Boosts Proven and Probable Mineral Reserves by 63%

TORONTO, ON / ACCESS Newswire / March 31, 2025 / Jaguar Mining Inc. ("Jaguar" or the "Company") (TSX:JAG)(OTCQX:JAGGF) is pleased to announce its annual Mineral Reserves and Mineral Resources (MRMR) statement for 2024.

Detailed tabulations and discussion of this 2024 MRMR disclosure may be found within the Company's Annual Information Form for the year ended December 31, 2024, which was filed today. An updated Technical Report for the MTL complex was prepared in accordance with National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101") and also filed today. Both documents can be found under Jaguar's profile on SEDAR+ https://www.sedarplus.ca.

HIGHLIGHTS

Proven and Probable Mineral Reserves (2P Mineral Reserves) increased by 63% to 764 koz (5,903 kt @ 4.03 g/t Au), net of mining depletion. The Onças de Pitangui projectreported the first Mineral Reserves of 284 koz (2,122 kt @ 4.16 g/t Au).

Measured and Indicated (M&I) Resources decreased by 1% net of depletion to 1,659 koz (12,325 kt @ 4.19 g/t Au).

Inferred Mineral Resources increased to 1,676 koz (14,621 kt @ 3.56 g/t Au), highlighting the Company's strong growth potential.

Onças de Pitangui project measured and indicated resources increased by 2% to 457 koz (3,547 kt @ 4.01 g/t Au) and inferred resources increased by 29% to 490 koz (4,184 kt @ 3.64 g/t Au).

Faina zone continued its upward trajectory, with a 16% increase in 2P Mineral Reserves to 160 koz (1,019 kt @ 4.87 g/t Au).

Life of Mine (LOM) plans at Pilar demonstrate five years of production starting in 2025, while the MTL complex LOM, with the inclusion of the Onças de Pitangui reserves and resources, demonstrates gold production well past 2030.

Vern Baker, CEO of Jaguar Mining stated, "This year's Mineral Reserve and Mineral Resource update further advances our organic growth strategy. With the initial disclosure of probable Mineral Reserves at our Onças de Pitangui project, we increased our reserve base by 63%. While we have challenges to overcome following the incident at our MTL Complex which resulted in the suspension of operations at our Turmalina mine, once we are able to return to work at this mine, we see a direct road to increase the ounce production across the Company. Increasing Mineral Reserves, especially with new orebodies, is the key to having new mining areas that can take our production to a new level."

Proven and Probable Mineral Reserves and Measured, Indicated and Inferred Mineral Resources figures are reported for the Company's two operating mining and production complexes, MTL and Caeté, and for the Paciência complex (currently on care and maintenance) in the Iron Quadrangle Gold Province, Minas Gerais, Brazil. The MTL complex (currently suspended) is comprised of the Turmalina mine (orebodies A, B and C), the Faina zone, the Onças de Pitangui project as well as the Zona Basal and Pontal deposits. The Caeté complex is comprised of the Pilar mine (orebodies BA, BF, SW, LPA and TORRE), the Roça Grande mine (on care and maintenance) and the Córrego Brandão open-pit deposit. The Paciência complex is comprised of the Santa Isabel and Margazão mines (both on care and maintenance) and the Bahú deposit.

2024 MINERAL RESERVES AND MINERAL RESOURCES

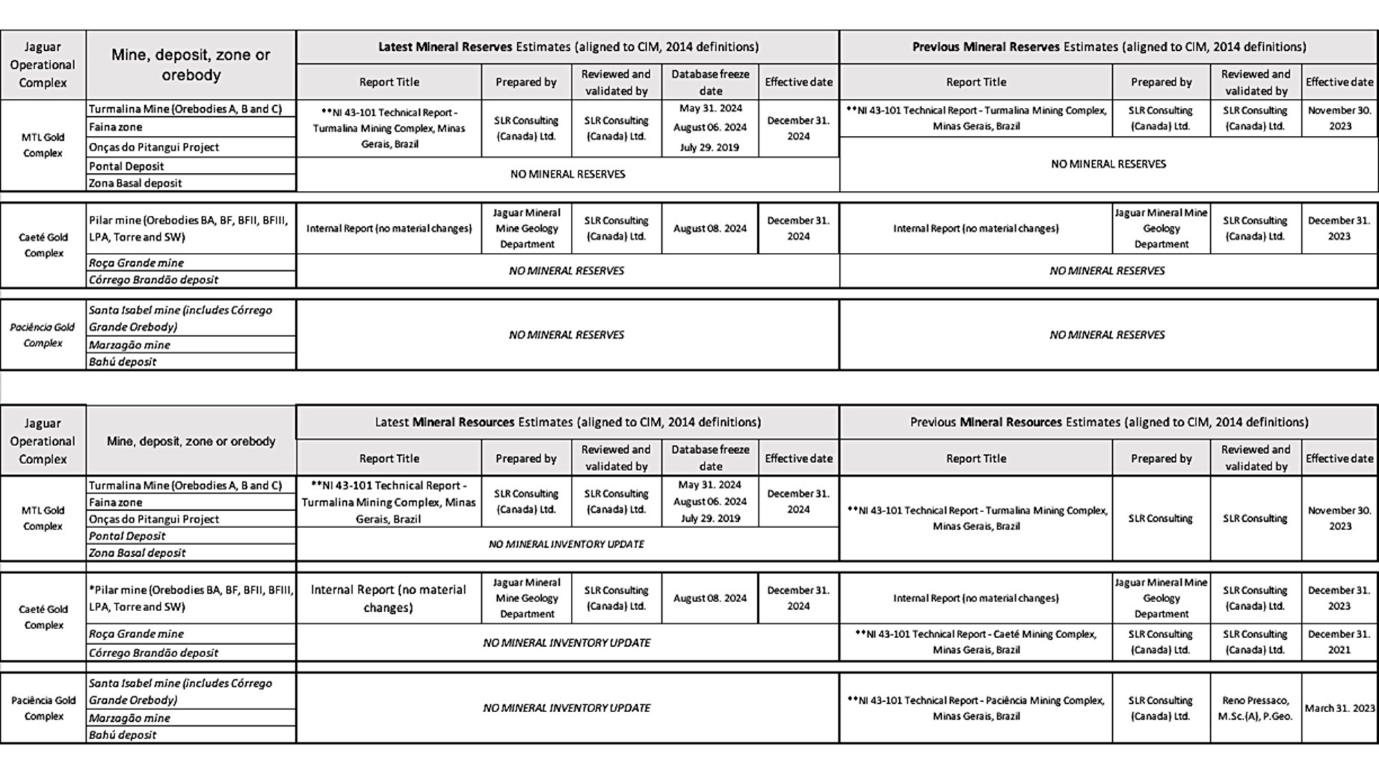

The Mineral Resources and Mineral Reserves reported herein and respective changes in inventory were consolidated based on estimates sourced from the technical reports listed in Table 3. CIM (2014) definitions were followed for Mineral Reserves estimates.

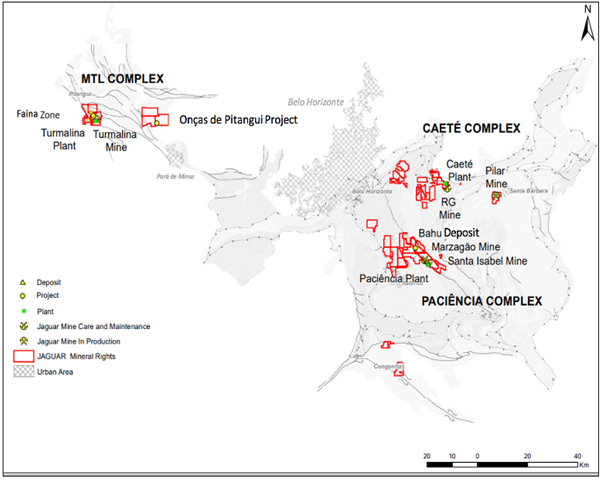

The location map in Figure 1 indicates the location of the Company's production complexes and respective mines and deposits. The Mineral Rights are situated inside a 60 km radius from Belo Horizonte, the state capital of Minas Gerais, Brazil.

Figure 1. Schematic location map showing Jaguar's mineral rights and production complexes associated to the Rio das Velhas greenschists of the Iron Quadrangle Gold Province

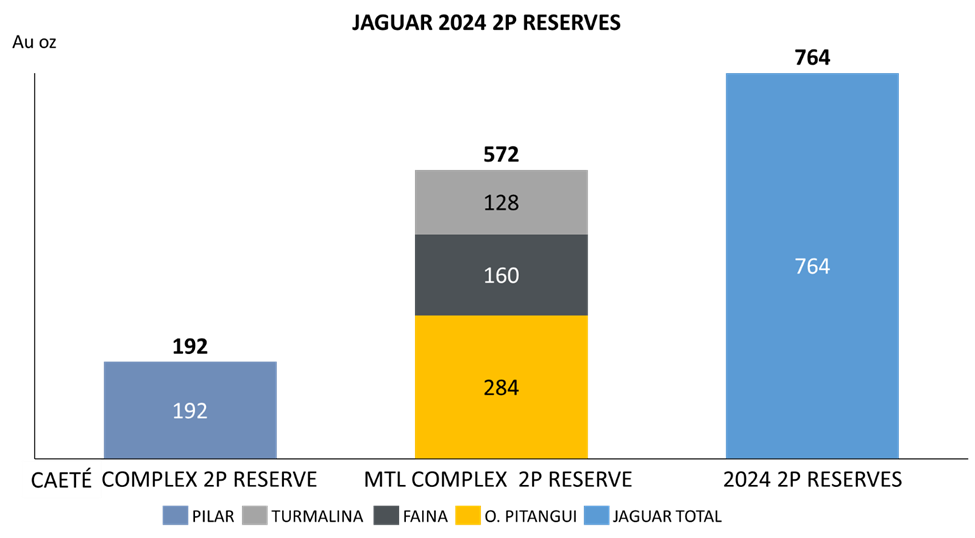

Figure 2. Bar chart of the consolidated 2024 Proven & Probable Mineral Reserves by operation

Mineral Reserves

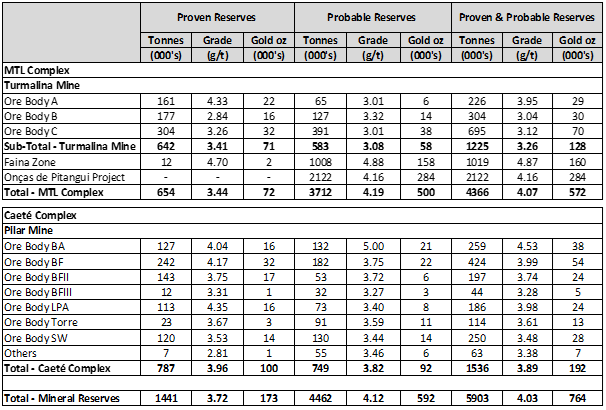

The Company's Proven and Probable Mineral Reservesas at December 31, 2024, increased by 63% to 764 koz, net of mining depletion, mainly due to the addition of 284 koz of Mineral Reserves from the Onças de Pitangui project (see bar chart in Figure 2).

Detailed information of the Company's current consolidated Mineral Reserves inventory, as at December 31, 2024, is shown in Table 1 at the end of this release.

MTL Complex Mineral Reserves

A total of 572 koz of Mineral Reserves are attributed to the MTL complex Mineral Reserves, distributed among the Turmalina mine Orebodies A, B, & C, the Faina zone and the Onças de Pitangui project.

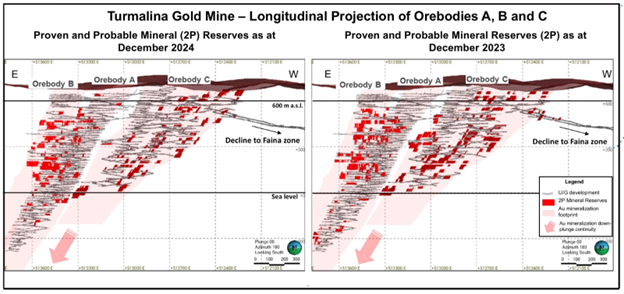

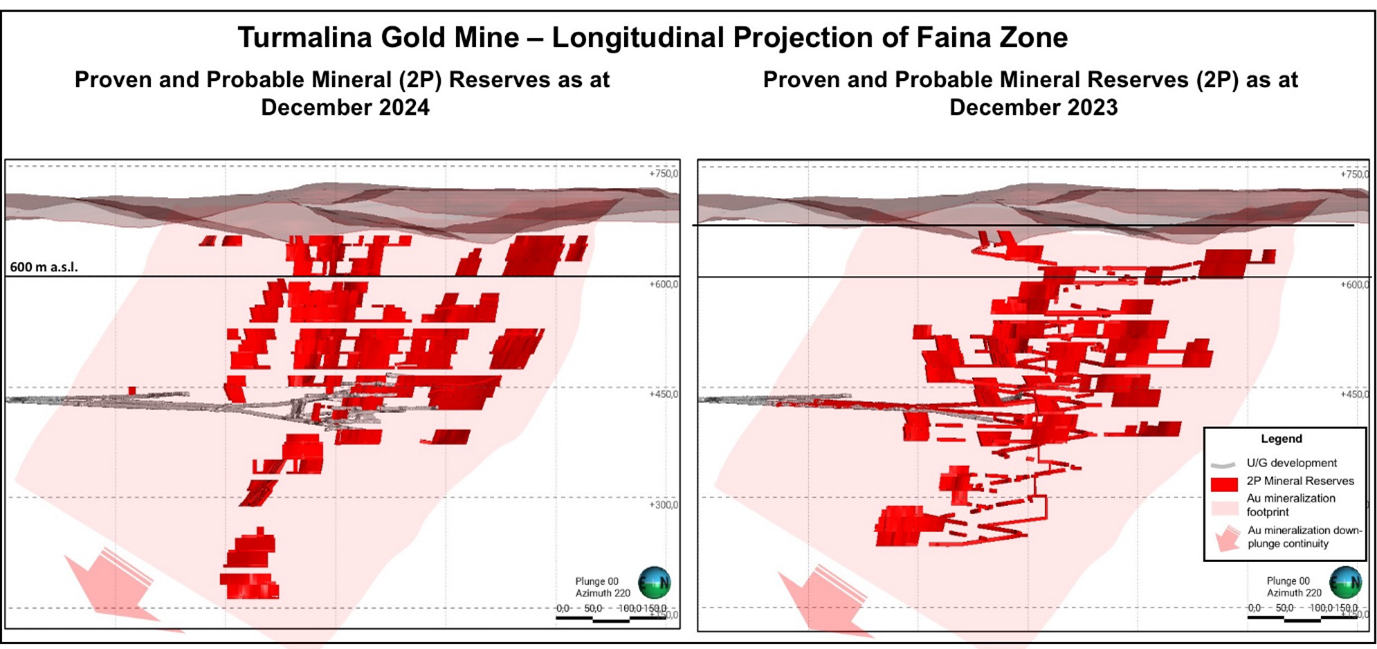

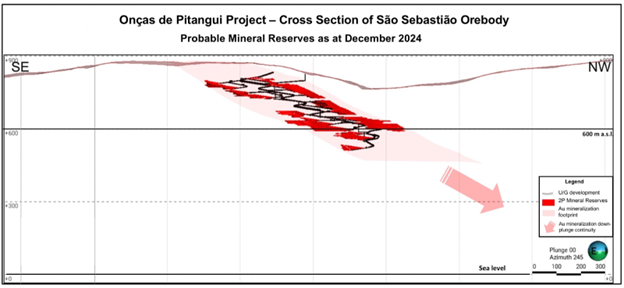

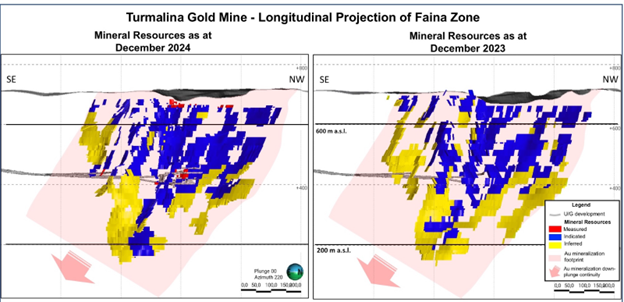

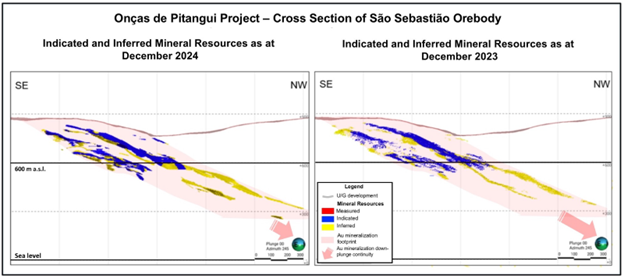

Longitudinal sections shown in Figures 3, 4 and 5 illustrate the spatial distribution of the Mineral Reserves and actual or planned development associated to the Turmalina mine, the Faina zone and the Onças de Pitangui project.

The current Mineral Reserves inventory resulted from the following add-ons and depletions in 2024:

Mineral Reserves were estimated by Jaguar staff, reviewed and validated by SLR's Qualified Persons.

Turmalina mine

The current Proven and Probable Mineral Reserves of 128 koz (1,255 kt @ 3.26 g/t Au) for Orebodies A, B, & C represent a net decrease of 16 koz from the Mineral Reserves established in December 2023 resulting from:

The depletion of 29 koz resulting from mining activities in 2024;

The subtraction of 5 koz resulting from a risk analysis performed in 2024 and,

The re-categorization of Mineral Resources into18 koz of Mineral Reserves resulting from in-fill / step-out drilling and geological model reinterpretation.

The Turmalina mine 2P Mineral Reserves are distributed among the following orebodies:

Orebody A (29 koz, 226 kt @ 3.95 g/t Au);

Orebody B (30 koz, 304 kt @ 3.04 g/t Au); and

Orebody C (70 koz, 695 kt @ 3.12 g/t Au).

Faina zone

The Faina zone hosts a total of 160 koz (1,019 kt @ 4.87 g/t Au) of Proven and Probable Mineral Reserves. The Mineral Reserve addition of 27 koz attributed to the re-categorization of Mineral Resources exposed by the underground development and infill drilling that took place in 2024. The addition was offset by the production of 4 koz in 2024, resulting in a net increase of 22 koz compared to the prior year.

Onças de Pitangui project

NI 43-101 Technical Report - Turmalina Mining Complex, Minas Gerais, Brazil, by SLR Consulting (Canada) Ltd. (SLR), includes an update of Probable Mineral Reserves totalling 284 koz (2,122kt @ 4.16 g/t Au) at the Onças de Pitangui project.

Figure 3. Long Sections showing year-over-year changes in Turmalina mine Mineral Reserves 2024 vs 2023

Figure 4. Long Sections showing year-over-year changes of the Faina zone Mineral Reserves

2024 vs 2023

Figure 5. Cross Section showing the Onças de Pitangui project Reserves as at December 31, 2024

Caeté Complex Mineral Reserves

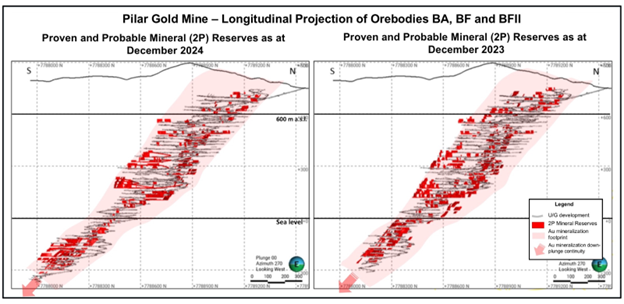

Pilar mine

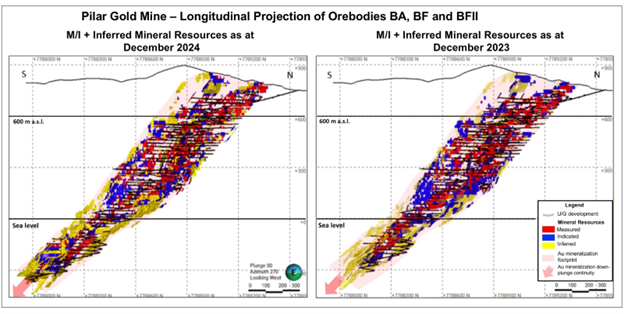

Infill and step-out drilling and geological model reinterpretation executed in 2024 at the Pilar mine resulted in the addition of 43 koz to the Pilar mine mineral inventory. This addition was offset by the extraction of 45 koz in 2024. As a result, the updated estimates of the Pilar mine Mineral Reserves total an amount of 192 koz (1536 kt @ 3.89 g/t Au), a 2 koz net decrease in the 2P Mineral Reserve categories if compared to the 194 koz (1,906 Kt @ 3.17 g/t Au) of 2P Mineral Reserves.

Mineral Reserves at the Pilar mine are divided between Orebody BA (38 koz, 259 kt @ 4.53 g/t Au), Orebodies BFs (106 koz, 850 kt @ 3.89 g/t Au), Orebody SW (28 koz, 250 kt @ 3.48 g/t Au), Orebody Torre (13 koz, 114 kt @ 3.61 g/t Au) and others (7 koz, 63 kt @ 3.38 g/t Au).

The Longitudinal sections shown in Figure 6 illustrate the spatial distribution of the Mineral Reserves and actual development at the Pilar mine.

Figure 6. Long Section showing year-over-year changes in Pilar mine Mineral Reserves 2024 vs 2023

Mineral Resources

The Company's consolidated Mineral Resources as at December 31, 2024, include both the updated Mineral Resources for the Pilar and Turmalina mines, Faina zone, as well as for the Onças de Pitangui project, along with the unchanged Mineral Resources from previous disclosures for the Pontal and Zona Basal deposits, the Roça Grande, Santa Isabel and Marzagão mines, and the Córrego Brandão and Bahu deposits.

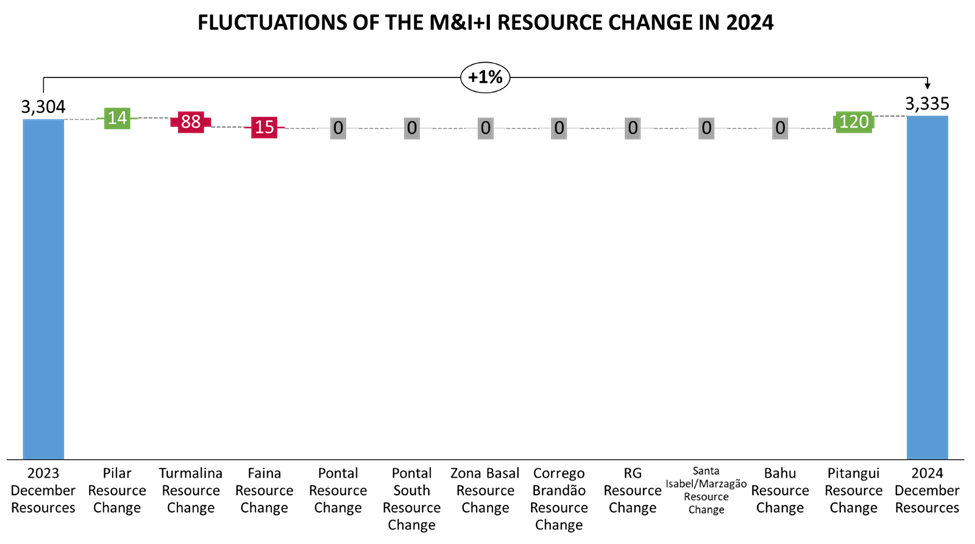

Consolidated Measured and Indicated Mineral Resources decreased by 1% to 1,659 koz (12,325 kt @ 4.19 g/t Au), net of mining depletion. Inferred Mineral Resources increased by 3% to 1,676 koz (14,621 kt @ 3.56 g/t Au) which is a 48 koz net increase over the prior year.

Mineral Resources were estimated by Jaguar staff, reviewed and validated by SLR's Qualified Persons.

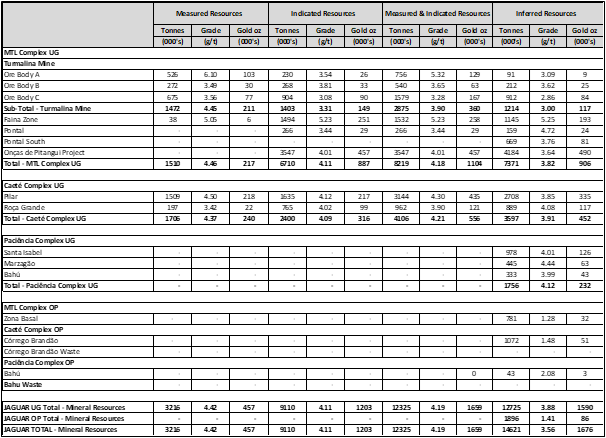

Detailed information of the Company's current consolidated Mineral Resources inventory as at December 23, 2024, is shown in Table 2 at the end of this release.

Figure 7. Graph showing the changes in M&I + I Resource Inventory in 2024 according to the estimation's updates and respective material sources.

MTL Complex

Consolidated MTL complex (Measured and Indicated) Mineral Resources underground are reported as 1,104koz (8,219 kt @ 4.18 g/t Au) and Inferred Mineral Resources underground are reported as 906 koz (7,371 kt @ 3.82 g/t Au). Open pit Inferred Mineral Resources are reported as 32kozs (781 kt @ 1.28 g/t Au). The consolidated Mineral Resources are subdivided as follows:

Underground Mineral Resources

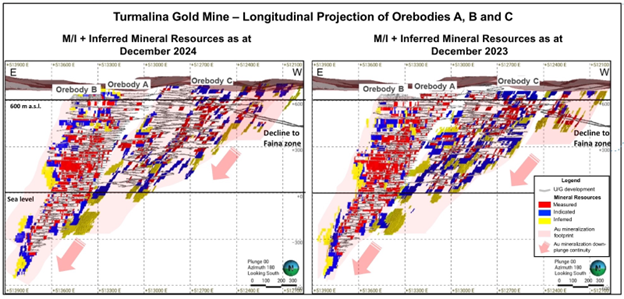

Turmalina mine Measured and Indicated Mineral Resources are reported as 360 koz, (2,875 kt @ 3.90 g/t Au).

Turmalina mine Inferred Mineral Resources are reported as 117 koz, (1214 kt @ 3.00 g/t Au).

Faina zone Measured and Indicated Mineral Resources of 258 koz, (1,532 kt @ 5.23 g/t Au).

Faina zone Inferred Mineral Resources are reported as 193 koz, (1,145 kt @ 5.25 g/t Au).

Pontal deposit Measured and Indicated Mineral Resources are reported as 29 koz, (266 kt @ 3.44 g/t Au) unchanged from 2023 disclosure.

Pontal deposit Inferred Mineral Resources are reported as 24 koz, (159 kt @ 4.72 g/t Au) unchanged from 2023 disclosure.

Pontal South deposit Inferred Mineral Resources are reported as 81 koz, (669 kt @ 3.76 g/t Au) unchanged from 2023 disclosure.

Onças de Pitangui project Measured and Indicated Mineral Resources of 457 koz, (3,547 kt @ 4.01 g/t Au).

Onças de Pitangui project Inferred Mineral Inferred Resources are reported as 490 koz, (4,184 kt @ 3.64 g/t Au).

The year-over-year changes in the Mineral Resources distribution at the Turmalina mine are illustrated in the longitudinal sections shown in Figures 8, 9 and 10.

Open Pit Mineral Resources

Zona Basal deposit Inferred Mineral Resources (Open Pit) are reported as 32 koz, (781 kt @ 1.28 g/t Au), unchanged since the initial estimates prepared by SLR reported in Technical Report on the Turmalina Complex, Minas Gerais, Brazil with effective date of November 30, 2023.

Figure 8. Long Section of the Turmalina mine's Mineral Resources year-over-year changes (2024 vs. 2023).

Figure 10. Cross Section of the Onças de Pitangui project Mineral Resources year-over-year changes (2024 vs. 2023).

Caeté Complex

The Pilar mine was the only source of Mineral Resources inventory changes at the Caeté Complex. The Mineral Resources estimates of the Pilar mine were prepared by Jaguar on site mine geology department under the coordination of the corporate geologists and mining engineers. The database and procedures were revised by the SLR qualified persons.

The year-over-year changes in the Mineral Resources distribution at the Pilar mine are illustrated in the longitudinal section shown in Figure 11.

Consolidated Caeté complex (Measured and Indicated) Mineral Resources Underground are reported as 556koz (4,106 kt @ 4.21 g/t Au) and Inferred Mineral Resources Underground are reported as 452 koz (3,597 kt @ 3.91 g/t Au) and Open Pit are reported as 51kozs (1,072 kt @ 1.48 g/t Au) subdivided as follows:

Underground Mineral Resources

Pilar mine Measured and Indicated Mineral Resources are reported as 435 koz, (3,144 kt @ 4.30 g/t Au).

Pilar mine Inferred Mineral Resources are reported as 335 koz, (2,708 kt @ 3.85 g/t Au).

Roça Grande mine Measure and Indicated Mineral Resources are reported as 121 koz, (962 kt @ 3.90 g/t Au).

Roça Grande mine Inferred Mineral Resources are reported as 117 koz, (889 kt @ 4.08 g/t Au).

Open Pit Mineral Resources

Córrego Brandão deposit Inferred Mineral Resources are reported as 51 koz, (1,072 kt @ 1.48 g/t Au) unchanged from 2021 disclosure.

Figure 11. Long Section showing year-over-year changes of the Pilar mine Mineral Resources 2024 vs. 2023.

GEOLOGICAL AND OPERATIONAL CONTEXT

MTL Complex

The MTL Complex underground operations consist of several geological structures grouped into three orebodies - Orebodies A, B, C (the Turmalina mine) - and the Faina zone, where production began in 2024 through underground development.

Orebody A, responsible for the bulk of the Turmalina mine accumulated production estimated in 870 recovered koz, is folded and steeply east dipping, with a strike length of approximately 250 m to 300 m, and average thickness of six metres. Underground development has exposed approximately 1,100 vertical metres of Orebodies A and B mineralization along a robust down-plunge continuity.

Orebody B includes three narrow, lower grade lenses positioned in the foot-wall, parallel to Orebody A. Orebody B mineralization has been outlined along a strike length of approximately 350 m to 400 m and to the same depths of Orebody A.

Orebody C is a series of northwest striking, lenses generally of lower grade located to the southwest in the structural footwall of Orebody A. Orebody C has replaced Orebody A as the Complex's principal production source. Mineralization has been outlined along a strike length of approximately 800 m to 850 m, to depths of 750 m below surface.

Orebodies A, B and C from Turmalina mine and the Pilar mine (Caeté Complex) share similar strong structural controls of the mineralization with the major gold mines known in the Iron Quadrangle Gold Province, well known for their reduced strike length compared to very deep, continuous down-plunge continuities.

Explored in the past through diamond drilling, the Faina zone is an orebody currently under development constituted by a series of offset striking parallel structures extending from surface to depth.

The focus of mining at Turmalina is shifting from Orebodies A and B to Orebody C and Faina zone. Orebody C continues to grow with successful conversion of Resources to Reserves. In addition to the development initiated at the Faina zone in 2024, the recent re-categorization of the Onças de Pitangui project Mineral Resources that resulted in 284 koz of Probable reserves will contribute to the MTL complex production growth.

The Pontal and Zona Basal deposits are unchanged from the previous year's estimates.

Caeté Complex

The Pilar Mineral Reserve 2024 inventory remained almost the same if compared to 2023 due to the gradual reduction in drilling activities and the depletion of 26 koz attributed to Orebody SW, located in the opposed limb of the major structure that hosts the Pilar mine mineralization resulting from geological modelling parameters.

No changes of the Mineral Resources inventories were reported in 2025 in the Roça Grande mine and the Córrego Brandão deposit.

Paciência Complex

No changes in Mineral Resources inventories were reported in 2024 in the Santa Isabel and Marzagão mines, and the Bahú deposit.

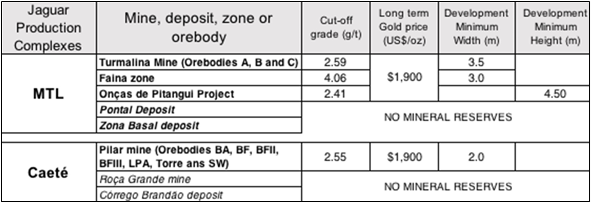

Table 1. Consolidated Mineral Reserves as at December 31, 2024

Notes

1. CIM (2014) definitions were followed for Mineral Reserves.

2. The released underground Mineral Reserves estimations include the Turmalina and Pilar mines the Faina zone, and Onças de Pitangui project.

3. Cut-off grades and constraints employed in the estimate such as minimum width and eventual minimum height for underground development and stopping are indicated in Table 4

4. Bulk density is 2.85 t/m3.

5. The Exchange rate of R$5.20 / US$1.00 was applied to all the estimates.

6. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

7. Numbers may not add due to rounding.

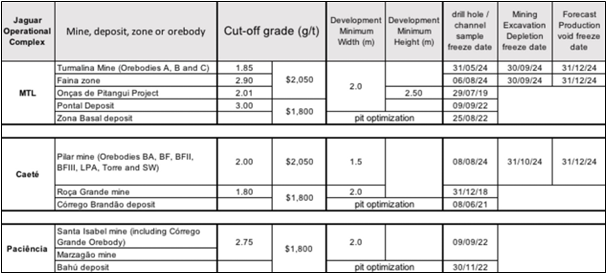

Table 2. Consolidated Mineral Resources as at December 31, 2024

Notes:

1. CIM (2014) definitions were followed for the classification of Mineral Resources.

2. The released Mineral Resources estimations include the Turmalina, Pilar, Roça Grande, Santa Isabel and Marzagão mines, the Faina zone, Pontal deposit, and Onças de Pitangui project underground Mineral Resources and the Zona Basal deposit, the Bahu and Córrego Brandão open-pit zones Mineral Resources.

3. Mineral Resources are inclusive of the Mineral Reserves at the Turmalina and Pilar mines, the Faina zone and Onças de Pitangui project.

4. Drill hole and channel samples assay results freeze dates are indicated in Table 5.

5. Freeze dates for depletion purposes relative to mining and forecast production volumes are shown in Table 5.

6. Long-term gold price applied to the Mineral Resources estimations are informed in Table 5.

7. Cut-off grades and constraints employed in the estimate such as minimum width and eventual minimum height for underground Mineral Resources and pit optimizations using Lerchs-Grossmann algorithm for open pit Mineral Resources estimations are indicated in Table 5.

8. The Exchange rate of R$5.20 / US$1.00 was applied to all the estimates.

9. Numbers may not add due to rounding.

Table 3. List of NI 43-101 Technical Reports and Internal Reports Employed to Support the Mineral Reserves and Resources Figures

Table 4. Development Parameters and Economic Premises Employed in the Mineral Reserves Estimates

Table 5. Development Parameters and Economic Premises Employed in the Mineral Resources Estimates

INCIDENT AT THE MTL COMPLEX DRY-STACKED PILE

On December 7, 2024, a slump occurred in the north wall of the Satinoco dry-stack (waste rock and tailings) pile at the Company's MTL complex in the state of Minas Gerais, Brazil, approximately 130 kilometers northwest of the city of Belo Horizonte. As a result of the Incident, the Company's operating license at the complex's Turmalina mine was temporarily suspended until further notice. The mine's personnel and nearby community members were evacuated before the slump occurred, and there were no reported injuries or significant environmental impacts as a result of the incident.

For more information please see the press releases issued on December 9, 2024, December 30, 2024, January 7, 2025 and March 26, 2025, which can be found on the Company's website https://jaguarmining.com/investors/news-releases and under Jaguar's profile on SEDAR+ at https://www.sedarplus.ca.

Qualified Persons

The scientific and technical information contained in this press release has been reviewed and approved (i) in respect of the estimated Mineral Reserves, by Jason Cox, P.Eng. and Jeff Sepp, P.Eng., and (ii) in respect of the estimated Mineral Resources, by Pierre Landry, P. Geo. (MTL and Paciência complexes), Reno Pressacco, P. Geo. (Caeté and Paciência complexes), and Dorota El-Rassi, P. Eng. (Pontal deposit) of SLR Consulting Canada Ltd (SLR), which office is situated at 55 University Avenue, Suite 501, Toronto, Ontario, M5J 2H7, Canada.

SLR is an independent mining consultancy. Mr. Cox, Mr. Sepp, Mr. Landry, Ms. El-Rassi and Mr. Pressacco are each "qualified persons" within the definition of NI 43-101.

During the preparation of the updated Mineral Resource and Mineral Reserve estimates, discussions were held on a weekly basis with Jaguar personnel and Deswik Brazil Holdings Pty Ltd. (Deswik).

Mr. Pressacco, Mr. Cox and Mr. Sepp have visited the MTL, Caeté and Paciência complexes several times. Mr. Pressaco and Mr. Sepp's latest visit to the properties occurred in December 2022.

All remaining scientific and technical information (other than described above) contained in this press release has been reviewed and approved by Jean-Marc Lopez BSc. PGeo, FAusIMM, of JML Consulting & Geology EI, who is a "qualified person" as defined by NI 43-101.

Quality Control

All sampling and samples utilized at Jaguar for Mineral Resource and or Mineral Reserves estimation uses a quality-control program that includes insertion of blanks and commercial standards in order to ensure best practice in sampling and analysis.

HQ, NQ, and BQ size drill core is sawn in half with a diamond saw. Samples are selected for analysis in standard intervals according to geological characteristics such as lithology and hydrothermal alteration. Rock channel sampling of the underground development follows the same standard intervals as for the drill core.

Half of the sawed sample is forwarded to the analytical laboratory for analysis while the remaining half of the core is stored in a secure location. The drill core and rock chip samples for resource-reserve conversion and grade control samples are transported for physical preparation and analysis in securely sealed bags to the Jaguar in-house laboratory located at the company´s Caeté Complex, Caeté, Minas Gerais. Growth exploration samples are sent to the independent ALS Brazil (subsidiary of ALS Global) laboratory located in Vespasiano, Minas Gerais, Brazil. The analysis of these exploration samples is conducted at ALS Global's respective facilities (fire assay is conducted by ALS Global in Lima, Peru, and multi-elementary analysis is conducted by ALS Global in Vancouver, Canada). ALS has accreditation in a global management system that meets all requirements of international standards ISO/IEC 17025:2005 and ISO 9001:2015. All major ALS geochemistry analytical laboratories are accredited to ISO/IEC 17025:2005 for specific analytical procedures.

For a complete description of Jaguar's sample preparation, analytical methods, and QA/QC procedures, please refer to "Technical Report on the Roça Grande and Pilar Operations, Minas Gerais State, Brazil", a copy of which is available on the Company's SEDAR profile at www.sedarplus.ca.

Mineralized material for each orebody was classified into the Measured, Indicated, or Inferred Mineral Resource categories based on the search ellipse ranges obtained from the variography study, the observed continuity of the mineralization, the drill hole and channel sample density, and previous production experience from these orebodies.

The Mineral Resources are inclusive of Mineral Reserves. For those portions of the Mineral Resources that comprise the Mineral Reserve, stope design wireframes were used to constrain the outlines of the Mineral Resource volumes.

The Iron Quadrangle

The Iron Quadrangle has been an area of mineral exploration dating back to the 16th century. The discovery in 1699-1701 of gold contaminated with iron and platinum-group metals in the south-eastern corner of the Iron Quadrangle gave rise to the name of the town Ouro Preto (Black Gold). The Iron Quadrangle contains world-class multi-million-ounce gold deposits such as Morro Velho, Cuiabá, and São Bento. Jaguar Mining is the second largest operating gold company tenement holder in the Iron Quadrangle, holding or having access to approximately 46,600 hectares distributed among 56 mining and exploration titles (23,800 hectares held by Jaguar and 22,900 hectares held by Iamgold).

About Jaguar Mining Inc.

Jaguar Mining Inc. is a Canadian-listed junior gold mining, development, and exploration company operating in Brazil with three gold mining complexes and a large land package with significant upside exploration potential from mineral claims. The Company's principal operating assets are located in the Iron Quadrangle, a prolific greenstone belt in the state of Minas Gerais and include the MTL Mining Complex (Turmalina mine and plant) and Caeté Mining Complex (Pilar and Roça Grande mines, and Caeté plant). The Roça Grande mine has been on temporary care and maintenance since April 2019. The Company also owns the Paciência Mining Complex (Santa Isabel mine and plant), which had been on care and maintenance since 2012 and is planned to restart in 2025. Additional information is available on the Company's website at www.jaguarmining.com.

For further information please contact:

Vernon Baker

Chief Executive Officer

Jaguar Mining Inc.

vernon.baker@jaguarmining.com

416-847-1854

Alfred Colas

Chief Financial Officer

Jaguar Mining Inc.

alfred.colas@jaguarmining.com

416-847-1854

Forward-Looking Statements

Certain statements in this news release constitute "forward-looking information" within the meaning of applicable Canadian securities legislation. Forward-looking statements and information are provided for the purpose of providing information about management's expectations and plans relating to the future. All of the forward-looking information made in this news release is qualified by the cautionary statements below and those made in our other filings with the securities regulators in Canada. Forward-looking information contained in forward-looking statements can be identified by the use of words such as "are expected," "is forecast," "is targeted," "approximately," "plans," "anticipates," "projects," "anticipates," "continue," "estimate," "believe" or variations of such words and phrases or statements that certain actions, events or results "may," "could," "would," "might," or "will" be taken, occur or be achieved. All statements, other than statements of historical fact, may be considered to be or include forward-looking information. This news release contains forward-looking information regarding, among other things, the duration of the indefinite suspension of the Company's MTL complex in the wake of the slump at its Satinoco dry tailings pile, the Company's assessment of the environmental impact of the Satinoco tailings slump, the expected operational impact of the tailings pile slump, including the cost and timeline for (and feasibility of) recommencing operations at the Turmalina mine, the future stability of the tailings pile in question and safety of the Turmalina mine, the Company's assessment of the financial impact of legal claims, regulatory fines and investigations related to the tailings pile slump, including the likelihood of successful appeals or settlements, which are currently ongoing and subject to a wide range of possible outcomes, the potential for new regulatory requirements, operational restrictions and increased inspections imposed by Brazilian mining authorities, the Company's ability to effectively manage relationships with affected community members, repair its social license and mitigate reputational damage, the potential for unforeseen environmental or human health consequences resulting from the tailings pile slump and the Company's ability to address any such issues, the Company's expectations regarding its ability to secure sufficient financing and maintain liquidity in light of the financial burdens associated with the tailings pile slump, the Company's plans for stakeholder engagement, risk mitigation and corporate responsibility initiatives aimed at ensuring long-term sustainability, management's expectations regarding the Company's response to the tailings pile slump and the Company's recovery and remediation efforts at the MTL complex, any information and statements related to expected growth, sales, production statistics, ore grades, tonnes milled, recovery rates, cash operating costs, definition/delineation drilling, the timing and amount of estimated future production, costs of production, capital expenditures, costs and timing of the development of projects and new deposits, success of exploration, development and mining activities, currency fluctuations, capital requirements, project studies, mine life extensions, restarting suspended or disrupted operations, continuous improvement initiatives, and resolution of pending litigation. The Company has made numerous assumptions with respect to forward-looking information contained herein, including, among other things, assumptions about the future and long-term stability of the Satinoco tailings pile; there will be no unforeseen adverse weather events or other external factors that could delay the Company's recovery or remediation efforts; the current assumptions regarding the extent of the damage and timeline for repairs at the MTL complex remain accurate and will not require significant revision as further assessments are completed; estimated timeline for the development of the Company's mineral properties; the supply and demand for, and the level and volatility of the price of, gold; the accuracy of reserve and resource estimates and the assumptions on which the reserve and resource estimates are based; the receipt of necessary permits; market competition; ongoing relations with employees and impacted communities; political and legal developments in any jurisdiction in which the Company operates being consistent with its current expectations including, without limitation, the impact of any potential power rationing, tailings facility regulation, exploration and mine operating licenses and permits being obtained and renewed and/or there being adverse amendments to mining or other laws in Brazil and any changes to general business and economic conditions. Forward-looking information involves a number of known and unknown risks and uncertainties, including among others: the risk of Jaguar not meeting the forecast plans regarding its operations and financial performance; uncertainties with respect to the price of gold, labour disruptions, mechanical failures, increase in costs, environmental compliance and change in environmental legislation and regulation, weather delays and increased costs or production delays due to natural disasters, power disruptions, procurement and delivery of parts and supplies to the operations; uncertainties inherent to capital markets in general (including the sometimes volatile valuation of securities and an uncertain ability to raise new capital) and other risks inherent to the gold exploration, development and production industry, which, if incorrect, may cause actual results to differ materially from those anticipated by the Company and described herein. In addition, there are risks and hazards associated with the business of gold exploration, development, mining and production, including environmental hazards, tailings dam failures, industrial accidents and workplace safety problems, unusual or unexpected geological formations, pressures, cave-ins, flooding, chemical spills, procurement fraud and gold bullion thefts and losses (and the risk of inadequate insurance, or the inability to obtain insurance, to cover these risks). Accordingly, readers should not place undue reliance on forward-looking information.

For additional information with respect to these and other factors and assumptions underlying the forward-looking information made in this news release, see the Company's most recent Annual Information Form and Management's Discussion and Analysis, as well as other public disclosure documents that can be accessed under the issuer profile of "Jaguar Mining Inc." on SEDAR+ at www.sedarplus.ca. The forward-looking information set forth herein reflects the Company's reasonable expectations as at the date of this news release and is subject to change after such date. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law. The forward-looking information contained in this news release is expressly qualified by this cautionary statement.

SOURCE: Jaguar Mining, Inc.

View the original press release on ACCESS Newswire