or $5.74. That is even lower than the price Nvidia paid ($6.01) and is 23% below today's price. This would only occur if, at any time during the next 2+ years until Jan. 21, 2028, NOK falls to $7.00, or just 6% below today's price.

Meanwhile, the investor makes a yield of 18.0% (i.e., $1.26/$7.00 = 0.18) for the next 27 months, or about 0.67% per month on average.

So, this is a very attractive way to set a lower buy-in price for a long-term investor in NOK shares.

Moreover, over time, if NOK stock does not fall to $7.00, the premium price will fall. That could allow the investor to buy back their short investment at a profit.

It's also possible that some investors are hedging their long-term investment in NOK shares at today's price. That means that if their purchase of NOK at $7.45 today goes south, their investment is hedged by a higher put option price as NOK falls below $7.00.

But again, the problem is that NOK would have to fall below $5.74 before the put investment would begin to have any intrinsic value. It's very possible that due to extrinsic value, it could occur at a higher NOK price, though.

But this, again, is a bullish sign, since the purchase of these puts is likely a move to hedge a long trade in NOK, following Nvidia's stake.

Should Investors Follow Nvidia into NOK?

Nokia reported strong Q3 results on Oct. 23, with net sales up 9% YoY on a comparable basis, and +12% on a reported YoY basis. Moreover, the company is now free cash flow (FCF) positive, although the margin is not too impressive at just 8.3%.

Analysts may begin to digest the impact of the Nvidia stake and whether it will accelerate the company's move into 6G equipment for telecom providers, as well as its push into AI-related software.

As it stands, the average price target is $6.71 per share for 10 analysts, according to Yahoo! Finance. That is 10% below today's price.

However, AnaChart.com shows that 6 analysts, with recent price target updates, have an average price target of $9.48, or $2.03 over today's price. That represents a potential upside of +27% from today's price.

As a result, there is a mixed survey result. Investors with a bullish view on NOK stock may be willing to follow today's put option trading activity and short these puts to set a lower buy-in price with a good yield.

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart