Semiconductor stocks have dominated headlines this year; some firms ride the AI surge, while others grapple with weaker device demand. Strong earnings from Intel (INTC) and TSMC (TSM) lifted major indexes to fresh highs, rewarding companies that translate demand into profits.

Qualcomm (QCOM) is squarely in that spotlight. The company is all set to report Q4 FY2025 results after the market close on Nov. 5, an update that could shape the stock’s trajectory into year-end. Analysts forecast $2.33 GAAP EPS on $10.9 billion in revenue, following Q3 sales near $10.4 billion and GAAP net income that rose about 25% year-over-year (YoY).

Investors will now focus on commentary about smartphone demand, licensing, and capital returns.

About QCOM Stock

Based in San Diego, Qualcomm is one of the leading fabless semiconductor companies in wireless and mobile technologies. Its main segments are Qualcomm CDMA Technologies (QCT, which makes chips for phones, IoT, automotive, etc.) and Qualcomm Technology Licensing (QTL, which collects patent royalties). Qualcomm’s products power 5G smartphones, automotive systems, Internet-of-Things devices, and more.

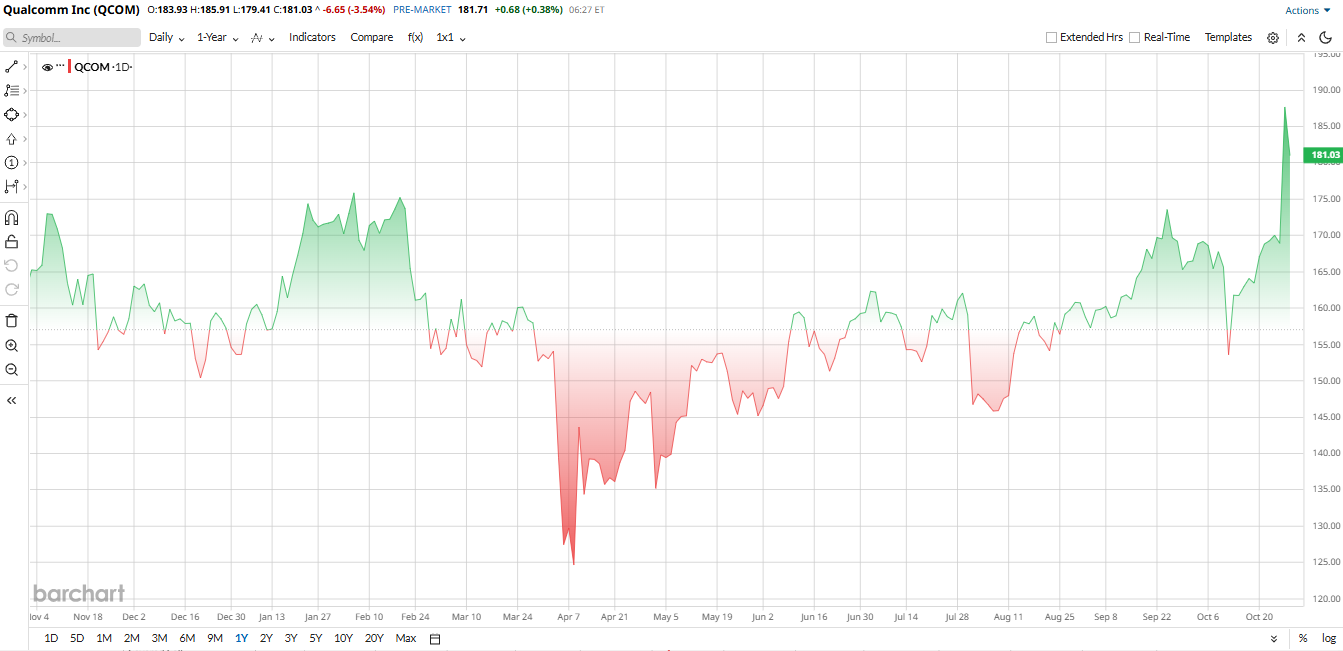

Valued at roughly $195 billion by market cap, QCOM stock has been a standout in 2025. Shares have added about 18% of their value year-to-date (YTD), outpacing the overall tech market. A big driver was October’s launch of new data center AI chips.

Talking about valuation, Qualcomm appears undervalued in a couple of key metrics. Its trailing P/E of 17.5x is well below the semiconductor industry median of 39.5x. Likewise, its enterprise value/EBITDA is roughly 15x, vs. a 24x median for the semiconductor sector. These comparisons suggest Qualcomm’s valuation is relatively attractive compared to peers, despite its high profit margins and steady cash flow.

What Happened and What to Expect

In Q3, Qualcomm posted what you could call a “mixed but encouraging” report. Revenue climbed a solid 10% YoY to $10.4 billion, thanks mostly to strength outside of smartphones. IoT sales surged almost 24%, and automotive grew 21%, helping the chip division achieve double-digit growth. The sticking point was Handset revenue, still Qualcomm’s biggest business, which rose just 7% and missed expectations. Automotive revenue also came in a bit light.

Looking ahead to Q4, the company has guided revenue between $10.3 billion and $11.1 billion with non-GAAP EPS of $2.75 to $2.95. Wall Street expects full-year earnings to come in around $9.73 per share, up nicely from last year. Expectations for QCOM’s fiscal Q4 focus on whether management can top the Street and provide upbeat forward color on smartphones, licensing, and its new AI data center push.

On the earnings call, management’s outlook on smartphones and its 100% free-cash-flow return plan will be key. Now, all eyes are on Nov. 5 to see if Qualcomm’s AI momentum can keep powering past any lingering handset weakness.

Qualcomm's Recent News and Developments

Earlier this week, Qualcomm unveiled two new data center inference chips (AI200 and AI250) based on AI acceleration. With these big data center chips, Qualcomm is making its first big strategic move, the news of which has sent the share surging 10% on Oct. 27. Analysts point to the trend in AI inference as an opportunity to reduce the market share of incumbents and create new markets of high size. This extends the move by Qualcomm to 5G infrastructure and automotive, which shows an increase in revenue diversification.

However, there are some reservations. Certain reservations are a result of uncertainty in the smartphone market. During Q3, the shipment of handsets was less than anticipated (because of China alone), and this burdened Qualcomm's core source of income. There was also an interest in high insider selling. CEO Cristiano Amon sold 150,000 shares in October at a price of $165.56 per share. Investors will be monitoring the possibility of handset weakness or trade concerns to lower sales in the coming quarter.

What the Analysts Say

Wall Street remains cautiously upbeat on QCOM stock. Recently, UBS analyst Timothy Arcuri raised his price target on QCOM last month to $175 from $165 while keeping a “Neutral” rating. UBS cited Qualcomm’s strong earnings but sees limited upside.

Susquehanna has an "Overweight" view and boosted its target to $200, emphasizing Qualcomm’s expanding IoT and auto design wins.

J.P. Morgan also raised its target to $200, noting that better-than-expected margins and the upcoming analyst day should refocus investors on Qualcomm’s growth catalysts.

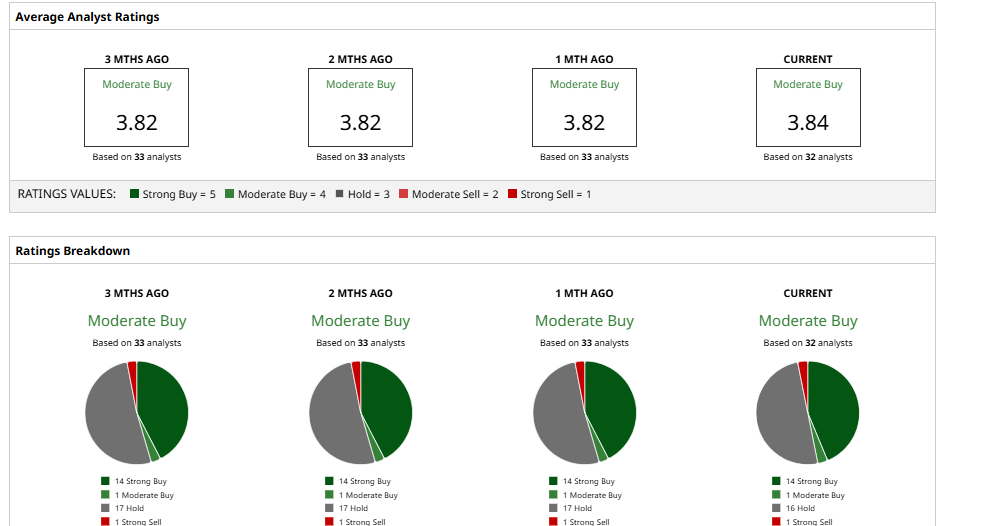

Overall, QCOM has a consensus “Moderate Buy” rating from the 32 analysts tracked by Barchart. The stock is currently trading right in line with the mean price target of $181.96; however, the street high target of $225 implies an uptrend of 23%.

In sum, analysts applaud the recent results and AI initiatives but are split on valuation; some see more upside if handset demand revives, while others remain cautious about macro headwinds.

On the date of publication, Nauman Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart